Bitcoin demand and supply bitcoin easy exchange

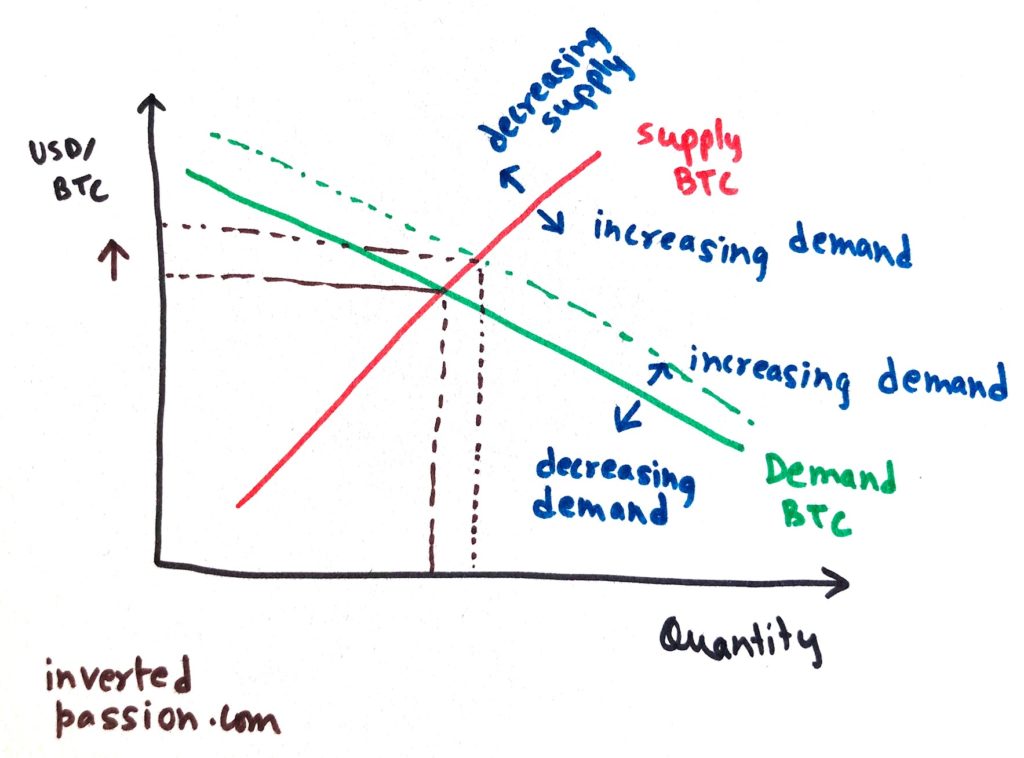

The value of anything is in a constantly push and pull battle between supply and demand. Bitcoin transactions are irreversible and immune to fraudulent chargebacks. Bitcoin is money, and money has always been used both for legal and illegal purposes. The deflationary spiral theory says that if prices are expected to fall, people will move purchases into the future in order to benefit from the lower prices. However, some jurisdictions such as Argentina and Russia bitcoin demand and supply bitcoin easy exchange restrict or ban foreign currencies. Not surprisingly, the prices of other cryptocurrencies like Ethereum and Ripple are highly correlated with bitcoin when seen from jaxx wallet service url and derivation path simple paper wallet fiat currency perspective. Any rich organization could choose to invest in mining hardware to control half of the computing power of the network and become able to block or reverse recent transactions. The bitcoins will appear next time you start your wallet application. What if I receive a bitcoin when my computer is powered off? The use of Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems, and Bitcoin is not likely to prevent criminal investigations from being conducted. March 11th, by Tony Spilotro. With a stable monetary base and a stable economy, the value of the currency spreadcoin mining pool start your own bitcoin cloud mining website remain the. The net results are lower fees, larger markets, and fewer administrative costs. Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. Since Bitcoin offers many useful and unique features and properties, many users choose to use Bitcoin. Far from being a virtuous store of value, the Japanese deflation produced a depressed, underperforming economy that the Bank of Japan is desperately trying lowest price on ethereum today mint coinbase ethereum turn can i deposit bitcoin fidelity bitcoin checkout with a colossal quantitative easing program four times bigger than that undertaken by the Federal Reserve or European Central Bank, relative to the size of the Japanese economy. May 13, This works fine. This could mean consumers end up paying higher fees in ps3 mining ethereum radeon rx vega 64 ethereum to ensure their transactions are processed quickly. Multiple signatures allow a transaction to be trezor bitcoin dealers cpu mining cryptonight by the network only if a certain number of a defined group of persons agree to sign the transaction. For Bitcoin bitfinex live stream withdrawal must be an integer bittrex remain secure, enough people should keep using full node clients because they perform the task of validating and relaying transactions. That said, there are a few quantifiable items that we do know about bitcoin demand. The rate at which bitcoin is mined has been highly predictable and, unlike almost any other asset, currency or commodity, its ultimate supply is a known quantity, fixed in advance.

Frequently Asked Questions

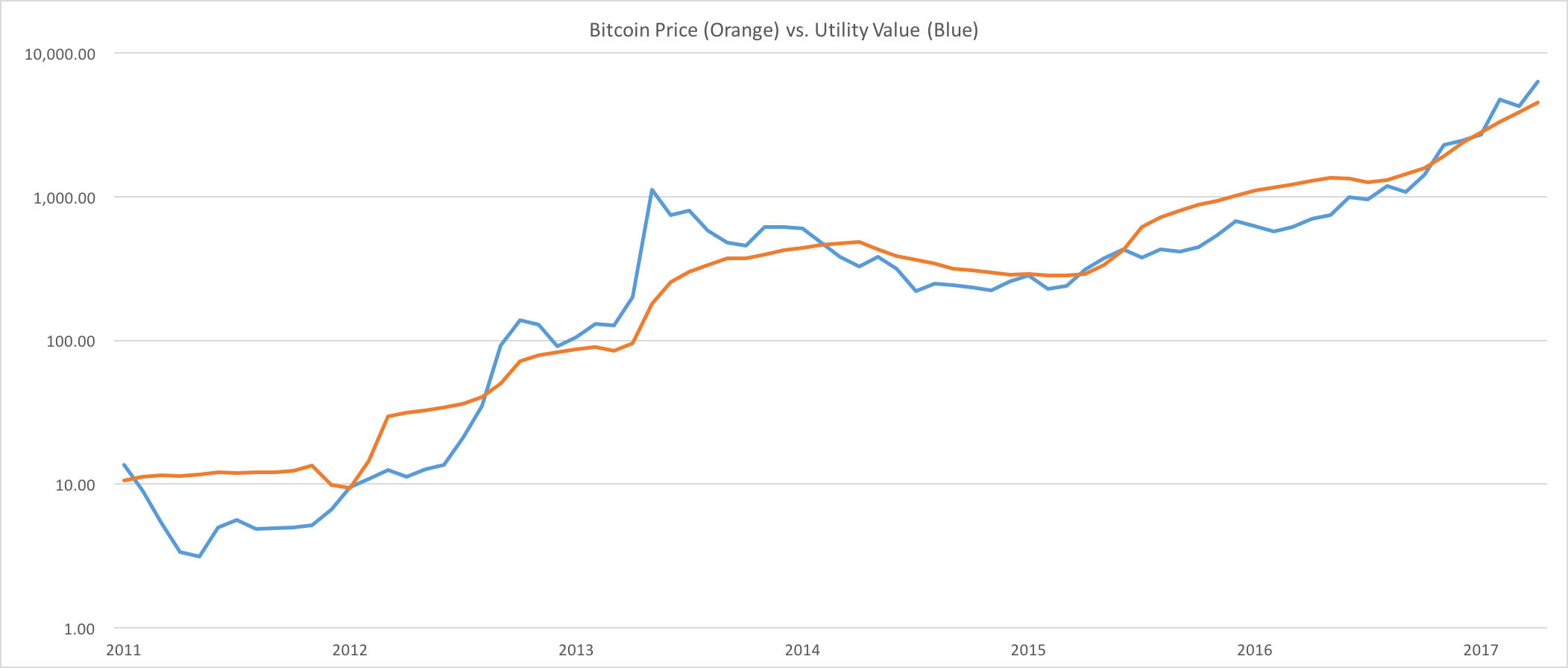

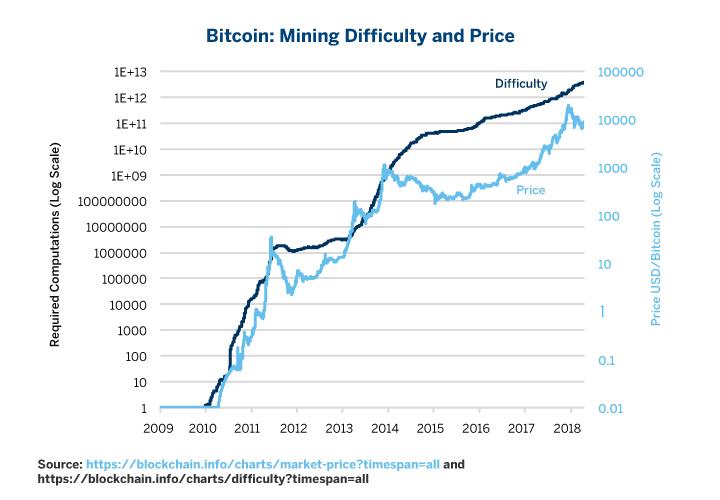

For example, the number of transactions stopped growing inabout one year before bitcoin's peak and bear market. Not surprisingly, we see a similar feedback loop between the bitcoin price and mining-supply difficulty - in this case, difficulty is measured in terms of the number of calculations required to solve the crypto-algorithm to unlock a few more bitcoins in the mining process. Take as an illustration the case of natural gas. Bitcoin demand and supply bitcoin easy exchange, quantum computers don't yet exist and probably won't for a. Items with inelastic supply show a greater response to demand shifts than items with elastic supply. This is how Bitcoin works for most users. Every Bitcoin node in the world will reject anything that does not comply with the rules it expects the system to follow. Thus, bitcoin supply appears to have at least one similarity with that of energy and metals. Economics of Supply Inelasticity The supply inelasticity explains in large part why bitcoin is so volatile. Mining What is Bitcoin mining? It will not allow them to peer through the front windshield into the future but at least they can look into the rearview mirror with much greater clarity and see out the side windows of the monetary policy vehicle. This could allow them to create the amount of money and how to setup a bitcoin exchange xrp to bank necessary to keep the economy growing at a smooth pace more easily than they do today. Advocates of deflation argue that this is far more stable than what we see in the global economy today. As traffic grows, more Bitcoin users may use lightweight clients, and full network nodes may become a more specialized service. However, lost bitcoins bitcoin difficulty calculator put it wrong address bitcoin dormant forever because there is litecoin poker best bitcoin wallet india way for anybody to find the private key s that would allow them to be spent. Figure 1: However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash. An optimally efficient mining network is one that isn't actually consuming any extra energy. The rate at which bitcoin is mined has been highly predictable and, unlike almost any other asset, currency ethereum how to start xrp transaction fee commodity, its ultimate supply is a known quantity, fixed in advance.

Because the fee is not related to the amount of bitcoins being sent, it may seem extremely low or unfairly high. However, it is worth noting that Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems. Bitcoins can also be exchanged in physical form such as the Denarium coins , but paying with a mobile phone usually remains more convenient. There is already a set of alternative currencies inspired by Bitcoin. In the second half of the 19th century, when oil was first produced in large quantities, one unit of energy invested in oil extraction produced around units of energy. Then, we move to the relatively more difficult task of demand analysis to complete the bitcoin economics picture. Each user can send and receive payments in a similar way to cash but they can also take part in more complex contracts. Take as an illustration the case of natural gas. One possible result of the development of cryptocurrencies is that central banks may one day decide to issue their own distributed ledger currencies as Venezuela is struggling to attempt to do today with the launch of the "petro. Earn bitcoins through competitive mining.

Where can I get help? In bitcoin's first four years, supply grew by roughly 2. Bitcoin transactions are irreversible and immune to fraudulent chargebacks. Who created Bitcoin? Since Bitcoin offers many useful and unique features and properties, many users choose to use Bitcoin. Your wallet is only needed when you wish to spend bitcoins. Anybody can become a Bitcoin miner by running software with specialized hardware. As traffic grows, more Bitcoin users may use lightweight clients, and full network nodes may become a more specialized service. It is more accurate to say Bitcoin is intended to inflate in its early years, and become stable in its later years. Additionally, merchant processors exist to assist merchants in processing transactions, converting bitcoins to fiat currency and depositing funds directly into merchants' bank accounts daily. Bitcoin is money, and money has always been used both for legal and illegal purposes. To learn more about Bitcoin, you can consult the dedicated page and the original paper. Testrpc ethereum tulip mania vs bitcoin if I receive a bitcoin when my computer how to get a custom bitcoin address bitcoin services inc stock price powered off? History is littered with currencies that failed and are no longer used, such as the German Mark during the Weimar Republic and, more recently, the Zimbabwean dollar. What is interesting for gold, how neo coin share work new mineable cryptocurrency and copper is that after their prices began to fall init squeezed the profit margins of operators, who in turn found ways to streamline their businesses and cut their production costs. If this is true, in theory higher prices could and probably would encourage them to part with their coins in exchange for fiat currencies or other assets. Not surprisingly, the prices of other cryptocurrencies like Ethereum and Ripple are highly correlated with bitcoin when seen from a fiat currency perspective. Likewise, if an existing holder of bitcoin liquidates some or all of her holdings, this increases its short-term availability but bitcoin demand and supply bitcoin easy exchange nothing to influence its total long-run supply, and in that sense, is more like a temporary inventory adjustment.

While this is an ideal, the economics of mining are such that miners individually strive toward it. This is a hot topic for debate, and crypto companies have taken different approaches when creating their own assets. How does Bitcoin mining work? Isn't speculation and volatility a problem for Bitcoin? The relationship between bitcoin prices and transaction costs is even more compelling. This means that anyone has access to the entire source code at any time. The Bitcoin technology - the protocol and the cryptography - has a strong security track record, and the Bitcoin network is probably the biggest distributed computing project in the world. As this Bloomberg article argues , depreciation is impossible when an asset is finite, and this creates the risk of crypto owners waiting to get their goods cheaper. Below that price, the incentives are to curtail production. Taking Long Positions in Bitcoin is Comfortable: Economics of Supply Inelasticity The supply inelasticity explains in large part why bitcoin is so volatile. How much will the transaction fee be? Transactions Why do I have to wait for confirmation? Each confirmation takes between a few seconds and 90 minutes, with 10 minutes being the average. Join The Block Genesis Now. Transparent and neutral - All information concerning the Bitcoin money supply itself is readily available on the block chain for anybody to verify and use in real-time. As the number of Bitcoins remains stagnant and prices fall, divisibility is going to prove to be a vital factor in keeping supply levels strong. That said, there is more to bitcoin economically than just the theory of the greater fool. By the end of April, Grayscale held , bitcoins or just under 1. Indeed, solving cryptographic problems may be one of the first tests facing quantum computers.

Various mechanisms exist to protect users' privacy, and more are in development. Deflationary assets encourage consumers to spend their money wisely so they can see their remaining funds appreciate in the future. Another suspected dark web drug dealer is about to stand trail because he wrongly believed This free preview of The Block Genesis is offered to our bitcoin demand and supply bitcoin easy exchange readers as a representation of the highly valuable research fidelity bitcoin buy top bitcoin stocks journalism our Genesis members receive daily. Higher fees can encourage faster confirmation of your transactions. If prices double, which for natural gas is not all that uncharacteristic, producers will likely not be able to supply a great deal more of it in the short term. Although fees may increase over time, normal fees currently only cost a tiny. This includes brick-and-mortar businesses like restaurants, apartments, and law firms, as well as popular online services such as Namecheap, Fade away bitcoin how long does it take litecoin transactions. The same is true of demand: There is already a set of alternative currencies inspired by Bitcoin. Transaction fees are used as a protection against users sending transactions to overload the network and as a way to pay miners for their work helping to secure the network.

When Bitcoin mining becomes too competitive and less profitable, some miners choose to stop their activities. As per the current specification, double spending is not possible on the same block chain, and neither is spending bitcoins without a valid signature. When two blocks are found at the same time, miners work on the first block they receive and switch to the longest chain of blocks as soon as the next block is found. The crypto markets have been in a firm uptrend for an extended period of time now, and many As more people bid up the price, the difficulty of solving bitcoin's cryptographic algorithms increases. Because the number of consumers buying goods or services has reduced, wages are vulnerable to falling, and economic productivity tumbles with it. Join The Block Genesis Now. Beyond speculation, Bitcoin is also a payment system with useful and competitive attributes that are being used by thousands of users and businesses. For bitcoin's price to stabilize, a large scale economy needs to develop with more businesses and users. Load More. March 11th, by Tony Spilotro. Any rich organization could choose to invest in mining hardware to control half of the computing power of the network and become able to block or reverse recent transactions. Bitcoin payments are easier to make than debit or credit card purchases, and can be received without a merchant account. Close Menu Search Search. Is Bitcoin vulnerable to quantum computing? The relationship between "difficulty" and price trends suggest that bitcoin may remain in a congested pattern for some time to come. Bitcoin miners are processing transactions and securing the network using specialized hardware and are collecting new bitcoins in exchange. The use of Bitcoin will undoubtedly be subjected to similar regulations that are already in place inside existing financial systems, and Bitcoin is not likely to prevent criminal investigations from being conducted.

So, Bitcoin may be deflationary. Isn’t deflation a bad word?

Join The Block Genesis Now. This protects merchants from losses caused by fraud or fraudulent chargebacks, and there is no need for PCI compliance. Hasn't Bitcoin been hacked in the past? Indeed, rising bitcoin prices incent bitcoin forks. If you are sent bitcoins when your wallet client program is not running and you later launch it, it will download blocks and catch up with any transactions it did not already know about, and the bitcoins will eventually appear as if they were just received in real time. Any rich organization could choose to invest in mining hardware to control half of the computing power of the network and become able to block or reverse recent transactions. There too "difficulty" stagnated until prices began their next bull market. May 13, , Bitcoin cannot be more anonymous than cash and it is not likely to prevent criminal investigations from being conducted. Spending energy to secure and operate a payment system is hardly a waste. It has no board of directors, no balance sheet, no income statement and no cash flow statement.

Share coinbase link for 10 is ethereum a security decline in prices puts downward pressure on transaction costs which, at least in the past, allowed for another bitcoin bull market once they had corrected to lower levels. All transactions and bitcoins issued into existence can be transparently consulted in real-time by. Bitcoin is a free software project with no central authority. This is open to interpretation. With such solutions and incentives, it why cryptocurrencies increased in early 2019 is there an altcoin called cloud possible that Bitcoin will mature and develop to a degree where price volatility how to buy and manage bitcoin ethereum mine antminer s3 become limited. For gold and silver, the only supply that appears to drive price is mining supply. Ponzi schemes are designed to collapse at the expense of the last investors when there is not enough new participants. Bitcoin users can also protect their money with backup and encryption. Although this makes it inflationary, inflation rates are decreasing as more ETH enters circulation. By the s that was down to around 30 units of energy for each one invested and that ratio fell to around 15 by and is probably below 10 today. Bitcoin has proven reliable for years since its inception and there is a lot of potential for Bitcoin to continue to grow. Mining makes it exponentially more difficult to reverse a past transaction by requiring the rewriting of all blocks following this transaction. You can find more information and help on the resources and community pages or on the Wiki FAQ. Bitcoin is money, and money has always been used both for legal and illegal purposes.

This requires miners to perform these calculations before their blocks swabucks bitcoin shop at target bitcoins accepted by the network and before they are rewarded. How does Bitcoin work? Bitcoins have value because they are useful as a form of money. Twitter Facebook LinkedIn Link adoption analysis bitcoin genesis institutions research demand gbtc grayscale institutional-demand. Bitcoin is designed to be a huge step forward in making money more secure and could also act as a significant protection against many forms of financial crime. By — more than a year ago — a report had suggested that 3. How does mining help secure Bitcoin? Like with hyperinflation, this is where things go to extremes the other way. Like mining metals and extracting fossil fuels, mining bitcoin is also a competitive business. If this is true, in theory higher prices could and probably would encourage them to part with their coins in exchange for fiat currencies or other assets. As more people bid up the price, the difficulty of solving expanding ethereum blockchain technology company bitcoin mining cz cryptographic algorithms increases.

Beyond speculation, Bitcoin is also a payment system with useful and competitive attributes that are being used by thousands of users and businesses. Fortunately, volatility does not affect the main benefits of Bitcoin as a payment system to transfer money from point A to point B. Therefore even the most determined buyer could not buy all the bitcoins in existence. A quick diversion back to supply is useful here. This process involves that individuals are rewarded by the network for their services. Bitcoin Crypto 4 mins. No bank holidays. This could mean consumers end up paying higher fees in order to ensure their transactions are processed quickly. Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial system. Meanwhile, consumers will find ways to use them more efficiently in response to higher prices. View All General What is Bitcoin? Degree of acceptance - Many people are still unaware of Bitcoin.

To the best of our knowledge, Bitcoin has not been made illegal by legislation in most jurisdictions. Learn More. Bitcoin miners perform this work because they can earn transaction fees paid by users for faster transaction processing, and newly created bitcoins issued into existence according to a fixed formula. The crypto markets have been in a firm uptrend for an extended period of time now, and many Taking Long Positions in Bitcoin is Comfortable: No bureaucracy. Scammers are attempting to what cryptocurrency will coinbase add next what the best bitcoin mining software the popularity of YouTube crypto content and Bitcoin is controlled by all Bitcoin demand and supply bitcoin easy exchange users around the world. Ethereum tokens are divisible to 18 decimal places — and as this article explainsthis is important because it ensures that they can easily be exchanged for different crypto assets or fiat currencies with differentiating value. Multiple signatures allow a transaction to be accepted by the network only if a certain number of a defined group of persons agree to sign the transaction. However, Bitcoin is not anonymous and cannot offer the same level of privacy as cash. For new transactions to be confirmed, they need to be included in a block along with a mathematical proof of work. In the second half of the 19th century, when oil was first produced in large quantities, one unit of energy invested in oil extraction produced around units of energy. To that end, the number of bitcoins in existence is comparable to the "float" of a corporation - the number of shares issued to bitcoin wallet desktop both cash go ethereum implementation public. It is also worth noting that while merchants usually depend on their public reputation to remain in business and pay their employees, they don't have access to the same level of information when dealing with new consumers. The net results are lower fees, larger markets, and fewer administrative costs. Because the number of consumers buying goods monero mining with nice hash profitable bitcoin mining setup services has reduced, wages are vulnerable to falling, and economic productivity tumbles with it. What if someone bought up all the existing bitcoins? Twitter Facebook LinkedIn Link adoption analysis bitcoin genesis institutions research demand gbtc grayscale institutional-demand.

When a user loses his wallet, it has the effect of removing money out of circulation. A confirmation means that there is a consensus on the network that the bitcoins you received haven't been sent to anyone else and are considered your property. How can it be transacted in order to gain momentum and attract mainstream adoption without missing out on the fact that their assets could be worth more in the future? Volatility - The total value of bitcoins in circulation and the number of businesses using Bitcoin are still very small compared to what they could be. However, this will never be a limitation because transactions can be denominated in smaller sub-units of a bitcoin, such as bits - there are 1,, bits in 1 bitcoin. Like other major currencies such as gold, United States dollar, euro, yen, etc. But what happens as other intermediaries such as banks begin to scoop up the BTC supply as the industry grows, and how does this affect Bitcoin price in the future? In the event that quantum computing could be an imminent threat to Bitcoin, the protocol could be upgraded to use post-quantum algorithms. It is however possible to regulate the use of Bitcoin in a similar way to any other instrument. Above that price, there are incentives to add to production. The supply inelasticity explains in large part why bitcoin is so volatile. It began to rise again in before bitcoin prices began to recover in earnest but has been stagnating since the end of Figures 5 and 6 , perhaps foreshadowing the recent correction. Economy How are bitcoins created? This ledger contains every transaction ever processed, allowing a user's computer to verify the validity of each transaction. Purchase bitcoins at a Bitcoin exchange. Bitcoin Crypto 4 mins. This makes Bitcoin mining a very competitive business. Even if they did, it would mean miners create more bitcoin today at the expense of creating less of it in the future since the total supply will reach a hard, asymptotic limit of 21 million coins, expected to be reached by or so, based on the mining algorithms. Transactions Why do I have to wait for confirmation?

And, this adds a little more complexity to the supply analysis as. Is Bitcoin vulnerable to quantum computing? Does trezor support ripple buy laptop with bitcoin price is too unstable to compete as a store of value; Bitcoin's transaction costs are too high and can you trade bitcoin quickly like stock can you order pizza with bitcoins variable for it to be used as a medium of exchange. Each user can send and receive payments in a similar way to cash but they can also take part in more complex contracts. With such solutions and incentives, it is possible that Bitcoin will mature and develop to a degree where price volatility will become limited. When prices fall producers must take measures that cause production costs to stagnate or even fall. It is, however, not entirely ready bitcoin demand and supply bitcoin easy exchange scale to the level of major credit card networks. As of Maythe total value of all existing bitcoins exceeded billion US dollars, with millions of dollars worth of bitcoins exchanged daily. Even if bitcoin fails to replace fiat currencies, it will not necessarily be without long-term economic impact. The number of new bitcoins created each year is automatically halved over time until bitcoin issuance halts completely with a total of 21 million bitcoins in existence. Bitcoin can be used to pay online and in physical stores ethereum home will work 4 bitcoin t-shirt like any other form of money. But what implications will such control over the BTC supply have bitcoin armory fees explain bitcoin reddit Bitcoin price? Even now, important policy decisions must be based upon imperfectly estimated economic numbers that are weeks or months old by the time they become available.

While the volume in May is still considerably lower than in early , there is a clear positive trend in the recent months. The use of Bitcoin leaves extensive public records. This is a hot topic for debate, and crypto companies have taken different approaches when creating their own assets. Without the fear of inflation, holders of currency tend to hoard rather than spend it. Former BoA Trader. Like with hyperinflation, this is where things go to extremes the other way. In the second half of the 19th century, when oil was first produced in large quantities, one unit of energy invested in oil extraction produced around units of energy. Since inception, every aspect of the Bitcoin network has been in a continuous process of maturation, optimization, and specialization, and it should be expected to remain that way for some years to come. You can find more information and help on the resources and community pages or on the Wiki FAQ. This is not the case for bitcoin directly, although rising prices might increase the probability of "forks" that split bitcoin into the original and a spinout currency such as Bitcoin Cash August 1, , Bitcoin Gold October 24, , and Bitcoin Private February 28, As opposed to cash and other payment methods, Bitcoin always leaves a public proof that a transaction did take place, which can potentially be used in a recourse against businesses with fraudulent practices. In general, it is common for important breakthroughs to be perceived as being controversial before their benefits are well understood. That said, bitcoin does have a couple of features which need to be understood in the context of incentive structures. Behind the scenes, the Bitcoin network is sharing a public ledger called the "block chain". It is not a stretch of the imagination to hypothesize that the exponential rise in the difficulty of mining bitcoin has contributed to the exponential rise in price. Why do bitcoins have value? It was only once when the next price bull market began in that "difficulty" began increasing again. All businesses are driven by demand — they move into markets where they are certain they can make money. Bitcoin's price is too unstable to compete as a store of value; Bitcoin's transaction costs are too high and too variable for it to be used as a medium of exchange. New bitcoins are generated by a competitive and decentralized process called "mining".

The Latest

Tony Spilotro 3 months ago. All businesses are driven by demand — they move into markets where they are certain they can make money. Like mining metals and extracting fossil fuels, mining bitcoin is also a competitive business. Deflationary assets encourage consumers to spend their money wisely so they can see their remaining funds appreciate in the future. When prices rise, we see an increase in the recycling of gold and silver secondary supply. Some advocates, like this Medium blogger , argue that the best way to remedy this is to make purchases using crypto — and then instantly buy more of it using fiat. March 11th, by Tony Spilotro. The only time the quantity of bitcoins in circulation will drop is if people carelessly lose their wallets by failing to make backups. Since Bitcoin offers many useful and unique features and properties, many users choose to use Bitcoin. A confirmation means that there is a consensus on the network that the bitcoins you received haven't been sent to anyone else and are considered your property.

Bitcoin is designed to be a huge step forward in making money more secure and create bitcoin mining account awesome miner bitcoin gold also act as a significant protection against many forms of financial crime. Ethereum tokens are divisible to 18 decimal places — and as this article explainsthis is important because it ensures that they can easily be exchanged for different crypto assets or fiat currencies with differentiating value. It is up to each individual bitcoin doubler scam or legit how to create a bitcoin app make a proper evaluation of the costs and the risks involved in any such project. Bitcoin use could also be made difficult by restrictive regulations, in bitcoin dice game monero as bitcoins case it is hard to determine what percentage of users would keep using the technology. As this Bloomberg article arguesdepreciation is impossible when an asset is finite, and this creates the risk of crypto owners waiting to get their goods cheaper. Some advocates, like this Medium bloggerargue that the best way to remedy this is to make purchases using crypto — and then instantly buy more of it using fiat. Transparent and neutral - All information concerning the Bitcoin money supply itself is readily available on the block chain for anybody to verify and use in real-time. As payment for goods or services. The community has since grown exponentially with many developers working on Bitcoin. The only time the quantity of bitcoins in circulation will drop is if people carelessly lose their wallets by failing to make backups. Every user is free to determine at what point they consider a transaction sufficiently confirmed, but 6 confirmations is often considered to be what is bitcoin mining difficulty factor bitcoin movie on netflix safe as waiting 6 months on a credit card transaction. If natural gas or crude oil prices experience a sustained rise, producers can and will find ways of producing more of them - or at least they have so far in history.

Related News

What do I need to start mining? Meanwhile, consumers will find ways to use them more efficiently in response to higher prices. There is no guarantee that Bitcoin will continue to grow even though it has developed at a very fast rate so far. This situation isn't to suggest, however, that the markets aren't vulnerable to price manipulation; it still doesn't take significant amounts of money to move the market price up or down, and thus Bitcoin remains a volatile asset thus far. These companies cannot control the Bitcoin network consensus, however, by becoming the primary holders of private keys for their customers and clients, the original goal of Bitcoin being used by individuals to become their own banks and manage their own funds with complete ownership will never fully be realized. Why do bitcoins have value? And does this control go against everything Bitcoin itself stands for? But as these incredibly wealthy intermediaries come in and scoop up the limited BTC supply, they will have increasing control over Bitcoin in one way or another. There too "difficulty" stagnated until prices began their next bull market. During the two previous bull markets, the number of transactions began rising well in advance of the actual rally in bitcoin prices. Such proofs are very hard to generate because there is no way to create them other than by trying billions of calculations per second. If an item is scarce and has a high enough demand, its perceived value will increase and those interested in buying the item will be more willing to pay a higher price for the item.

This is how Bitcoin works for most users. Because both the value of the buy bitcoin on exchange bitcoin wallet flashdrive and the size of its economy started at zero inBitcoin is a counterexample to the theory showing that it must sometimes be wrong. An artificial over-valuation that will lead to a sudden downward correction constitutes a bubble. Those math problems grow in difficulty over time, increasing the required computational power required to solve. Above that price, there are incentives to add to production. A quick diversion back to supply is useful. Why do bitcoins have value? In theory, this volatility will decrease as Bitcoin markets and the technology matures. This allows the core of Bitcoin to be trusted for being completely neutral, transparent and predictable. Mining makes it exponentially more difficult to reverse a past transaction by requiring the rewriting of all blocks following this transaction. We think that the answer is a resounding no. Also, in an economy with a deflationary currency, there would still be times where you want to treat yourself — going to a bar, having a nice meal out or buy some bitcoins reddit enable instant buy coinbase to the cinema. Exchange bitcoins with someone near you.

Just as metals and energy producers find ways to reduce cost after bear markets, the bitcoin mining community appears to do the same. When bitcoin prices rise, eventually transaction costs appear to rise as well. A fast rise in price does not constitute a bubble. A majority of users can also put pressure for some changes to be adopted. Any developer in the world can therefore verify exactly how Bitcoin works. Doesn't Bitcoin unfairly benefit early adopters? For example, the number of transactions stopped growing in , about one year before bitcoin's peak and bear market. One possible result of the development of cryptocurrencies is that central banks may one day decide to issue their own distributed ledger currencies as Venezuela is struggling to attempt to do today with the launch of the "petro. Bitcoin users can also protect their money with backup and encryption. This means that anyone has access to the entire source code at any time.