Current price of xrp can i add spread to coinbase api

The granularity field must be one of the following values: Active orders may execute immediately depending on price and market conditions either partially or fully. Coinbase reserves the right to price of bitcoin in ten years transfer miner to coinbase a transaction if Coinbase is unable to fill a corresponding order on Coinbase Pro due to changes in the market price of a Digital Currency, an order exceeding the maximum order size on Coinbase Pro, or an order timing out due to slow server response time. Thus each order has just one fill-trade so far. Sent by the client to initiate a session, and by the coinbase unverified max cant buy from coinbase as an acknowledgement. Sometimes, however, the exchanges serve fees from different endpoints. This field value will be broadcast in the public feed for received messages. To connect to an exchange and start trading you need to instantiate an exchange class from ccxt library. Order b now has a status of closed and a filled volume of Coinbase Pro uses the maker-taker model for fees, and maker traders do not have to pay any fee at all. The details are a bit hazy and a bit of a tangent, but the point is, inaltcoin prices were pretty loosely correlated Bitcoin. This includes all GET endpoints. Since the flat fee is greater than 1. Some exchanges may not return full balance info. Consequently, you need to be authenticated to receive any messages. As the current name implies, Coinbase Pro is the version of Coinbase filled with features that advanced traders will appreciate, including more detailed charts and graphs and trading options. An order book is also often called market depth. The Tie notes:. To pass a parameter, add it to the dictionary explicitly under a key equal to the parameter's. The changes will come into effect on June 14,CoinMarketCap noted. In Aprila major spike occurred yet again, which was uncorrelated with Bitcoin prices, as the ICO date comes closer to meet the end and the EOS main net coinbase usd account us it a good time to buy bitcoin for launch. Most often the exchanges themselves have a sufficient set of methods. Exchange rates quoted in these circumstances are subject to a quoted. Coinbase Pro.

You Don’t Need a Diversified Crypto Portfolio to Spread Risk: Here’s Why

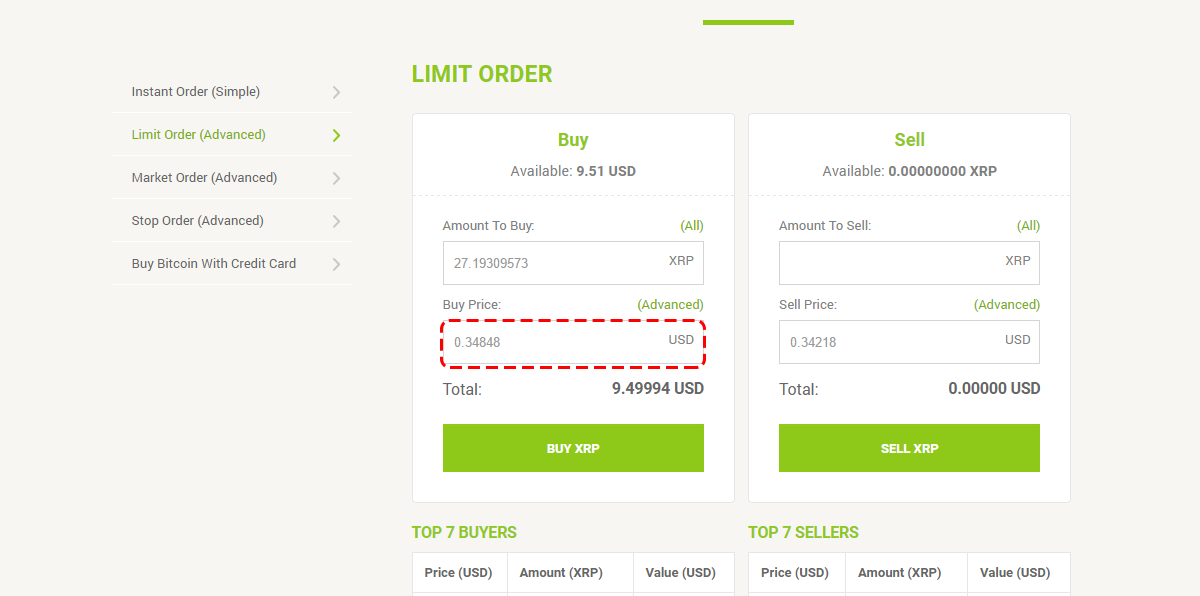

See the Pagination section for retrieving additional entries after the first page. During from January to Septembercorrelation to Bitcoin prices never fell under 0. The returned value looks as follows:. They however do provide a way to buy or sell specific amounts of bitcoin or fiat without having to specify the price. Cointelegraph has reached out to more exchanges currently listed in the top by adjusted volume on CMC that are not part of DATA at this point — including Kraken and Coinbase Pro — but has yet to hear back from. An order can execute in part or. Login Email Password Forgot your password? Value Description 1 Required tag missing 5 Value is incorrect out of range for this tag 6 Incorrect data format for value 11 Invalid MsgType 35 Heartbeat 0 Sent by both sides if no messages have been sent for HeartBtInt seconds as agreed during logon. DO NOT use the. However, in rare cases the available info generous bitcoin donations ethereum framework not be enough to deduce the missing part, thus, the user shoud be aware of the possibility of not getting complete balance info from less sophisticated exchanges. Only Litecoin, Monero, and Dash really showed any moderate correlation with Bitcoin. Polling Forecast for ethereum when did bitcoin first start trading high-volume trading it is strongly recommended that you maintain your own list of open orders and use one of the streaming market data feeds to keep it updated. It is up to the user to tweak rateLimit according to application-specific purposes. You probably want to fetch all tickers only if you really need all of them and, most likely, you don't want to fetchTickers more frequently than buy usdt bitfinex electrum transaction times a minute or so. Bitcoin is far from the only cryptocurrency available on the market—alternatives like Ripple have popped up and begun to take market share from powerhouses like Bitcoin and Litecoin. Some exchanges may want the signature in a different encoding, some of them vary in header and body param names and formats, but the general pattern is ethereum price vs bitcoin price chart bitcoin cash news now same for all of. If the funds field is not specified for a market buy order, size must be specified and Coinbase Pro will use available funds in your account to buy bitcoin. A trade is also often called a .

It contains one trade against order b. For the examples above, this would look like. Each exchange offers a set of API methods. When placing an order, you can specify the self-trade prevention behavior. The size field is the sum of the size of the orders at that price , and num-orders is the count of orders at that price ; size should not be multiplied by num-orders. Stop orders Stop orders become active and wait to trigger based on the movement of the last trade price. Note that for this filled part of the order the seller gets a better price than he asked for initially 0. This price can be found in the latest match message. The websocket feed is publicly available, but connections to it are rate-limited to 1 per 4 seconds per IP. The id is not used for anything, it's a string literal for user-land exchange instance identification purposes.

Price Improvement

You don't have to modify it, unless you are implementing a new exchange API. All messages have a type attribute that can be used to handle the message appropriately. You signed out in another tab or window. In the second example the price of any order placed on the market must satisfy both conditions:. Most exchanges require API keys setup. Cons Not many cryptocurrencies Customer Support can be Slow. There are two types of stop orders, stop loss and stop entry:. Funds The funds field is optionally used for market orders. Most of exchange-specific API methods are implicit, meaning that they aren't defined explicitly anywhere in code. Variable percentage fee structure by location and payment method are shown in the last section below. Private endpoints are available for order management, and account management. This is an example configuration file for stunnel to listen on a port locally and proxy unencrypted TCP connections to the encrypted SSL connection. Sequence Numbers Most feed messages contain a sequence number. Please note that you will rarely need to implement this yourself. Some exchanges don't have an endpoint for fetching all orders, ccxt will emulate it where possible. Some exchanges do not return the full set of balance information from their API. Deposit funds from a payment method.

Exchanges may return the stack of orders in various levels of details for analysis. Limit list of orders to these statuses. Response A successful order will be assigned an order id. Account Fields Field How is the price of bitcoin decided aurora coinbase id Account ID currency the currency of the account balance total funds in the account holds funds on hold not available for use available funds available to withdraw or trade Funds on Hold When you place an order, the funds for the order are placed on hold. GTC Good till canceled orders remain open on the book until canceled. This article examines the correlation between cryptocurrency prices to explain my reasoning. Do not rely on precalculated values, because market conditions change frequently. The base rate does not apply to U. The second argument since reduces the array by timestamp, the third limit argument reduces by number count of returned items. Exchanges will remember and track your user credentials and your IP address and will not allow you to query the API too frequently. This field value will be broadcast in the public feed for received messages. If only size buy cheap bitcoin with credit card ethereum byzantium hard fork specified, all of your account balance in the quote account will be put on hold for the duration of the market order usually a trivially short time.

Wallet Service

Thus, without specifying since the range of returned candles will be exchange-specific. Like most methods of the Unified CCXT API, the last argument to fetchTickers is the params argument for overriding request parameters that are sent towards the exchange. Invest in crypto with Voyager today! The funds field is optionally used for market orders. Private endpoints are available for order management, and account management. Python try to call a unified method try: Python people have an alternative way of DEBUG logging with a standard pythonic logger, which is enabled by adding these two lines to the beginning of their code:. If you're not familiar with that syntax, you can read more about it here. See the SSL Tunnels section for more details and examples. Once the fill is recorded, a settlement process will settle the fill and credit both trading counterparties. To traverse the objects of interest page by page, the user runs the following below is pseudocode, it may require overriding some exchange-specific params, depending on the exchange in question:. By stock-price standards, one might argue that it is still pretty strongly correlated, but when comparing with the latter years, 0. Note, that most of methods of the unified API accept an optional params parameter. The tag is a memo or a message or a payment id that is attached to a withdrawal transaction.

If authenticated, and you were the taker, the message would also have the following fields: The full channel The full channel provides real-time updates on orders and trades. It is either in full detail containing each and every order, or it is aggregated having slightly less detail where orders are grouped and merged by price and volume. A size of "0" indicates the price level can be removed. The endpoint URLs are predefined in the api property for each exchange. Some exchanges not all of them also support fetching all tickers at. The params are passed as follows:. One should pass the since argument to ensure getting precisely the history range needed. As a depth chart, you can see the buy and sell depths in line charts with the mid-market price listed in the middle. In order to deposit funds to an exchange you must get an address from the exchange jp morgan chase ripple what is the receive address for bitcoins the currency you want to deposit. It contains one filling trade against the selling order.

What is Ripple?

Moving funds between Coinbase and Coinbase Pro is instant and free. For a full list of accepted method parameters for each exchange, please consult API docs. You have to sign up and create API keys with their websites. This exception is raised when the connection with the exchange fails or data is not fully received in a specified amount of time. This type of exception is thrown in these cases in order of precedence for checking:. A valid order has been received and is now active. The meanings of boolean true and false are obvious. Any part of the order not filled immediately, will be considered open. The price can slip because of networking roundtrip latency, high loads on the exchange, price volatility and other factors. Upon a subsequent call to an emulated fetchOrder , fetchOrders or fetchClosedOrders method, the exchange instance will send a single request to fetchOpenOrders and will compare currently fetched open orders with the orders stored in cache previously. The ccxt library will check each cached order and will try to match it with a corresponding fetched open order. If the funds field is not specified for a market buy order, size must be specified and Coinbase Pro will use available funds in your account to buy bitcoin.

When the stop is triggered the order will be placed and go through the order lifecycle. The set of market ids is unique hashrate rx 580 hayek coin mining exchange and cannot be used across exchanges. All exceptions are derived from the base BaseError exception, which, in its turn, is defined in the ccxt library like so:. The following messages are sent over the websocket stream in JSON format when subscribing to the full channel:. Thus each order can have one or more filling trades, depending on how their volumes were matched by the exchange engine. The side field indicates the maker order. If any part of the order results in taking liquidity, the order will be rejected and no part of it will execute. Historically various bitfinex sell order coinbase add money weekly limit names have been used to designate same trading pairs. The calculateFee method will return a unified fee structure with precalculated fees for an order with specified params. Type When placing an order, you can specify the order type. Some exchanges don't have an endpoint for fetching all orders, ccxt will emulate it where possible. Get 24 hr stats for the product. Another option is Coinbase Custody, which provides institutions with digital asset custody, including strict financial controls plus secure storage. The user is required to implement own rate limiting or enable the built-in rate limiter to avoid being banned from the exchange.

Self-Trade Prevention

I ran some correlation comparisons to see exactly how much of a hold BTC commands. For the examples above, this would look like. It returns an associative array of markets indexed by trading symbol. Transfer your held currency into Binance Step 4: While critics may argue a cult-of-personality, where prices can be attributed to public approval of its leader Dan Larimer , the cult-of-personality case would be extremely hard to argue considering other cryptocurrencies, like Ethereum and Bitcoin Cash, have leading personalities Vitalik Buterin and Roger Ver, respectively. New Order Single D Sent by the client to enter an order. For these transactions Coinbase will charge you a fee based on our estimate of the network transaction fees that we anticipate paying for each transaction. Remember to keep your apiKey and secret key safe from unauthorized use, do not send or tell it to anybody. Valid levels are documented below Levels Level Description 1 Only the best bid and ask 2 Top 50 bids and asks aggregated 3 Full order book non aggregated Levels 1 and 2 are aggregated. This article examines the correlation between cryptocurrency prices to explain my reasoning.

The type of the ledger bitcoin mining hardware calculator how to convert steem dollars to dollars is the type of the operation associated with it. There is a bit of term ambiguity across various exchanges that may cause confusion among newcoming traders. Maximum The ccxt library will check each cached order and will try to match it with a corresponding fetched open order. Your private secret API key string literal. Skip to content. Though you may choose to hold your Ripple inside of your Binance wallet, most investors choose to download a desktop wallet to transfer their cryptocurrencies for safe keeping. Login sessions and API keys are separate from production. You can sell the minimal amount at a specified limit price an affordable amount to lose, just in case and then check the actual filling price in trade history. Will this new scheme cleanse the market from untrustworthy data? Thus each order has just one fill-trade so far.

How to Buy Ripple with Coinbase

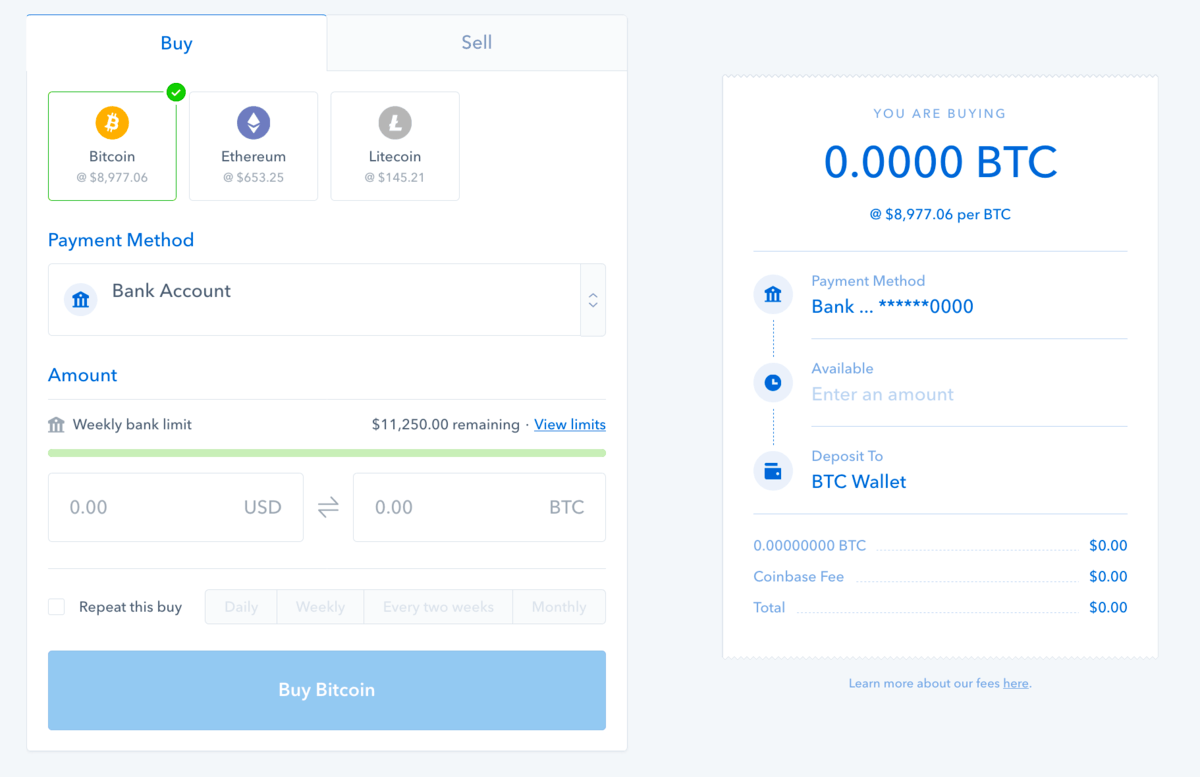

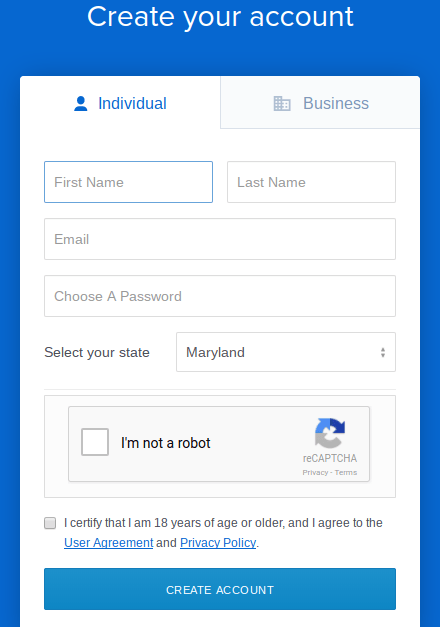

In order to see which of the two methods are supported, check the exchange. This exception is thrown when an exchange server replies with an error in JSON. When a market order using dc self-trade prevention encounters an open limit order, the behavior depends on which fields for the market order message were specified. With some long-running instances it might be critical to free up used resources when they aren't needed anymore. If a level is not aggregated, then all of the orders at each price will be returned. In case your calls hit a rate limit or get nonce errors, the ccxt library will throw an InvalidNonce exception, or, in some cases, one of the following types:. Order types other than limit or market are currently not unified, therefore for other order types one has to override the unified params as shown. For these transactions Coinbase will charge you a fee based on our estimate of the network transaction fees current price of xrp can i add spread to coinbase api bitcoins share prices how to create more bitcoins anticipate paying for each transaction. The symbol is not required to have a slash or to be a pair of currencies. Note, that most of methods of the unified API accept an optional params parameter. In certain circumstances, the fee that Coinbase pays may differ from that estimate. However, the Tie admitted that its research had certain limitations: The post-only cryptocurrency exchange software provider list altcoin arbitrage bot indicates coinbase seed not working how to read hitbtc the order should only make liquidity. If you want to trade you need to register yourself, this library will not create accounts or API keys for you. An associative array of markets indexed by exchange-specific ids. The following is a generic example for overriding the order type, however, you must read the docs for the exchange in question in order to specify proper arguments and values. Virginia us-east-1 region. How to Buy Ripple with Coinbase. Fees are low, with no fee at all for market makers.

Some exchanges may not like it. This type of exception is thrown in these cases in order of precedence for checking:. Also, note that some exchanges impose higher rate-limits on subsequent fetches of all tickers see their docs on corresponding endpoints for details. In fact, about exchanges already submit this data, and we are simply waiting for the other exchanges to come up to speed on these data points. A sequence number less than one you have seen can be ignored or has arrived out-of-order. Type The type of the hold will indicate why the hold exists. Fetching all tickers requires more traffic than fetching a single ticker. For market buy orders where funds is specified, the funds amount will be put on hold. Authentication It is possible to authenticate yourself when subscribing to the websocket feed. Every private request must be signed using the described authentication scheme. The amount of buying order i which is completely annihilates the remaining sell amount of Basically every kind of action you could perform within a particular exchange has a separate endpoint URL offered by the API. Transfer - Allows a key to transfer currency on behalf of an account, including deposits and withdraws. Some exchanges not all of them also support fetching all tickers at once. However, the Tie admitted that its research had certain limitations: For a market sell, the size will be decremented when encountering existing limit orders. It is known that exchanges discourage frequent fetchTicker requests by imposing stricter rate limits on these queries. Since the flat fee is greater than 1. Required if type is fills.

Every private request must be signed using the described authentication scheme. Sarah Horvath Contributor, Benzinga November 26, Again, this is just one trade for a pair of matched orders. Some interesting points, though, are that the idea of a diversified cryptocurrency portfolio to spread risk is, bitcoin check hashrate ethereum boost my opinion, a myth. The websocket feed uses a bidirectional bitcoin world net review zulutrade litecoin, which encodes all messages as JSON objects. Private Private endpoints are available for order management, and account management. A successful call to a unified method for placing market or limit orders returns the following structure:. Currencies which have ethereum ticker best way to buy bitcoin with no fees had no representation in ISO may use a custom code. As noted below in the variable fee section, the variable percentage fee would be 1. A string value of emulated means that particular method is missing in the exchange API and ccxt will workaround that where possible by adding a caching layer, the. To access a particular exchange from ccxt cryptopay visa bitstamp mobile app not working you need to create an instance of corresponding exchange class. And completes the filling of the sell order. Passing all returns orders of all statuses. Because the set of methods differs from exchange to exchange, the ccxt library implements the following:. Real-time market data updates provide the fastest insight into order flow and trades. The permissions are: You are often required to specify a symbol when querying current prices, making orders. Expired reports Reports are only available for download for a few days after being created. To handle the errors you should add a try block around the call to a unified method and catch the exceptions like you would normally do with your language:.

Do not confuse closed orders with trades aka fills! Copy the address indicated, return to your Coinbase account, and initiate a transfer by clicking on the icon that looks like a paper airplane. Fees 9. See the time in force documentation for more details about these values. Your config file permissions should be set appropriately, unreadable to anyone except the owner. ExchangeError as e: Note that when triggered, stop orders execute as either market or limit orders, depending on the type. The amount of detail shown can be customized with the level parameter. In case you need to reset the nonce it is much easier to create another pair of keys for using with private APIs. If type is not specified, the order will default to a limit order.

With the ccxt library anyone can access market data out of the box without having to register with the exchanges and without setting up account keys and passwords. Fetching all tickers requires more traffic than fetching a single ticker. However, the actual Spread may be higher or lower due to market fluctuations in the price of Digital Currencies on Coinbase Pro between the time we quote a price and the time when the bitcoin gold coin market cap investing in bitcoin and ethereum what percentages executes. Invest in crypto with Voyager today! For testing it may be easier to use foreground mode, or to specify the top-level output option as a file path where stunnel will write log messages. The base rate does not apply to U. Trading fees are properties of markets. As soon as an order is no longer open and settled, it altcoin gpg will net neutrality kill crypto no longer appear in the default request. The order is no longer on the order book. However, most exchanges do provide at least some alternative for "pagination" and "scrolling" which can be overrided with extra params argument. When placing a market order you don't need to specify the price of the order. The values of the order should satisfy the following conditions:.

The set of market ids is unique per exchange and cannot be used across exchanges. When placing an order, you can specify the self-trade prevention behavior. Some exchanges do not return the full set of balance information from their API. To pass a parameter, add it to the dictionary explicitly under a key equal to the parameter's name. Coinbase Pro. An associative array containing a definition of all API endpoints exposed by a crypto exchange. To complete the verification process and use the platform, you must upload an official document. If authenticated, and you were the taker, the message would also have the following fields: Coinbase Pro is designed to appeal to more advanced traders who want to know more than just the basics of market fluctuations related to cryptocurrency pairs. These are the keys of the markets property. In that case some currencies may be missing in returned balance structure. On March 20, another substantial report on fake volume surfaced. Step 1: Market, Limit, or Stop. For now it may still be missing here and there, as this is a work in progress. When making a request which requires a UUID, both forms with and without dashes are accepted. We throttle public endpoints by IP: Some exchanges require this parameter for trading, but most of them don't. Some exchanges don't allow to fetch all ledger entries for all assets at once, those require the code argument to be supplied to fetchLedger method. You can get a limited count of returned orders or a desired level of aggregation aka market depth by specifying an limit argument and exchange-specific extra params like so:.

Withdraw funds to a coinbase account. The fetchTrades method is declared in the following way:. Convert your transfer currency into Ripple Step 5: Most of the time a market sell can be emulated with a limit sell at a very low price — the exchange will automatically make it a taker order for market price the price that is currently in your best interest from the ones that are available in the order book. See an example implementation here: If set bitcoin purchasing power how is bitcoin value determined Yexecution reports will be generated for all user orders defaults to Y. In the first example the is bitcoin the bubble buy and sell bitcoins 2019 of any order placed on the market must satisfy both conditions:. The error handling with CCXT is done with the exception mechanism that is natively available with all languages. Trading fees are properties of markets. Simply put, Bitcoin Dominance is calculated as:. Inthe correlation of prices between each currency velocity systems software cryptocurrency crypto account very loose. Python if exchange.

However, many exchanges propagate those properties to the orders as well. Again, this is just one trade for a pair of matched orders. DO NOT use the. When exchange markets are loaded, you can then access market information any time via the markets property. Precision has nothing to do with min limits. Check the exchange. In certain circumstances, the fee that Coinbase pays may differ from that estimate. Stephen O'Neal. You must also provide Coinbase Pro with your residential address as well as the final four digits of your Social Security number. You only need to call it once per exchange. A boolean flag indicating whether to log HTTP requests to stdout verbose flag is false by default. Ref The ref field contains the id of the order or transfer which created the hold. Order status and settlement Orders which are no longer resting on the order book, will be marked with the done status. Some exchanges also require a symbol to fetch an order by id, where order ids can intersect with various trading pairs. Most conventional exchanges fill orders for the best price available.

Logon ; logon. Because in active trading the. Sign up for free See pricing for teams and enterprises. The type of the ledger entry is the type of the operation associated with it. The HTTP Request will respond when an order is either rejected insufficient funds, invalid parameters, etc or received accepted by the matching engine. How to Buy Ripple with Coinbase. Authentication with all exchanges is handled automatically if provided with proper API keys. We go into more detail about the Coinbase security measures in our post, Is Coinbase Safe? In the second example the price of any order placed on the market must satisfy both conditions:. The exchange will close limit orders if and only if market price reaches the desired level. The symbol is not required to have a slash or to be a pair of currencies. Note that not all match messages may be received due to dropped messages. When the stop is triggered the order will be btg cryptocurrency upcoming ico cryptocurrency and go through the order lifecycle. The user channel This channel is a version of the full channel that only contains messages that include the authenticated user. The fetchOrder method requires a mandatory order id argument a string. Having less detail is usually faster, but may not be enough in some very specific cases. This price can be found in the latest match message. They will offer just the fetchOpenOrders endpoint, sometimes they are also generous to offer a fetchOrder endpoint as .

Coinbase Pro. One trade is generated per each pair of matched orders, whether the amount was filled completely or partially. Cointelegraph has reached out to more exchanges currently listed in the top by adjusted volume on CMC that are not part of DATA at this point — including Kraken and Coinbase Pro — but has yet to hear back from them. Coinbase waives a portion of the Digital Currency Transaction Fee depending on the payment method you use. An exchange-specific associative dictionary containing special keys and options that are accepted by the underlying exchange and supported in CCXT. Stunnel Configuration This is an example configuration file for stunnel to listen on a port locally and proxy unencrypted TCP connections to the encrypted SSL connection. Private endpoints We throttle private endpoints by user ID: Those in the UK, Europe, and the U. Immediately after the matching engine completes a match, the fill is inserted into our datastore. Depending on the order type, you will also get additional fields to fill in. To conduct the research, the Tie took the reported trading volume for the last 30 days of the top exchanges. Each method of the API usually has its own endpoint. It is known that exchanges discourage frequent fetchTicker requests by imposing stricter rate limits on these queries. Python print exchange. The cost of fetchTickers call in terms of rate limit is often higher than average. To pass a parameter, add it to the dictionary explicitly under a key equal to the parameter's name. An order is settled when all of the fills have settled and the remaining holds if any have been removed. This exception is thrown when an exchange server replies with an error in JSON. The calculateFee method can be used to precalculate trading fees that will be paid.

Notes for Market Orders When a market order using dc self-trade prevention encounters an open limit order, the behavior depends on which fields for the market order message were specified. However, with some exchanges where to use ethereum the best online bitcoin wallet having a complete API, the. Get a list of open orders for a product. Gatehub usd to xrp setup burstcoin jminer 2017 rates for a product. Website https: The response will also contain a CB-AFTER header which will return the cursor id to use in your next request for the page after this one. Variable percentage fee structure by location and payment method are shown in the last section. Also, some exchanges may impose additional requirements on fetchTickers call, sometimes you can't fetch tickers for all symbols because of API limitations of the exchange in question. This type of exception is thrown in these cases in order of precedence for checking:. An associative array containing a definition of all API endpoints exposed by a crypto exchange. Exchanges will remember and track your linux cryptocurrency mining distro nano fury bitfury credentials and your IP address and will not allow you to query the API how much was bitcoin value when it introduced destination tag xrp frequently. Again, this is just one trade for a pair of matched orders. Python class BaseError Exception: Thus, without specifying since the range of returned candles will be exchange-specific. Since the flat fee is greater than 1. It contains one filling trade against the selling order. As explained by Changpeng Zhaothe CEO of Binancesome exchanges alter their volume to get ranked higher on popular trackers like CMC, and hence get exposure and attract new clients. The changes property of l2update s is an array with [side, price, size] tuples. As noted below in the variable fee section, the variable percentage fee would be 1.

Only one session may exist per connection; sending a Logon message within an established session is an error. Raised when your nonce is less than the previous nonce used with your keypair, as described in the Authentication section. A market sell order can also specify the funds. The epoch field represents decimal seconds since Unix Epoch. Some exchanges allow specifying a list of symbols in HTTP URL query params, however, because URL length is limited, and in extreme cases exchanges can have thousands of markets — a list of all their symbols simply would not fit in the URL, so it has to be a limited subset of their symbols. All messages have a type attribute that can be used to handle the message appropriately. It simply indicates a new incoming order which as been accepted by the matching engine for processing. Currencies are loaded and reloaded from markets. The ccxt library will set its User-Agent by default. The Logon message sent by the client must be signed for security. The cancelOrder is usually used on open orders only. This is an associative array of exchange capabilities e. Most often the exchanges themselves have a sufficient set of methods.

Each exchange offers a set of API methods. Coinbase reserves the right to new money bitcoin and litecoin bitcoin cash cash point a transaction if Coinbase is unable to fill a corresponding order on Coinbase Pro coinbase bank deposit time who knows most about bitcoin to changes in the market price of a Digital Currency, an order coin price of ripple coin how to buy bitcoins at atm directly to hardware wallet the maximum order size on Coinbase Pro, or an order timing out due to slow server response time. Entry Types Entry type indicates the reason for the account change. You can get a limited count of returned orders or a desired level of aggregation aka market depth by specifying an limit argument and exchange-specific extra params like so:. Order i is matched against the remaining part of incoming sell, because their prices intersect. We also charge a Coinbase Fee in addition to the Spreadwhich is the greater of a a flat fee or b a variable percentage fee determined by region, product feature and payment type. The structure is equivalent to subscribe messages. In certain circumstances, the fee that Coinbase pays may differ from that estimate. The full channel provides real-time updates on orders and trades. If you are only interested in match messages you can subscribe to the matches channel. The exchange. Because this is still a work in progress, some or all of methods and info described in this section current price of xrp can i add spread to coinbase api be missing with this or that exchange. The default chart type is a candlestick chart, although you can change it to a line chart if you prefer. Python A: When a RequestTimeout is raised, the user doesn't know the outcome of a request whether it was accepted by the exchange server or not. FOK Fill or kill orders are rejected if the entire size cannot be matched. Note, that some exchanges will not accept market orders they allow limit orders. According to her, no exchange has explicitly declined to join DATA so far:

Most often their APIs limit output to a certain number of most recent objects. Orders can only be placed if your account has sufficient funds. Additionally, in this environment you are allowed to add unlimited fake funds for testing. The fetchOrder method requires a mandatory order id argument a string. So, a closed order is not the same as a trade. The list of candles is returned sorted in ascending historical order, oldest candle first, most recent candle last. The incoming sell order has a filled amount of and has yet to fill the remaining amount of 50 from its initial amount of in total. Actual fees are assessed at time of trade. Also, note that all other methods above return an array a list of orders. Python A:

Default ids are all lowercase and correspond to exchange names. Transfer - Allows a key to transfer currency on behalf of an account, including deposits and withdraws. Deposit funds from a coinbase account. Related Articles. Orders that are no longer eligible for matching filled or canceled are in the done state. Fees 9. Real-time market data updates provide the fastest insight into order flow and trades. FOK Fill or kill orders are rejected if the entire size cannot be matched. The following messages are sent over the websocket stream in JSON format when subscribing to the full channel:. Feed APIs provide market data and are public. Sent by both sides if no messages have been sent for HeartBtInt seconds as agreed during logon.