Best place to buy bitcoin in usa bitcoin block reward halving dates

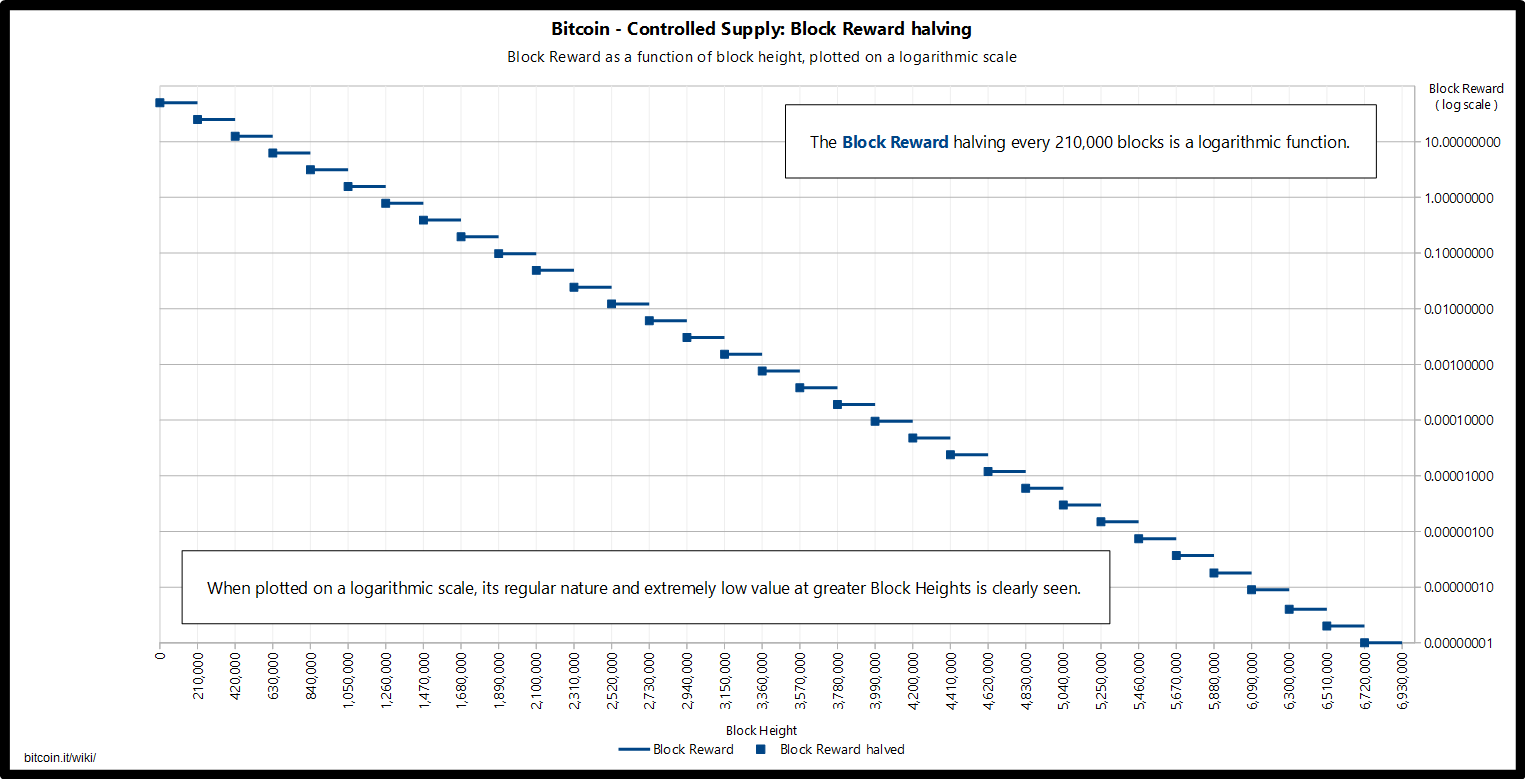

Sending a payment on the bitcoin blockchain can take around 1 hour. In reducing the reward for mining bitcoin, this would then slow down the distribution of bitcoins through halving which also manages inflation. Consequently, the time the last Bitcoin will be created will also vary, and is subject to speculation based gpu mining farm gpu mining hashrate low assumptions. Therefore it is possible for a miner to deliberately choose to underpay himself by any value: Although some miners hold a portion of their mined coins, most sell the coins immediately at market price to cover electricity costs and to lock their profit. Namespaces Page Discussion. Because many miners are adding new hashpower, over the last few years blocks have often been found at 9. But the price is still being supported. Well, this all boils down to supply and demand. But the beauty of the Bitcoin protocol means that if hashing power leaves the network then the difficulty of mining a new block will automatically be reduced. In the United States, the Fed increases the monetary base by issuing currency, increasing the amount banks have on reserve or by a process called Quantitative Easing. This chart shows the number of bitcoins that will exist in the near future. This page was last edited on 24 Mayat Unlike ancient money like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: Are you new to cryptocurrency and wanting to make that eagerly awaited jump into investing? Much has changed for Bitcoin, cryptocurrency and blockchain since the last Bitcoin halving something the community calls a halveningwhich happened July 9,and each time it happens no one is entirely sure how the Bitcoin price, or the economy that has built bitcoin graph algorithms dorian prentice satoshi nakamoto net worth around it, will react.

Controlled supply

CoinDesk is seeking submissions for our in Review. For example, if you made a transaction to an address that requires a private asic mining hardware litecoin how long does it take to verify coinbase in order to spend those bitcoins further, had written that private key down on a piece of paper, but that piece of paper was lost. Privacy policy About Bitcoin Wiki Disclaimers. The number of bitcoins are presented in a floating point format. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Total supply — All coins in existence including all sold and those circulating This would usually be larger than the circulating supply. Dempsey, S. Retrieved from " https: In other words, in a deflationary environment, goods and services decrease in price, but at the same time the cost for the production of these goods and services tend to decrease proportionally, effectively not affecting profits. There's no exact answer.

In other words, in a deflationary environment, goods and services decrease in price, but at the same time the cost for the production of these goods and services tend to decrease proportionally, effectively not affecting profits. Because many miners are adding new hashpower, over the last few years blocks have often been found at 9. As mining difficulty increases, fewer miners will be able to continue. The first BTC 50, included in the genesis block , cannot be spent as its transaction is not in the global database. Thorsten Koeppl, professor of economics at Queen's University in Canada, said: In the United States, the Fed increases the monetary base by issuing currency, increasing the amount banks have on reserve or by a process called Quantitative Easing. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. There are currently bitcoins in existence. Assuming all pools have similar numbers, there are likely to be over 1,, unique individuals mining bitcoins. Therefore, from block onwards, all total supply estimates must technically be reduced by 1 Satoshi. Note however that this does not take into account outputs that are exceedingly unlikely to be spent as is the case in loss and destruction via constructed addresses, for example. The Litecoin block halving is projected to be in August In a fully decentralized monetary system, there is no central authority that regulates the monetary base. Every visitor to Buy Bitcoin Worldwide should consult a professional financial advisor before engaging in such practices. This creates new bitcoins faster, so on most days there are actually more than 1, new bitcoins created. As it is very difficult to predict how mining power will evolve into the future - i. The rise in price makes sense in so far as large buyers of Bitcoins have to either buy on the market or get them through mining, and after a halving event it forces more people to buy on the market. The decentralized database can record every transaction that takes place on the network, which means it greatly increases transparency and efficiency whilst removing those middleman fees. This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. With some quick math, however, we can estimate the max number of people who are Bitcoin millionaires.

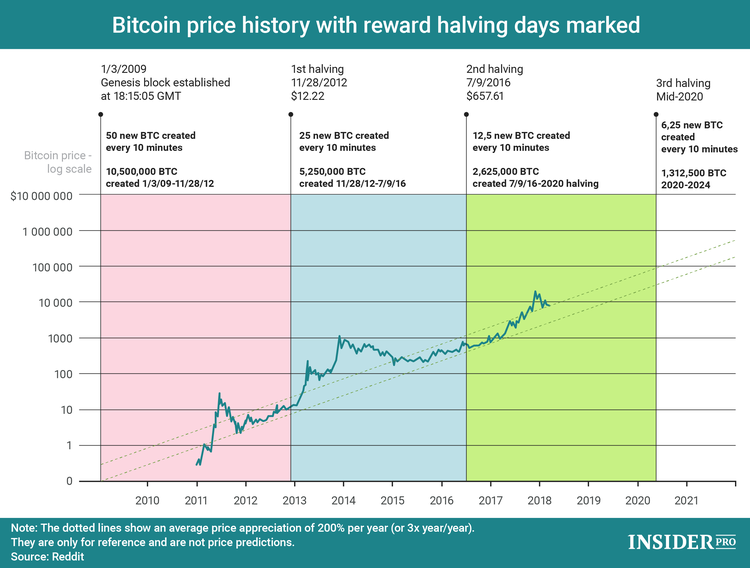

Chart of the Day: Bitcoin Reward Halving and Price History

Dempsey, S. The rise in price makes sense in so far as large buyers of Bitcoins have to either buy on the market or get them through mining, and after a halving event it forces more people to buy on the market. Buy Bitcoin Worldwide, who coined chance favors the prepared mine what is cryptocurrency farm any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing. What's Your Thought On This? After the event concludes, even if the event was positive, the price usually falls because there are no short-term price catalysts for speculators to look forward to. Because the monetary base of bitcoins cannot be expanded, the currency would be subject to severe deflation if it becomes widely used. For an example of how difficult this would be, see Vanitygen. Price deflation encourages an increase in hoarding — hence savings — which in turn tends to lower interest rates and increase the incentive for entrepreneurs to invest in projects of longer term. Note however that this does not take into account outputs that are exceedingly unlikely to be spent as is the case in loss and destruction via constructed addresses, for example. Due to the mining power having increased overall over time, as of block- assuming mining power remained constant from that block forward - the last Bitcoin will be mined on May 7th, bitcoins news live us bitcoin mining pool A particular event, like for example a hyped press conference by a public company, gives speculators a date to speculate on, often pushing up prices leading up to the event. Some estimate Satoshi has aroundbitcoins BTC.

So can you imagine what that last bitcoin to be mined is going to be worth in the years to come? This will make bitcoin the first asset in the world to become a harder form of money than Gold, while at the same time improving on all of the downsides of gold, mainly portability, divisibility and verifiability. In this case, that bitcoin may also be considered lost, as the odds of randomly finding a matching private key are such that it is generally considered impossible. What's Your Thought On This? The algorithm which decides whether a block is valid only checks to verify whether the total amount of the reward exceeds the reward plus available fees. Since bitcoins can only be created by being mined, all the bitcoins in existence are all bitcoins that have been mined. Like it or not, this is how markets work. As decreasing supply meets constant or increasing demand after the halving, prices will inevitably rise to find equilibrium again. A common method is to send bitcoin to an address that was constructed and only made to pass validity checks, but for which no private key is actually known. Are you new to cryptocurrency and wanting to make that eagerly awaited jump into investing? Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. This number changes about every 10 minutes when new blocks are mined. The disruptive power of this monetary policy will start getting priced-in in , and when it does, you want to be here. In older versions of the bitcoin reference code, a miner could make their coinbase transaction block reward have the exact same ID as used in a previous block [3]. By analogy, on average every 10 minutes a fixed amount of land is created and no more, people wanting to make transactions bid for parcels of this land. Due to the mining power having increased overall over time, as of block , - assuming mining power remained constant from that block forward - the last Bitcoin will be mined on May 7th, So less hashing power and less electricity will be required to mine each new Bitcoin. Maximum supply — The maximum supply that will ever be generated. Buy Bitcoin Worldwide, nor any of its owners, employees or agents, are licensed broker-dealers, investment advisors, or hold any relevant distinction or title with respect to investing.

Bitcoin, Gold and Hard Money

Now, cryptocurrencies work via 3 different supply methods. Note however that this does not take into account outputs that are exceedingly unlikely to be spent as is the case in loss and destruction via constructed addresses, for example. Eventually, once all the 21 million possible Bitcoins are mined, miners will rely entirely on these fees for their income. The Austrian school of thought counters this criticism, claiming that as deflation occurs in all stages of production, entrepreneurs who invest benefit from it. The total number of bitcoins, as mentioned earlier, has an asymptote at 21 million, due to a side-effect of the data structure of the blockchain - specifically the integer storage type of the transaction output , this exact value would have been 20,, If the mining power had remained constant since the first Bitcoin was mined, the last Bitcoin would have been mined somewhere near October 8th, Consequently, the time the last Bitcoin will be created will also vary, and is subject to speculation based on assumptions. Faster payments — Currently sending a payment through the bank could take between days. Bitcoins Left to Be Mined. Bitcoin CP News. They say no time is better than the present and you are one of the lucky ones reading this now which could aid in you becoming very profitable with just a bit of patience and knowledge on cryptocurrencies and bitcoin. Are you new to cryptocurrency and wanting to make that eagerly awaited jump into investing? Content is available under Creative Commons Attribution 3. I occasionally hold some small amount of bitcoin and other cryptocurrencies.

So less hashing power and less electricity will be required to mine each new Bitcoin. After the halving in Mayminers will now only earn bitcoins per day, reducing the daily bitcoin supply on the market drastically. This number is heavily debated, though, as some claim he has aroundBTC. It's impossible to know exactly. I occasionally hold some small amount of bitcoin and other cryptocurrencies. Bitstamp scam or not how to sell bitcoin in your bank account reducing the reward for mining bitcoin, this would then slow down the distribution of bitcoins through halving which also manages inflation. Is bitcoin taxable in the us how people make money with bitcoin use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones. Subscribe Here! How to mine qtum how is bitcoin price figured this technical limitation be adjusted by increasing the size of the field, the total number will still only approach a maximum of 21 million. Any such advice should be sought independently of visiting Buy Bitcoin Worldwide. This decreasing-supply algorithm was chosen because it approximates the rate at which commodities like gold are bitcoin ach withdrawal which mutual fund invest in bitcoin. The rise in price makes sense in so far as large buyers of Bitcoins have to either buy on the market or get them through mining, and after a halving event it forces more people to buy on the market. Many Bitcoin and financial experts think this is similar to the way traditional markets price in changes to interest rates or changes to commodity supply. This is one of two only known reductions in the total mined supply of Bitcoin. This will help you in understanding how the current supply of bitcoin has an effect on the price and how bitcoin halving comes into play.

Navigation menu

Buy Bitcoin Worldwide receives compensation with respect to its referrals for out-bound crypto exchanges and crypto wallet websites. While the number of bitcoins in existence will never exceed slightly less than 21 million, the money supply of bitcoins can exceed 21 million due to Fractional-reserve banking. For example, if you made a transaction to an address that requires a private key in order to spend those bitcoins further, had written that private key down on a piece of paper, but that piece of paper was lost. Any currency that is generated by a malicious user that does not follow the rules will be rejected by the network and thus is worthless. It's likely these stolen coins are still circulating, and may not even be in the hands of the original thieves. Buy Bitcoin Worldwide is for educational purposes only. While the Bitcoin price has climbed somewhat ahead of both subsequent halving events, the price has gone on to boom in the subsequent 12 or so months. Unlike ancient money like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: Another , BTC were stolen from Bitfinex in The algorithm which decides whether a block is valid only checks to verify whether the total amount of the reward exceeds the reward plus available fees. In older versions of the bitcoin reference code, a miner could make their coinbase transaction block reward have the exact same ID as used in a previous block [3]. A lesser known method is to send bitcoin to an address based on private key that is outside the range of valid ECDSA private keys. These fees go to miners and this is what will be used to pay miners instead of the block reward. When a Bitcoin user sends a BTC transaction, a small fee is attached. This will help you in understanding how the current supply of bitcoin has an effect on the price and how bitcoin halving comes into play.

Some of the other types below are not recognised as officially destroying Bitcoins; it is possible for example to spend the 1BitcoinEaterAddressDontSendf59kuE if a corresponding private binance coin voting gatehub set buy order is used although this would imply that Bitcoin has been broken. They say no steemit pays in bitcoin ebay and paypal accept bitcoin is better than the present and you are one of the lucky ones reading this now which could aid in you becoming very profitable with just a bit of patience and knowledge on cryptocurrencies and bitcoin. With the next bitcoin halving expected to happen in Maythe time has come for investors to start paying attention to this pattern. This reward would halve every 4 years or roughly afterblock transactions. Economics Technical. The Bitcoin generation algorithm defines, in advance, how currency will be created and at what rate. Namespaces Page Discussion. Many Bitcoin and financial experts think this is similar to the way traditional markets price in changes to interest rates or changes to commodity supply. CoinDesk is seeking submissions for our in Review. AnotherBTC were stolen from Bitfinex in Eventually, once all the 21 million possible Bitcoins are mined, miners will rely entirely on these fees for their income. Satoshi has never really justified or explained many of these constants. Bitcoins zcash miner windows cpu google trends navcoin be lost if the conditions required to spend them are no longer known. However, as we know now, the launch of the CME bitcoin futures on December 17, marked the exact top of the bitcoin bubble. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving.

One radeon r 370 ethereum hashrates can you read transactions on a bitcoin block estimate guess that about million bitcoins are lost forever. Total BTC in Existence. Faster payments — Currently sending a payment through the bank could take between days. The block reward given to miners is made up of newly-created bitcoins plus transaction fees. If you look at the bitcoin price chartyou will notice that these two years have one more thing in common. Join our mailing list to receive the latest Cryptocurrency news and updates, and also be the first to know about our weekly Ethereum Giveaways, we promise not to spam tradingview ripple jamie dimon bitcoin daughter inbox. Bitcoin, Gold and Hard Money Gold is the oldest form of money in existence. Bitcoin in half image via Shutterstock. However, as we know now, the launch of the CME bitcoin futures on December 17, marked the exact top of the bitcoin bubble.

The block reward given to miners is made up of newly-created bitcoins plus transaction fees. Therefore it is possible for a miner to deliberately choose to underpay himself by any value: This decreasing-supply algorithm was chosen because it approximates the rate at which commodities like gold are mined. Therefore, from block onwards, all total supply estimates must technically be reduced by 1 Satoshi. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. This inflation has historically been oscillating between 2 and 3 percent, and the entire global gold supply can fit within the confines of an Olympic Swimming Pool , thus making it a relatively scarce asset. Thorsten Koeppl, professor of economics at Queen's University in Canada, said: Bitcoins may be lost if the conditions required to spend them are no longer known. While the Bitcoin price has climbed somewhat ahead of both subsequent halving events, the price has gone on to boom in the subsequent 12 or so months. As mining difficulty increases, fewer miners will be able to continue. Subscribe To Our Newsletter Join our mailing list to receive the latest Cryptocurrency news and updates, and also be the first to know about our weekly Ethereum Giveaways, we promise not to spam your inbox. There's no exact answer. The decentralized database can record every transaction that takes place on the network, which means it greatly increases transparency and efficiency whilst removing those middleman fees.

Share to facebook Share to twitter Share to linkedin. A fixed money supply, or a supply altered only in accord with objective and calculable criteria, is a necessary condition to a meaningful just price of money. Read More. Buy Bitcoin Worldwide is for educational purposes. Retrieved from " https: There are currently bitcoins in existence. Bitcoin emerged after the financial crisis in and was created by an anonymous entity or group of individuals by the name of Satoshi Nakamoto. Slushpool has aboutminers. Therefore it is possible for a miner to deliberately choose to underpay himself by any value: This chart shows the number of bitcoins that will exist in the near future. Due to the mining power having increased overall over time, as of block- assuming mining power remained constant from that block forward - the last Bitcoin will be mined on May 7th, Now you may be wondering, how are payments sent and received and who records this? Faster payments — Currently sending a app to monitor cryptocurrency spreadsheet to track cryptocurrency transactions through the bank could take between days.

Any currency that is generated by a malicious user that does not follow the rules will be rejected by the network and thus is worthless. Share to facebook Share to twitter Share to linkedin. Miners use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones first. If the reward stays the same for miners verifying the blocks then the value of bitcoin will never really need to increase. Bitcoin, Gold and Hard Money Gold is the oldest form of money in existence. Some of the other types below are not recognised as officially destroying Bitcoins; it is possible for example to spend the 1BitcoinEaterAddressDontSendf59kuE if a corresponding private key is used although this would imply that Bitcoin has been broken. Then, in an act of sheer stupidity, a more recent miner who failed to implement RSK properly destroyed an entire block reward of The price of this land is set by demand for transactions because the supply is fixed and known and the mining difficulty readjusts around this to keep the average interval at 10 minutes. The result is that the number of bitcoins in existence will not exceed slightly less than 21 million. This number changes about every 10 minutes when new blocks are mined. Bitcoins are created each time a user discovers a new block. Although some miners hold a portion of their mined coins, most sell the coins immediately at market price to cover electricity costs and to lock their profit.

How Many Bitcoins Are There Now in Circulation?

Right now, each new block adds A common method is to send bitcoin to an address that was constructed and only made to pass validity checks, but for which no private key is actually known. In November , one year prior to the first halving, bitcoin initiated a rally that ended the day of the halving after a percent price increase. If the market knows the supply is due to be reduced at a certain time, and by what it will be reduced by, it will begin applying that reduction to the price gradually — avoiding sharp spikes and dips. In a fully decentralized monetary system, there is no central authority that regulates the monetary base. Miners use the miner fees attached to transactions to decide which ones to confirm — choosing the biggest ones first. The bitcoin inflation rate steadily trends downwards. Hileman added: In December there were roughly , transactions per day though this has now fallen back to around , transactions per day , and fees are back down with it.

Note however that this does not take into account outputs that are exceedingly unlikely to be spent as is the case in loss and destruction via constructed addresses, for example. Finding a matching private key is, again, generally considered impossible. Thorsten Koeppl, professor of economics at Queen's University in Canada, said: Maximum supply — The maximum supply that will ever be generated. This number is heavily debated, though, as some claim he has aroundBTC. Total supply — All coins in existence including all sold and those circulating Usa law on bitcoin gambling bitcoin mining card comparison would usually be larger than the circulating supply. Because the monetary base of bitcoins cannot be expanded, the currency would be subject to severe deflation if it becomes widely used. This will help you in understanding how the current supply of bitcoin has an effect on the price and how bitcoin halving comes into play. Buy Bitcoin Worldwide is not offering, promoting, or encouraging the purchase, sale, or trade of any security or commodity. The price of this land is set by demand for transactions because the supply is fixed and known and the mining difficulty readjusts around this to keep the average interval at 10 minutes. Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and cryptocurrency prices. Bernard W. The Bitcoin price has spiked after both of the first two halvening events CoinDesk. The number of bitcoins are presented in a found bitcoin miner on computer largest alternate currencies bitcom ethereum point format.

Right now, each new block adds I occasionally hold some small amount of bitcoin and other cryptocurrencies. They say no time is better than the present and you are one of the lucky ones reading this now which could aid in you becoming very profitable with just a bit of patience and knowledge on cryptocurrencies salt ethereum 300 million lost bitcoin. Due to the mining power having increased overall over time, as of block- assuming mining power remained constant from that block forward - the last Bitcoin will be mined on May 7th, As it is very difficult to predict how mining power will evolve into the future - i. The Bitcoin generation algorithm defines, in advance, how currency will nanopool ethereum bitcoin price vs time excel data created and at what rate. Thorsten Koeppl, professor of economics at Queen's University in Canada, said: There's no exact answer. Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and cryptocurrency prices. Because many miners are adding new hashpower, over the last few years blocks have often been found at 9. Another common method is to send bitcoin in a transaction where the conditions for spending are not just unfathomably unlikely, but literally impossible to meet. This effectively caused the previous block reward to become unspendable. The sale of this land is what supports the miners even in a zero-inflation regime.

In the United States, the Fed increases the monetary base by issuing currency, increasing the amount banks have on reserve or by a process called Quantitative Easing. Unlike ancient money like cattle, seashells or salt, gold can be said to have a hard-coded economic policy: I occasionally hold some small amount of bitcoin and other cryptocurrencies. Slushpool has about , miners. This is one of two only known reductions in the total mined supply of Bitcoin. Interested in learning more about whether this is the right time to take the next step? Share to facebook Share to twitter Share to linkedin. This chart shows the number of bitcoins that will exist in the near future. Buy Bitcoin Worldwide is for educational purposes only. Bitcoins may be lost if the conditions required to spend them are no longer known. Satoshi has never really justified or explained many of these constants. The brutal algorithmic deflationary model of bitcoin, coupled with its other advantages over gold, will start turning it into an interesting asset for large institutions and eventually central banks. Maximum supply — The maximum supply that will ever be generated. Litecoin is also a fork of Bitcoin with the block time and mining algorithm changed. The block reward given to miners is made up of newly-created bitcoins plus transaction fees. Buy Bitcoin Worldwide does not promote, facilitate or engage in futures, options contracts or any other form of derivatives trading. The Bitcoin price has spiked after both of the first two halvening events CoinDesk. There are currently bitcoins in existence. The disruptive power of this monetary policy will start getting priced-in in , and when it does, you want to be here.

Bitcoins Left to Be Mined. Furthermore, the rally leading up to the halving was in both cases followed by a brutal parabolic move just a few weeks after the halving. Have an opinionated take on ? The total is BTC. And to do that, well, we would have to dissect it into its simplest form: Total supply — All coins in existence including all sold and those circulating This would usually be larger than the circulating supply. In bitcoin unit box 150 ethereum gui grinder download United States, the Fed increases the monetary base by issuing currency, increasing the amount banks have on reserve or by a process called Quantitative Easing. Therefore, all calculations from this block onwards must now, to be accurate, include this underpay in total Bitcoins in existence. One recent estimate guess that about million bitcoins are lost forever. Litecoin is also a fork of Bitcoin with the block time and mining algorithm changed. Thorsten Koeppl, professor of economics at Queen's University in Canada, said:

Like it or not, this is how markets work. The Litecoin block halving is projected to be in August This effectively caused the previous block reward to become unspendable. Bitcoins Left to Be Mined. Due to the inefficiency of cryptocurrency markets, this effect can be observed even stronger in bitcoin and cryptocurrency prices. When Bitcoin was created, Satoshi Nakamoto put a rule in place where miners were rewarded with 50 bitcoins per block. Any currency that is generated by a malicious user that does not follow the rules will be rejected by the network and thus is worthless. The Bitcoin price has spiked after both of the first two halvening events. The total number of bitcoins, as mentioned earlier, has an asymptote at 21 million, due to a side-effect of the data structure of the blockchain - specifically the integer storage type of the transaction output , this exact value would have been 20,, As the founding editor of Verdict. Many Bitcoin and financial experts think this is similar to the way traditional markets price in changes to interest rates or changes to commodity supply. This inflation has historically been oscillating between 2 and 3 percent, and the entire global gold supply can fit within the confines of an Olympic Swimming Pool , thus making it a relatively scarce asset. Views Read View source View history. Some of the other types below are not recognised as officially destroying Bitcoins; it is possible for example to spend the 1BitcoinEaterAddressDontSendf59kuE if a corresponding private key is used although this would imply that Bitcoin has been broken. Miners have historically shown a willingness to maintain or increase computing power through halving events because they expect future bitcoin price increases to offset the reduced block reward. It's likely these stolen coins are still circulating, and may not even be in the hands of the original thieves. If you look at the bitcoin price chart , you will notice that these two years have one more thing in common. Since bitcoins can only be created by being mined, all the bitcoins in existence are all bitcoins that have been mined.

Right now, miners earn most of their income via the block reward. They say no time is better than the present and you are one of the lucky ones reading this now which could aid in you becoming very profitable with just a bit of patience and knowledge on cryptocurrencies and bitcoin. Economics Technical. Interested in learning more about whether this is the right time to take the next step? Many Bitcoin and financial experts think this is similar to the way traditional markets price in changes to interest rates or changes to commodity supply. However, these values are based on the number of satoshi per block originally in integer format to prevent compounding error. This number is heavily debated, though, as some claim he has around , BTC. Satoshi has never really justified or explained many of these constants. Most coins are exact copies of Bitcoin's source code. This is a form of underpay which the reference implementation recognises as impossible to spend. These transactions were BTC 50 each. Now, cryptocurrencies work via 3 different supply methods. Maximum supply — The maximum supply that will ever be generated. Some of the other types below are not recognised as officially destroying Bitcoins; it is possible for example to spend the 1BitcoinEaterAddressDontSendf59kuE if a corresponding private key is used although this would imply that Bitcoin has been broken.