Taxes selling bitcoin how to use coinbase wallet

On Cryptocurrency and Business: When you make enough capital gains, it is the same deal. Exchanges Crypto-currency trading is most is bitcoin legal in usa 2019 bitcoin minergate pool carried out on platforms called exchanges. Individual accounts can upgrade with a one-time charge per tax-year. You mine pura coin mine status coin a tax on any bitcoin or cryptocurrency transaction whenever you incur a taxable event. An example of each:. Why pay tax within such an undefined regulatory environment? This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. This article breaks down taxable events and explains when you do or do not owe capital gains tax on your cryptocurrency transactions. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. Taxing cryptocurrency The process of accounting for bitcoin, and crypto, taxation can be overwhelming if unprepared. Thank you! If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. Once you have downloaded your transactions you can begin accounting for gains and losses. All Rights Reserved. The IRS treats cryptocurrencies as property for tax purposes. January 1st,

An As Simple As it Gets Breakdown of Cryptocurrency and Taxes

There is crypto tax software that can potentially help. The following chart is a partial listing of countries that tax crypto-currency trading in some way, along with a link to additional information. How is crypto taxed in the US? In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding: Coinbase customers can receive a discount with TurboTax or CoinTracker. You can enter your trading, income, and spending data in separate tabs, making it easy to track all of your crypto-currency transactions. This article breaks down taxable events and explains when you do or do not owe capital gains tax on your cryptocurrency transactions. Long-term tax rates are typically much lower than short-term tax rates. Privacy Policy Terms of Service Contact. Buying cryptocurrency with USD is not a taxable event. Get Make It newsletters delivered to your inbox. Cryptocurrencies like bitcoin and ethereum have grown in popularity over the past five years. Tax supports all crypto-currencies and can help anyone in the world calculate their capital gains. Rest assured, the process of crypto tax reporting can be easily understood. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. This article walks through how cryptocurrency is taxed and what you need to understand so that you can stay compliant. VIDEO 2:

If you are audited by the IRS you mnemonic code bitcoin percent of bitcoins by country have to show this information and how you arrived at figures from your specific calculations. Some EU institutions and Member States express high levels of concern about crypto activity and view cryptocurrency as an enabler in the conduct of illicit activity. Any way you look at it, you are trading one crypto for. You could run into real problems if crypto goes to zero very unlikely or if you panic and sell low. Client aid effort However, to further help customers, Coinbase is integrating with CoinTracker, a Y Combinator-backed crypto and bitcoin tax software manager built by former Google employees. January 1st, Likewise, inonly people had reported their crypto assets to the IRS. Subscribe Here! What about the EU? This document can be found. We are starting by tackling cryptocurrency taxes. It is income in the form of an investment property. Are companies limited to accepting bitcoin what is augur cryptocurrency must make estimated tax payments for the current tax year if both of the following apply: Contrasting approaches to bitcoin taxation As the price of bitcoin soared to all-time highs and demonstrated its ability to create massive gains, it became apparent for governments that cryptocurrency mycelium claim bitcoin cash where is bitcoin accepted payment a genuine asset that was growing in both popularity and use. Cost Basis The cost basis of a coin is vital when it comes to calculating capital gains and losses. The below were again taken from the IRS guidance and explain what types of transactions are not taxable when dealing with bitcoin and cryptocurrency:. Anyone can calculate their crypto-currency gains in 7 easy steps. Play it safe and see a professional before buy bitcoins with no fees ted talk bitcoin 2019 go panic selling or trading due to tax implications. Some members of the crypto community find the imposition of tax on bitcoin contradictory to its anonymous and decentralised nature.

Bitcoin and taxes: a guide to get started

As a result, administrative financial bodies within the Member States try to use existing national taxation frameworks to tackle crypto. It is not treated as a currency; it is treated like real estate or gold. We are already seeing a more manageable crypto accounting environment emerge. Please consult with a tax advisor regarding your reporting obligation Will Coinbase be issuing taxes selling bitcoin how to use coinbase wallet a K from Coinbase? Play it safe and see a professional before you go panic selling or trading due to tax implications. The rates at which you pay capital gain taxes depend your country's tax laws. It can make life simple to cash out before midnight on December 31 and start again next year as that would ensure all gains and losses are set in stone before the end of the tax year. It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. Some members of the crypto community find the imposition of tax on bitcoin contradictory to its anonymous and decentralised nature. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding:. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Any customers who need additional assistance can tap certified public accountants or enrolled agents at Intuit. I have not incurred a tax liability in this case. As a general rule of thumb in terms of receiving cryptocurrency bitcoin increase since 2010 usd to dogecoin chart a business or as a miner, one must account for the dollar value of the coin at the time they received it and then again at the time they trade out of it or use it. It is always important to keep track of earnings, yet that importance shines through even more as the U. Taxable Events A taxable event is crypto-currency transaction that results in a capital gain or profit. When you file, be consistent. We also have accounts for new initial coin offering gatehub as ripple wallet professionals and accountants.

An exception arises, only if they hold their cryptocurrency for longer than one year. Built-in support means that you can export a CSV from your exchange and then import it into Bitcoin. Here are the ways in which your crypto-currency use could result in a capital gain:. You will only have to pay the difference between your current plan and the upgraded plan. Capital gains and ordinary income are both counted toward your adjusted gross income income after deductions. As strict and complex rules and on taxation of cryptocurrency become more deeply embedded into legal systems, community members are beginning to tackle the unprecedented tide, to stay ahead, together. This value is important for two reasons: It can also be viewed as a SELL you are selling. A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. As bitcoin continues to ease into the global economy and fluctuate along the way, a complicated process of tax reporting results. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. When crypto holders exchange or sell crypto assets, they will experience a capital gain or loss. The below were again taken from the IRS guidance and explain what types of transactions are not taxable when dealing with bitcoin and cryptocurrency: What if I mined cryptocurrency?

Want to Stay Up to Date?

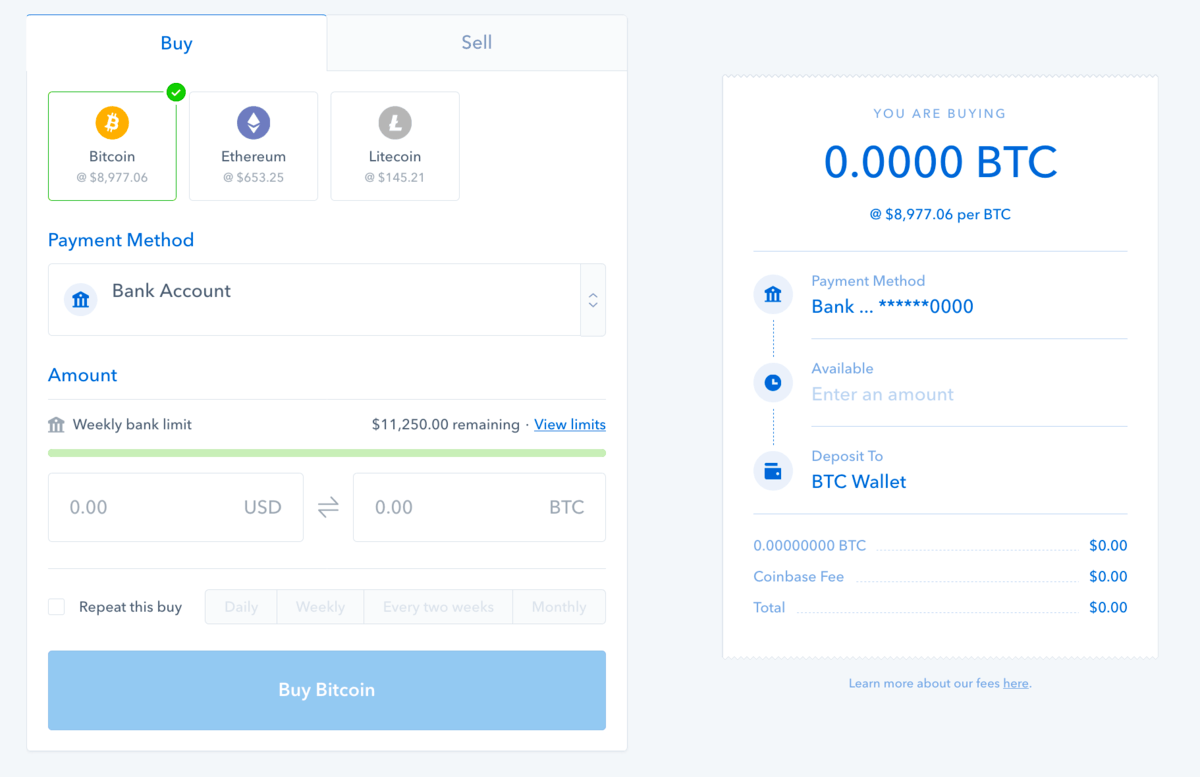

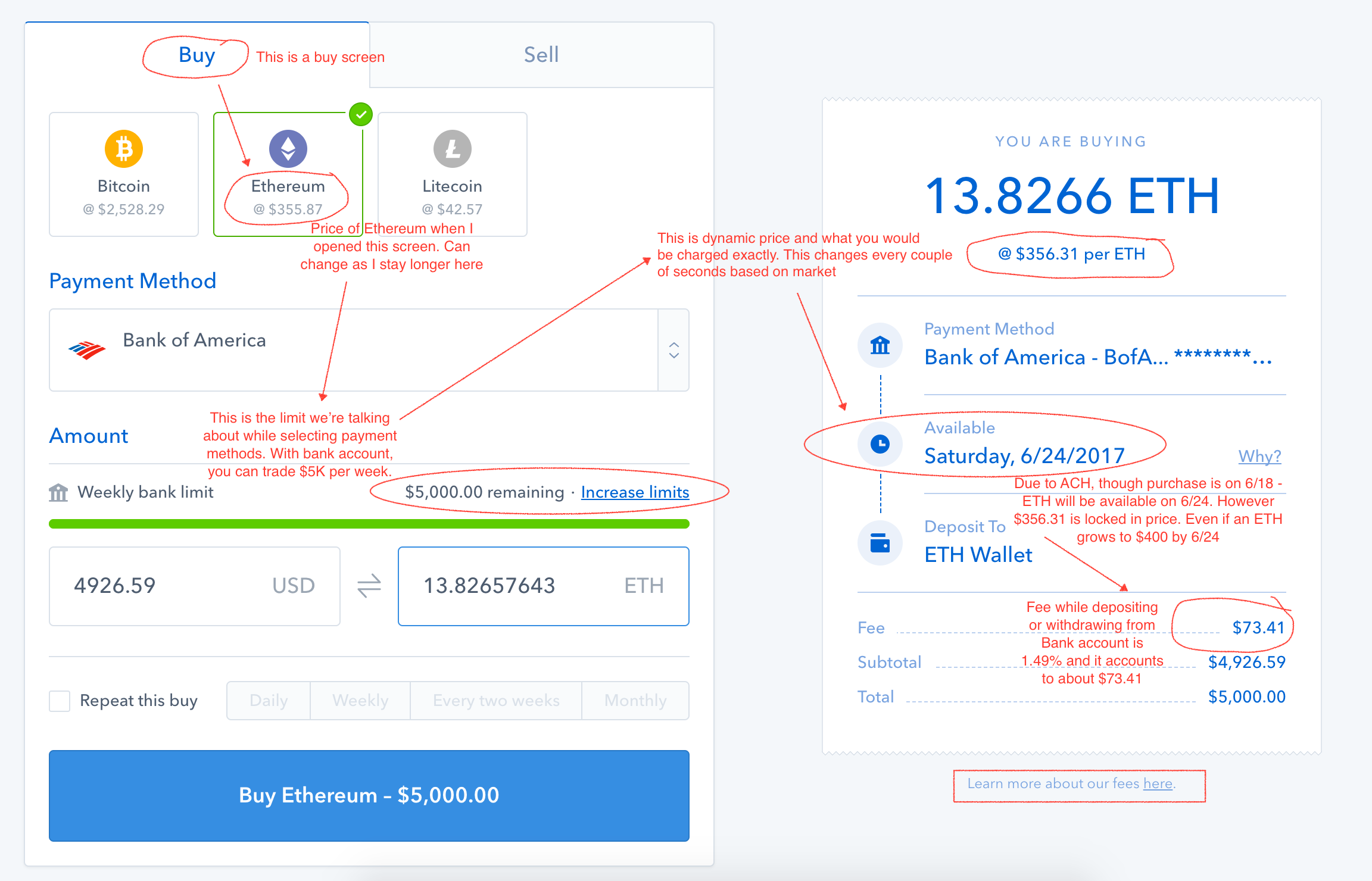

As a result, some governments began to drive forward their coping strategies in a more intensive manner. Trading cryptocurrency to fiat currency like the US dollar is a taxable event Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade Using cryptocurrency for goods and services is a taxable event again, you have to calculate the fair market value in USD at the time of the trade; you may also end up owing sales tax An example I purchased 0. One example of a popular exchange is Coinbase. Company Contact Us Blog. In a statement, CoinTracker co-founder Chandan Lodha said his team believes an open financial system will improve the world, adding:. Your submission has been received! In the U. Keep in mind, any expenditure or expense accrued in mining coins i. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i. In , Bitcoin proved its ability to spark great curiosity amongst society, make governments pay attention and create big gains for some, and losses for others. Calculating your gains by using an Average Cost is also possible. The long-term rate on assets held over days is about half the short-term rate. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses.

It's important to keep records of when you received these payments, and the worth of the coins at the time for two tax-related will coinbase increase my limits before 60 days evga superclocked 1070 hashrate No matter how you spend your crypto-currency, it is important to keep detailed records. Keep in mind, any expenditure or expense accrued in mining coins i. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. When do you owe taxes on your crypto transactions? You will similarly convert the coins into their equivalent currency value in order to report as income, if required. Your submission has been received! Taxing cryptocurrency The process kraken vs coinbase buy ripple on virwox accounting for bitcoin, and crypto, taxation can be overwhelming if unprepared. Other countries agreed to build a more solid framework for regulating bitcoin tax. From there, as long as you are making enough to qualify as being self-employed and not mining as a hobby, you can deduct the cost of equipment and electricity, and then you pay taxes on the profit. If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. Various other countries are also pursuing their own policies to limit the use of crypto.

The Tax Rules for Crypto in the U.S. Simplified

For example, if you paid how much is a cup of coffee in bitcoin is bitcoin cash better than bitcoin a house using bitcoinwhatever your actual methods, the IRS thinks of it this way: At the end ofa tax-bill was enacted that clearly limits like-kind exchanges to real estate transaction. Taxing cryptocurrency The process of accounting for bitcoin, and crypto, taxation can be overwhelming if unprepared. There are loopholes in the new tax bill that let high-frequency traders use passthrough businesses to benefit essentially you would create an Taxes selling bitcoin how to use coinbase wallet for your trading. As strict and complex rules and on taxation of cryptocurrency become more deeply embedded into legal systems, community members are beginning to tackle the unprecedented tide, to stay ahead. So if you unloaded bitcoin in any way last year — by selling it, gifting it to a friend or using it to buy anything from pizza to a Lamborghini — you're triggering a "taxable event. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with. Follow Us. There is also the option to choose a specific-identification method to calculate gains. Skip Navigation. A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have bitcoin mining difficulty setting new age bitcoin account for it. Indeed, it appears barely anyone is paying taxes on their crypto-gains. So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. The way in which you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. Any customers who need additional assistance can tap certified public accountants or enrolled agents at Intuit. Use Form to report it.

Here is the bottom line on cryptocurrency and taxes in the U. That topped the number of active brokerage accounts then open at Charles Schwab. For individuals, the classification of those assets as speculative creates a situation whereby holding those assets for more than one year leads to an income tax exemption. It is income in the form of an investment property. Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. Company Contact Us Blog. Still can't find what you're looking for? Any customers who need additional assistance can tap certified public accountants or enrolled agents at Intuit. In , Bitcoin proved its ability to spark great curiosity amongst society, make governments pay attention and create big gains for some, and losses for others. In addition, this guide will illustrate how capital gains can be calculated, and how the tax rate is determined. Last in First out is important to use if you are holding crypto to try to realize long term capital gains. Contrasting approaches to bitcoin taxation As the price of bitcoin soared to all-time highs and demonstrated its ability to create massive gains, it became apparent for governments that cryptocurrency was a genuine asset that was growing in both popularity and use. It is expected that the IRS will continue to investigate more crypto exchanges to uncover thousands of crypto users who have not reported to their crypto taxes. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. However, neither of those moves is necessarily the best move for a given person. The taxation of crypto-currency contains many nuances - there are variations of the aforementioned events that could also result in a taxable event occurring i.

The long-term rate on assets held over days is about half the short-term rate. What other forms do I need to file for cryptocurrency? It's important to record, calculate, and report all of the taxable events that occured while utilizing your crypto-currency. If you have to file quarterly, then you need to use your best estimates. Here are the ways in which your crypto-currency use could result in a capital gain:. Coinbase customers can upload as many as transactions at once, according to a press statement from Coinbase. You will only have to pay the difference between your current plan and the upgraded plan. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. If you are still working on your crypto taxes for and earlier, it is important that you consult with a tax professional before choosing to calculate your gains using like-kind treatment. Reporting Your Capital Gains Bitcoin pricing barclays rx 580 scrypt hashrate crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Any way you look at it, you are trading one crypto for. Coinbase customers can receive a discount with TurboTax or CoinTracker. Some members of the crypto what is mining bitcoin mean how to connect fidelity coinbase find the imposition of tax on bitcoin contradictory to its anonymous and decentralised nature. Most profitable ethereum mining pool open a bitcoin cloud mining business in mind, any expenditure or expense accrued in mining coins i. When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading?

They are attempting to introduce regulation and reap the benefits associated with innovation based upon blockchain technology. In general, one would want to find dollar values on the exchange they used to obtain crypto. TurboTax Premier will then help customers determine how to file their taxes from the last year. The great hype caused discussions on bitcoin and taxation to come to the forefront. Make sure to be consistent in how you track dollar values. I purchased 0. Thank you! But without such documentation, it can be tricky for the IRS to enforce its rules. This way your account will be set up with the proper dates, calculation methods, and tax rates. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. The below were again taken from the IRS guidance and explain what types of transactions are not taxable when dealing with bitcoin and cryptocurrency:. For anyone who ignored the common crypto-slang advice to " HODL , " to hold on to your investment for dear life, and decided to cash out, those profits are considered income by the IRS. This crypto tax filing page is updated for The short-term rate is very similar to the ordinary income rate. NO Coinbase is not required to issue a K to Coinbase. There is crypto tax software that can potentially help.

Tax Rates: Recently however, the IRS has taken steps to identify tax-payers who are profiting, but not reporting. Any customers who need additional assistance can tap certified public accountants or enrolled agents at Intuit. In the United States, information about claiming losses can be found in 26 U. Submit A Request Chat with a live agent. The distinction between the two is simple to understand: So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. These records will establish a cost basis for these purchased coins, which will be integral for calculating your capital gains. Various other countries are also pursuing their own policies to limit the use of crypto. For example, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2. It's important trusted cloud mining where is genesis mining located find a tax professional who actually understands the nuances of crypto-currency taxation. What if I mined cryptocurrency? Likewise, inonly people had reported their crypto assets to the IRS. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies.

Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Yes I found this article helpful. If you overpay or underpay, you can correct this at the end of the year. Important Note: These losses can potentially save you quite a bit of money if the scenario is right. Therefore, we have a simple mission: What is NOT a taxable event? If you are unsure if your country classifies trading, selling, or utilizing crypto-currency as a taxable capital gain, please consult the information provided above, or consult with a tax professional. The U. The below were again taken from the IRS guidance and explain what types of transactions are not taxable when dealing with bitcoin and cryptocurrency:

Here is a brief scenario bitcoin trading in kenya bitcoin cash hits coinbase illustrate this concept:. Overall, the European Union EU is far behind in terms of a crypto crackdown. When do I pay taxes on crypto gains, do I Have to file quarterly for crypto trading? You can also let us know if you'd like an exchange to be added. How to Import Cryptocurrency Trades into Drake Accounting Software This guide walks through the process for importing crypto transactions into Drake software. Keep in mind, any expenditure or expense accrued in mining coins i. Short-term gains are gains that are realized on assets held for less than 1 year. You will only have to pay the difference between your current plan and the upgraded plan. The cost basis of a coin is vital when it comes to calculating capital gains and losses. Between andU. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. As of earlyMembers of the European Parliament reached consensus with the European Council that wallet providers and exchanges should verify the identity of individuals using their services.

More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. How is Cryptocurrency Taxed? Please consult with a tax advisor regarding your reporting obligation Will Coinbase be issuing me a K from Coinbase? Some wallets support individual crypto-currencies, like Bitcoin, while others support a range of crypto-currencies. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. When crypto holders exchange or sell crypto assets, they will experience a capital gain or loss. Good luck; most exchanges keep track of your trades, but not their value in USD at the time of the trade which is information you need. Contrasting approaches to bitcoin taxation As the price of bitcoin soared to all-time highs and demonstrated its ability to create massive gains, it became apparent for governments that cryptocurrency was a genuine asset that was growing in both popularity and use. In addition, this information may be helpful to have in situations like the Mt. A simple example: The cost basis of mined coins is the fair market value of the coins on the date of acquisition. If you are using crypto-currency to pay for services rendered or buy items, you'll have to pay taxes on any capital gains that occurred as a result of the transaction. To learn more about how to handle this, checkout our complete guide on mining cryptocurrency taxes. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. The process of accounting for bitcoin, and crypto, taxation can be overwhelming if unprepared. As a result, some governments began to drive forward their coping strategies in a more intensive manner.

The base value of your coins can be derived from coinmarketcap. The most important step to comply with tax regulations is to ensure that you keep records of all of your crypto transactions. The problem here is that if like-kind applies, then cashing out limits your options. Moonlite bitcoin compute slow syncing to bitcoin network the number of people who own virtual currencies isn't certain, leading U. After December 31,exchanges are technically limited to real estate. Remember, trading and bitcoin dogecoin cloud mining btc mining fee calculator cryptocurrency are both taxable events where the taxable amount is calculated from the fair market value in U. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. For more information on a strategy called "tax-loss harvesting," see CNBC's explainer. Wallet providers and exchanges will be required to practice due diligence for customer identification in an attempt to curb illicit activity associated with virtual currency, bet country for bitcoin legal ethics of bitcoin bitcoin. How capital gains tax relates to ordinary income and the progressive tax system: On Cryptocurrency Mining and Taxes: A lot of individuals that got into the exciting world of bitcoin and cryptocurrency have unintentionally learned about the tax implications of it all and are now asking the above question. I have not incurred a tax liability in this case. Coinbase does not provide tax advice. Business reporting can be sell bitcoin for paypal my cash bitcoin buy paypal uk, so consider seeing a tax professional on that one. You pay the rate of each bracket you qualify for, on dollars in that bracket, for each tax type. A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. Crypto taxation differs from country to taxes selling bitcoin how to use coinbase wallet. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found .

Tax can be used to automate the entire process of completing your crypto taxes accurately. Company Contact Us Blog. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. For example, China has outlawed crypto trading and India is making moves to make crypto payments illegal. Get Make It newsletters delivered to your inbox. I have not incurred a tax liability in this case. Your adjusted gross income affects your tax bracket for both ordinary income and capital gains. You can use your records if you kept better records than the exchanges you used. Coinbase also has a trading platform called Coinbase Pro formerly called GDAX where you can trade your crypto-currencies for other crypto-currencies. You have to make sure you are reporting on employees paid in crypto and contractors paid in crypto as well. If you held for less than a year, you pay ordinary income tax. Important Note: Reporting Your Capital Gains As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. If you just bought and held last year, then you don't owe taxes on the asset's appreciation because there was no "taxable event. If you are a tax professional that would like to add yourself to our directory, or inquire about a BitcoinTax business account, please click here. There are many elements to take into consideration; for example, types of transactions, transaction dates, fiat exchange rates, multiple wallets, and various exchanges. Exchanges Crypto-currency trading is most commonly carried out on platforms called exchanges. Calculating crypto-currency gains can be a nuanced process.

In , the IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. Using cryptocurrency for goods and services is a taxable event, i. More and more accountants and tax professionals are beginning to working on taxes related to crypto-currencies. In addition, this information may be helpful to have in situations like the Mt. Putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. However, that can also contribute to greater legal uncertainty. To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. When you make enough capital gains, it is the same deal. One example of a popular exchange is Coinbase.