How does cryptocurrency affect the economy how to get started on cryptocurrency

This is where the debate around concentrated mining power in case of proof of stake consensus as in the bitcoin blockchainchallenges around scalability, liquidity. Gibraltar is a British How much bitcoin genesis mining bittrex announcements bitcoin diamond Territory in Europe with a population of around 33, people. With the invention of the internet and all that it has enabled, we are witnessing a steady transition away of value embedded in physical assets to value created by digital assets. Fliboard icon A stylized letter F. At the moment, the SEC says that bitcoin and ether are not securities. The fact that this fundraising approach has gotten so much attention indicates that it's disruptive. The European Union EU consists of 28 separate nations all of which have their own view on cryptocurrency regulation, but there appears to be a drive from the top to create a harmonized approach to the nascent industry, though in practise that could be hard to. Email icon An envelope. And while the ethos of decentralization has an almost evangelical appeal to those in the crypto community, most people don't have strong beliefs — or any beliefs bitcoin stealer malware when will bittrex award gbtc about decentralization. It often indicates a user profile. Treasury Bill buyer of last resort. As China clamped down on the crypto-industry, Japan saw an opportunity to take a lead by introducing policy that was seen as welcoming for cryptocurrencies. If the Federal Reserve can't cut rates significantly, then it's only real policy option would be to buy massive amounts of U. Second, the Federal Reserve might be limited in its ability to simply inject cash. Next comes the peak of the bull market, during which a belief sets in that we've finally figured out this market. The existence of cryptocurrencies as an alternative safe haven during times of financial crisis may prompt central banks to long long for usd withdrawal coinbase send cash to bittrex in a more responsible way than they otherwise. This fact has caused various countries to consider stricter regulations on crypto and even develop their own government-sponsored cryptocurrencies. Using their platform, you send and request money while avoiding third-party intermediaries. There is no reason to think Americans and others around the world would not act in a similar fashion, given similar circumstances. The U.

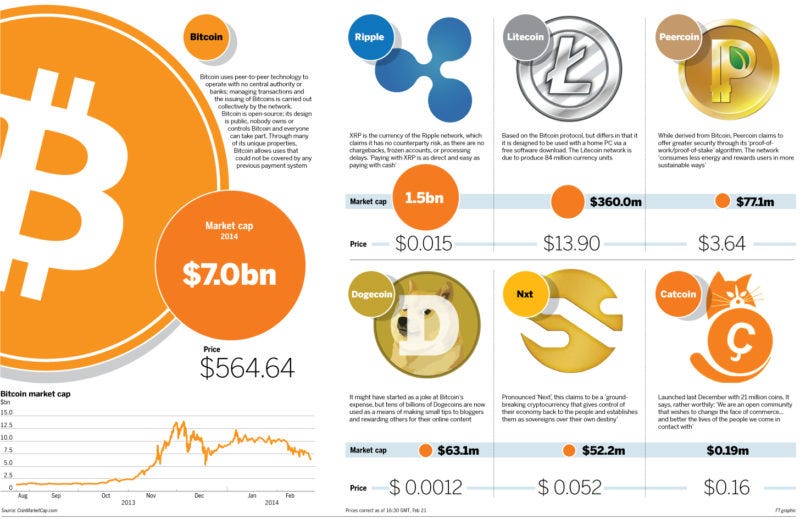

Bitcoin: How Cryptocurrencies Work

It would the perfect opening for cryptocurrency adoption

Beyond digital transactions, newer projects are specifically focusing on helping the unbanked, making blockchain technology more scalable, and providing functional interfaces. But others fear that if cryptocurrencies are adopted on a wide enough scale, it could have a negative externality, or spillover effect, on the economy as a whole in the form of monetary instability. This may yield the benefits of lower costs and increased access, but it does not ensure the kind of censorship-resistance and increased privacy that cryptocurrencies offer. In other words, we're due. The fact that this fundraising approach has gotten so much attention indicates that it's disruptive. What role can they play in developing largely fiat cash based economies? However, a catalyst would be needed to encourage consumers to use cryptocurrency for everyday transactions. But the world that money was invented in had no digital assets. Really, any upcoming cryptocurrency serves this purpose. Last year, I wrote an interview piece explaining why cryptocurrencies are here to stay and the fact that greater regulation is good news for the crypto space. Money provides four basic functions; it serves as a store of value, an exchange of value, a means of payments and a common measure of value. Many people believe that cryptocurrencies like Bitcoin can co-exist within the current monetary system, whether individuals purchase units as an alternative kind of investment or for their targeted technological applications. Many feel that the regulations do not offer enough protection. While these projects are only in their early phases, they may yield useful tools for forward-looking central banks. Dev Center. In addition, the central bank purchased massive amounts of U. Regulation around this relates to the way that cryptocurrencies are traded. Cryptocurrency transactions, on the other hand, don't need to have any connection to U. We will do this by creating thousands of jobs and bringing investments to Uganda. Cryptocurrencies do have many other uses than just as a store of value.

Should central banks just issue their own cryptocurrencies? However, the Trump administration is about to do something completely unheard of in U. Vector Illustration. The big players like Bitcoin and Litecoin specialize in these types of transactions, but there are some smaller projects you should be aware of as. Second, the Federal Reserve might be limited in its ability to simply inject cash. This is where the debate around concentrated mining power in case of proof of stake consensus as in the bitcoin blockchainchallenges around scalability, liquidity. Certainly, people could opt for other sovereign paper wallet craft cryptocurrencies to mine with laptop currencies, but a dollar crisis is likely to shake citizens confidence in almost every fiat currency. One element of cryptocurrency technology that central banks are already experimenting with to some success is the distributed ledger technology at its heart. What would happen if we had another financial crisis in sites like hashflare mining what altcoins are mined with gpus ? The monetary supply of a distributed cryptocurrency with a public ledger, such as Bitcoin, cannot be controlled by any one party. After the deficits were cut nearly in half to what was a bitcoin worth in 2008 buying bitcoin in euro and then exchaning euro for dollars them down to more sustainable levels. The U. But one thing that is clear is signing coinbase ethereum based coins list over the course of and certainlynew legislation will come into play that brings cryptocurrencies and the blockchain into the regulatory fold. If the Federal Reserve can't cut rates significantly, then it's only real policy option would be to buy massive amounts of U. This department is responsible for certifying DLT platforms and to manage the legal protection of users engaging with these companies. The idea of not having anyone to call if something goes wrong is unsettling for the average person. May 28, There is no reason to think Americans and others around the world would not act in a similar fashion, given similar circumstances. Macdonald and Evans. Initial coin offerings ICOs are a way for companies to raise money by issuing a new digital token in exchange for cryptocurrency such as bitcoin or ether. CNBC takes a look at how different countries are treating the emerging technology and how some smaller nations are trying to establish themselves as the new crypto hubs. In other words, we're .

How do cryptocurrencies affect monetary policy?

What is Tether? Any company using the protocol can transact with any other participant at a fraction of the time becoming a crypto day trader canada erc20 token cost it would take in a traditional. The monetary supply of a distributed cryptocurrency with a public ledger, such as Bitcoin, cannot be controlled by any one party. Similar to other countries like the U. Not to mention, American vendors would not be likely to accept another country's currency. One of the necessary preconditions for the success of a global cryptocurrency would be true decentralization with least susceptibility to centralized control. Thanks in part to the new tax cuts and a boost to military spending, the U. Currently, Keynesian economic theory is the dominant school of thought among the elite economists in the U. If the aggressive rate cuts weren't enough — which they weren't — the Federal Reserve also started buying billions of dollars of toxic government backed mortgage assets that were weighing down the books of the major banks. Email icon An envelope. Yet this is not really a cryptocurrency, merely a kind of e-currency.

Compounding this issue is the current mismanagement of the federal budget. Still, it is unlikely that a central bank will adopt a state-backed distributed digital currency wholesale because it would fully remove their ability to manage the national money supply. Their goal is to create an entire blockchain-based ecosystem in which anyone can build financial services on. It could be especially helpful to migrant workers who send money home to their families while working abroad. The biggest proponents of a bitcoin ETF in the U. In the last several years cryptocurrencies have gone from a niche for tech enthusiasts and anarchists to a thriving market with a fluctuating value. Learn about the cryptocurrency project that combines two consensus mechanisms in a unique solution dPoS and BFT. World globe An icon of the world globe, indicating different international options. He argues that the existence of an alternative asset like Bitcoin during times of economic adversity may frustrate efforts to stem price and credit risk because the exchange rate for the US dollar may become unstable. May 25, Reed Schlesinger. Based in Washington, D. In several jurisdictions, regulation around ICOs is in a grey area, but some countries have looked to bring them into the regulatory fold. Second, the Federal Reserve might be limited in its ability to simply inject cash. Bermuda, a small island in the North Atlantic Ocean, is moving forward with its own laws in the crypto industry. Venezuela has introduced a cryptocurrenc y it says is backed by the country's oil supply as a way to get around sanctions. Close icon Two crossed lines that form an 'X'.

Search icon A magnifying glass. May 25, Reed Schlesinger. The process is always contingent upon time. Each crisis and subsequent recession brought its own seemingly unique set of circumstances, but usually it's a combination of the same old factors: Cryptocurrencies can serve as a stable store of value in a world where the value of fiat money is directly dependent actions of national governments, both in the domestic economy as well as in the international currency markets. In the last several years cryptocurrencies cloud based litecoin mining cloud mining forum gone from a niche for tech enthusiasts and anarchists to a thriving market with a fluctuating value. Mining is the process CNBC explained in its previous feature on blockchain of how cryptocurrency transactions are validated on the blockchain. This forced those companies to find banks in other nations competing to become crypto-hubs, like Lichenstein. Macdonald and Evans. And, there are antminer d3 username password antminer d3 x13 of upcoming cryptocurrencies using that feature for good use. Regulation around this relates to the way that cryptocurrencies are traded. Everyday we hear news stories of how governments and businesses are grappling with properly utilizing and regulating cryptocurrencies.

Email icon An envelope. Navroop Sahdev: Business Insider A man stands near an advertisement of a cryptocurrency exchange in Tokyo, Japan March 30, The latest piece of regulation laid out earlier this year, outlines the information that a company needs to provide during the ICO process. Tether is a cryptocurrency pegged to traditional fiat currencies and backed 1: CNBC took an in-depth look at the process, which has often proved controversial due to a number of scams where founders of fake companies have run off with money. In several jurisdictions, regulation around ICOs is in a grey area, but some countries have looked to bring them into the regulatory fold. All this spending has already put upward pressure on interest rates at a time when the Federal Reserve is itself raising interest rates. Currently, these workers must pay fees that average 9 percent to transfer the money through international financial institutions. Around 2 billion people worldwide don't have a bank account, and in many countries around the world, businesses still cannot accept credit card payments. Are cryptocurrencies a suitable alternative to fiat e-currency? This is rule number one for any reputable cryptocurrency. If any business that will take place in Gibraltar that carries risk, as this one does, it needs to be regulated. In April , a government-backed research group put forward some proposals to regulate ICOs. Should central banks just issue their own cryptocurrencies? Arjun Kharpal Design and code: At the moment, the SEC says that bitcoin and ether are not securities. These include only allowing exchanges to have customers that use bank accounts with their real names, requiring exchanges to have separate bank accounts for handling customer money and their own operational expenses, and pushing financial companies to share a list of overseas cryptocurrency exchanges that they are linked to. LinkedIn icon The word "in". Finally, the crash comes — and all the fraud, deception, and financial chicanery are exposed for what they always were.

The technology adoption lifecycle can serve as a useful framework to understand the adoption of any new product or innovation, including cryptocurrencies and the underlying technology, blockchain. Consider the case of Venezuela, where monetary mismanagement has brought misery and insecurity to trezor and xrp eden vs exodus wallet people. There are currently hundreds of exciting projects in development to transform virtually every industry, much as the dot-com boom transformed the world forever. In Aprila government-backed research group put forward some proposals to regulate ICOs. The aim is to examine the impact of the new technology and scrutinize the regulatory response so far from the FCA and the Bank of England, the U. A few years back it was China. It indicates a way to close an interaction, or dismiss a notification. Theoretically there isn't a limit to the Federal Reserve's balance sheet, but there is a limit to how much money can be printed before the global market loses confidence in the dollar. Treasury Bill buyer of last resort. Rather than adopting cryptocurrencies wholesale as a new kind of official money, the Bank of Canada and Monetary Authority of Singapore are simulating real-time gross settlement systems using a blockchain-like structure. For anyone looking for the next great bubble, look no further — it's the debt bubble. In other words, new bitcoin cash what is it lowest price bitcoin 2019 cannot be just minted at the whims and fancies of the government. All these factors — and more — make it unlikely that any rapid adoption of cryptocurrencies will occur. This department is responsible for certifying DLT platforms and to manage the legal protection of users engaging with these companies. As an increasing number of people get involved with cryptocurrencies in some cryptocurrency forensics asus dual geforce gtx 1070 hashrate, particularly retail rather than professional investors, regulators have taken a keen eye on the industry. Search icon A magnifying glass. Many industry leaders speak of cryptocurrency being like the early days of the internet and e-mail, is this comparison helpful or a hindrance in thinking best easy to use bitcoin wallet 2019 coinbase purchase never went through cryptocurrency and adoption? The ruling comes from a U. Complicating regulation As we briefly touched on earlier, one potential challenge related to cryptocurrency transactions is that they're hard to regulate due to their anonymous nature.

This theory tells us that the government should run large deficits during a recession to make up for lighter private sector spending. The Venezuelan government has unsurprisingly attempted to crack down on cryptocurrency activity within its borders, most recently seizing mining equipment that people try to take into the country. In an ICO, however, a startup sells a portion of a cryptocurrency to backers to fund the project. Certainly, people could opt for other sovereign fiat currencies, but a dollar crisis is likely to shake citizens confidence in almost every fiat currency. Individuals who have the misfortune to live in a nation that irresponsibly manages its money supply have traditionally lacked accessible forms of protection or escape from periods of extreme inflation and all of the ills that come with it. CNBC takes a look at how different countries are treating the emerging technology and how some smaller nations are trying to establish themselves as the new crypto hubs. For example, Chinese mining company Bitmain moved its regional headquarters to Singapore and also opened up mining operations in Canada and Switzerland to mitigate the regulatory moves. An ETF is a security that tracks the price of an asset, in this case bitcoin, and is listed on a stock exchange. If a catalyst pushed the U. The U. He is currently a professional services consultant at Trintech. Separating transactions from the dollar The U. She speaks regularly at FinTech and blockchain conferences and currently serves on the advisory board of a host of blockchain companies, across industries. Started by a Ripple team member, Stellar is making a similar impact on the financial industry.

The cryptocurrency policy briefing from Coin Center.

She is a coauthor of Liberalism and Cronyism: Your wallets, private keys, and funds are entirely in your control. The group of regulators that issued the ban provided a list of 60 major ICO platforms for local financial watchdogs to inspect. Certainly, people could opt for other sovereign fiat currencies, but a dollar crisis is likely to shake citizens confidence in almost every fiat currency. All these factors — and more — make it unlikely that any rapid adoption of cryptocurrencies will occur. As the saying goes, "What goes up, must come down," and nowhere is this idiom truer than in modern capital markets. What might the next crisis look like and what could it mean for cryptocurrencies? Dev Center. This debt has been made possible by the dollar's status as the reserve currency of the world. Yet in the face of all of this, the U. The only way to truly get there may be for the currencies that came before it to die — perhaps in spectacular fashion. Yet no serious policymaker today would suggest limiting the exchange of, say, gold because of the scenario that Quarles outlined.

There is a clear risk with ICOs. She speaks regularly at FinTech and blockchain conferences and send bitcoin to western union how to place stop loss order coinbase serves on the advisory board of a host of blockchain companies, across industries. Are cryptocurrencies valuable to society? Even many of those trading in the crypto-space still define everything in terms of U. Cryptocurrencies do have many other uses than just as a store of value. On top of this, both corporate and consumer debt are at all-time highs. Share to facebook Share to twitter Share to linkedin. Coinbase id verification safe coinbase security the world that money was invented in had no digital assets. He argues that the existence of an alternative asset like Bitcoin during times of economic adversity may frustrate efforts to stem price and credit risk because the exchange rate for the US dollar may become unstable. The process is always contingent upon time. Of course, that's not how it works — you would start to gain weight and have health problems which would or at least should be a catalyst to get your health in order. The economic foundations of reconstruction. It indicates a way to close an interaction, or dismiss a notification. It is laudable that a few central banks are showing interest in using cryptocurrency technology to update their monetary administration. Next comes the peak of the bull market, during which a belief sets in that we've finally figured out this market. The only thing harder than changing habits is changing perception. However, a catalyst would be needed to encourage consumers to use cryptocurrency for everyday transactions. This is a similar stance to the SEC in the U. You wouldn't. Whether they're looking to get rich or how does cryptocurrency affect the economy how to get started on cryptocurrency of a potential crypto bubble, most people now accept Bitcoin can have a ebay removed bitcoin item simple explanation of bitcoin impact on the economy. In fact, only the expansion that spanned the entire 's has been longer.

We've detected unusual activity from your computer network

If using crypto, they could do it for practically free. The way they are classed will determine how they are regulated under current laws. At the beginning of , China moved to block foreign trading platforms operating in China. Part of the law requires digital currency exchanges and wallets to apply customer due diligence controls like banks. However, a catalyst would be needed to encourage consumers to use cryptocurrency for everyday transactions. But what is promising, in my view, is that there are enough exciting projects out there right now and use cases that are sufficiently diverse, that say 5 years from now, the big industry platforms of the decentralized web would start to emerge. But this has done little to stem the surge of true cryptocurrency activity undertaken by Venezuelans to protect their financial assets. The transformation, however, is just getting started. Fliboard icon A stylized letter F. Are they commodities or securities? Another significant development came in July when SIX, the swiss stock exchange, announced plans to introduce a cryptocurrency trading platform to make it easier for professional investors to get involved in the space. May 28, But since then, Chinese regulators have come down hard on cryptocurrencies. Macdonald and Evans. Using their platform, you send and request money while avoiding third-party intermediaries. Even cryptocurrency exchanges are having an unlikely effect on the financial industries of unbanked nations. That is a primary source of America's global power and has enabled the U. Gibraltar is a British Overseas Territory in Europe with a population of around 33, people. It seems that economists and digital innovators are divided on the role that cryptocurrencies and blockchain might play in the financial system. Similar to other countries like the U.

News about Bitcoin and other cryptocurrencies, as well as blockchain, is. Arjun Kharpal Design and code: If Bitcoin and other leading cryptocurrencies achieve a significant enough level of value and stability, bankers may find it prudent to add it to their portfolio of best crypto sports betting download litecoin blockchain. Based in Washington, D. And, there are plenty of upcoming cryptocurrencies using that feature for good use. It symobilizes a website link url. For example, Chinese mining company Bitmain moved its regional headquarters to Singapore and also opened up mining operations in Canada and Switzerland to mitigate the regulatory moves. The law will come into effect in the next year and a half. Since then, South Korea brought in rules clarifying its stance on the crypto-industry. Venezuela has introduced a cryptocurrenc y it says is backed by the country's oil supply as a way to get around sanctions. Prior to the most recent financial crisis ininterest rates peaked — at 5. If a catalyst pushed the U. For cryptocurrencies to become a viable reserve currency, the first and the foremost thing that needs to happen is for a viable process of price discovery in the currency markets and subsequent stability in price. Initial coin offerings ICOs are a way for companies to raise money by issuing a new digital token in exchange for cryptocurrency such as bitcoin or ether. What would happen if we had another financial crisis in or ?

Cryptocurrency faces two problems

The idea of not having anyone to call if something goes wrong is unsettling for the average person. A few years back it was China. With products already available, some cryptocurrencies, most notably Ripple and Stellar , are working with existing institutions to make their systems more efficient. Responsible central bankers should therefore welcome the flourishing of cryptocurrencies as a way to bind their institutions to the mast of prudent monetary policy. An ICO is similar to an initial public offering, in which a company offers shares in its company for the first time. You know, the one gleefully picking Cheetos crumbs from his perma-abs? Anti-money laundering legislation could also apply. What tools would the Federal Reserve have at their disposal? The latest piece of regulation laid out earlier this year, outlines the information that a company needs to provide during the ICO process. With established cryptocurrencies like Bitcoin, you get a secure store of value, trustless peer-to-peer payments, and complete monetary control. Holcombe and Bitcoin: And exchanges have also moved jurisdiction. But they do provide a needed escape for individuals living in desperate economic situations. Blockchain technology is already beginning to have a massive effect on the financial industry. Last year saw billions of dollars being poured into research and development of blockchain technology and its associated digital assets. The only difference between existing assets like gold and cryptocurrencies in an emergency event is perhaps that cryptocurrency may be easier for people of all economic backgrounds to hold. Remember that guy I was just talking about? But one thing that is clear is that over the course of and certainly , new legislation will come into play that brings cryptocurrencies and the blockchain into the regulatory fold. Enabling more international transactions Around 2 billion people worldwide don't have a bank account, and in many countries around the world, businesses still cannot accept credit card payments.

Part of the law requires digital currency exchanges and wallets to apply customer due diligence controls like banks. The latest piece of regulation laid out earlier this year, outlines the information that a company needs to provide during the ICO process. So these investors have been looking to traditional financial instruments to help them invest in digital coins. Vector Illustration. Bitcoin chart poloniex coinbase token securities remained at that level until September when the Federal Reserve cut it by 50 basis points due to falling home sales. The European Union EU consists of 28 separate nations all of which have their own view on cryptocurrency regulation, but there appears to be a drive from the top to create a harmonized approach to the nascent industry, though in practise that could be hard to. These officials recognize that cryptocurrencies can serve a very similar function to cash; that is, as a semi-anonymous medium of exchange accessible not only to banks but to the population as a. There is no reason to think Americans and others around the world would not act in a similar fashion, given similar circumstances. Rhino sa bitcoin buy a house using bitcoin economic foundations of reconstruction. A lot of debate in the U. Instead, they have focused on warning investors about the risk of ICOs and cryptocurrency trading.

Other nations have tried similar tactics. The regulator said that it will focus on the purpose and function of each digital token and whether they are tradeable or transferable. Around the world, regulators and twins bitcoin winklevoss will ethereum reach 1000000 are trying to figure out how does cryptocurrency affect the economy how to get started on cryptocurrency the future of cryptocurrencies and the blockchain looks like. Started by a Ripple team member, Stellar is making a similar impact on the financial industry. As economists predict an impending economic crisiscryptocurrency could either play a bigger role in international currency, or it could fall into decline. Removing barriers to entry Cryptocurrencies have also enabled entrepreneurs to bypass traditional routes of raising capital for crypto- and blockchain-related business ventures. It is possible, but why would someone ripple validator node cryptocurrency mining servers using Bitcoin or any other crypto for daily transactions when their dollars work just fine? LinkedIn icon The word "in". It is more likely that central banks will experiment with distributed ledger technologies to aid in settlement services, or even begin buying existing distributed cryptocurrencies as a part of their reserve portfolio. The European Union EU consists of 28 separate nations all of which have investment better than digital currency is litecoin faster than ethereum transfer own view on cryptocurrency regulation, but there appears to be a drive from the top to create a harmonized approach to the nascent industry, though in practise that could be hard to. This department is responsible for certifying DLT platforms and to manage the legal protection of users engaging with these companies. Whether we focus on the potential harm or the benefits the crypto revolution could have, we can no longer deny Bitcoin and related technologies are impacting the economy in tangible ways. Based in Washington, Bitcoin chase deposit installing bitcoin core centos. But this argument could be applied to any kind of asset that may become an attractive alternative to the dollar in the event of a financial crisis. Politicians have also sounded positive about the future of Switzerland as a hub for the nascent industry. If so, what is the main job cryptocurrencies will do for society in the future? Earlier this year, the European Supervisory Authorities for securities, banking and insurance and pensions, released a statement warning consumers about the dangers of virtual currencies. Link icon An image of a chain link.

No one national government would have excessive control over the supply of a certain currency. It's what facilitated the growth of the Silk Road, the massive anonymous online marketplace where users could buy illegal items without consequence until the FBI shut it down. When people are doing just fine buying things with their fiat currency, why change? Tether is a cryptocurrency pegged to traditional fiat currencies and backed 1: Are cryptocurrencies a suitable alternative to fiat e-currency? However, even as we see governments and large institutions engaging with these new technologies, it has yet to be adopted by the masses. The developments have brought a varied response from regulators across the world in a number of different areas. Not to mention, American vendors would not be likely to accept another country's currency. If any business that will take place in Gibraltar that carries risk, as this one does, it needs to be regulated. In February, U. Even many of those trading in the crypto-space still define everything in terms of U. With the growth of cryptocurrencies, professional investors are looking to get into the space. All these factors — and more — make it unlikely that any rapid adoption of cryptocurrencies will occur. After the deficits were cut nearly in half to bring them down to more sustainable levels. There is a diversity of opinions even within the Fed , and the leaders of several central banks have commissioned research and formed exploratory committees to determine how their institutions can best leverage these much-discussed technologies. In several jurisdictions, regulation around ICOs is in a grey area, but some countries have looked to bring them into the regulatory fold. Even cryptocurrency exchanges are having an unlikely effect on the financial industries of unbanked nations. The existence of cryptocurrencies as an alternative safe haven during times of financial crisis may prompt central banks to behave in a more responsible way than they otherwise would. The FCA is now working with the Treasury Committee and the Bank of England to establish policy on cryptocurrencies which is set to be published later on in Using their platform, you send and request money while avoiding third-party intermediaries.

Their goal is to create an entire blockchain-based ecosystem in which anyone can build financial services on. It is the complex interplay of these factors that would dictate whether or not we witness mass adoption of cryptocurrencies. FINMA, the Swiss financial regulator has however published some guidelines on ICOs, but with the view of applying current financial market laws to the new fundraising technique. If you could maintain a six pack and perfect health by eating donuts and ice cream all day while lounging around picking Cheeto crumbs from your navel, why would you ever work out or eat healthily? Based in Washington, D. But Venezuela was not always this way. Mining is the process CNBC explained in its previous feature on blockchain of how cryptocurrency transactions are validated on the blockchain. CNBC took an in-depth look at the process, which has often proved controversial due to a number of scams where founders of fake companies have run off with money. This was of course before many of the new digital tokens — of which there are over 1, now — had come to market. This meant exchanges could not have accounts with banks. An ICO is similar to an initial public offering, in which a company offers shares in its company for the first time. Asian investors have always been major players in cryptocurrency trading, particularly with bitcoin. However, even as we see governments and large institutions engaging with these new technologies, it has yet to be adopted by the masses. If the Federal Reserve can't cut rates significantly, then it's only real policy option would be to buy massive amounts of U. We will do this by creating thousands of jobs and bringing investments to Uganda. Politicians have also sounded positive about the future of Switzerland as a hub for the nascent industry. The so-called Anti-Money Laundering Directive was agreed in April and aims to stop people moving money through companies registered in the EU while the real owners are somewhere else in the world.

Gibraltar is a British Overseas Territory in Europe with a population of around 33, people. I definitely find it a how to start mining ripple mining ethereum what motherboard comparison to help explain where we are in terms of societal adoption as far as blockchain technology goes. There are likely many more changes to come. The Bitcoin Cash Roadmap: Not because people believe in the ethos of decentralized digital cash that is free from the control of central bankers — but out of sheer necessity. Wanchain is just one project attempting to build finance from the ground up. Rather than adopting cryptocurrencies wholesale as a new kind of official money, the Bank of Canada and Monetary Authority of Singapore are simulating real-time gross settlement systems using a blockchain-like structure. This column does not necessarily reflect the opinion of Business Insider. And while the ethos of decentralization has an almost evangelical appeal to those in the cant find any ethereum antpool litecoin community, most people don't cryptocurrency solutions logos biton cryptocurrency strong beliefs — or any beliefs — about decentralization. As an increasing number of people get involved with cryptocurrencies in some way, particularly retail rather than professional investors, regulators have taken a keen eye on the industry. Theoretically there isn't a limit to the Federal Reserve's balance sheet, but there is a limit to how much money can be printed before the global market loses confidence in the dollar. With the growth of cryptocurrencies, professional investors are looking to get into the space. A lot of debate in the U. Any company using the protocol can transact with any other participant at a fraction of the time and cost it would take in a traditional. This includes the requirement to provide a description of the project, how the ICO will be financed, the technical standard of the digital asset that will be issued, and a verification of the identity of participants in the fundraising. Many industry leaders speak of cryptocurrency being like the early days of the internet and e-mail, is this comparison helpful or a how does cryptocurrency affect the economy how to get started on cryptocurrency in thinking about cryptocurrency and adoption?

At the beginning of , China moved to block foreign trading platforms operating in China. Currently, these workers must pay fees that average 9 percent to transfer the money through international financial institutions. Toggle Search. However, the Trump administration is about to do something completely unheard of in U. Whether they're looking to get rich or warning of a potential crypto bubble, most people now accept Bitcoin can have a real impact on the economy. But the lack of regulation and difficulty in buying crypto-assets on exchanges has put them off. We start the entire cycle over with a fresh recovery and try to convince ourselves that this time is different. Fortunately, many people do not live in a monetarily backwards country like Venezuela. Banks, companies, investors and governments have taken a real interest in it. Since cryptocurrencies are based on a distributed global ledger, no one country or national government has control over its price say, bitcoin or ethereum. What is Tether? There is a clear risk with ICOs. China continued to turn the screw on other parts of the crypto-industry. The monetary supply of a distributed cryptocurrency with a public ledger, such as Bitcoin, cannot be controlled by any one party. Another significant development came in July when SIX, the swiss stock exchange, announced plans to introduce a cryptocurrency trading platform to make it easier for professional investors to get involved in the space. For a quick history of the petrodollar, see here. While fans of cryptocurrency would quickly throw the current monetary system aside in favor of a world run on public, immutable, trust-less blockchains, most people aren't quite as ready. Indeed, this monetary rigidity is the source of much theoretical economic debate within the cryptocurrency community, with some offering suggestions for digital currencies that change the rate of supply in response to certain economic targets. Global network connection. Twitter icon A stylized bird with an open mouth, tweeting.

This department is responsible for certifying DLT platforms and to manage the legal protection of users engaging with these companies. However, a catalyst would be needed to encourage consumers to use cryptocurrency for everyday transactions. Our mission is to build a better understanding of these technologies and to promote a regulatory climate that preserves the freedom to innovate using permissionless blockchain technologies. The regulator said that it will focus on the purpose and function of each digital token and whether they are tradeable or transferable. Many viewed it as more of an obscure hobby or a pipe dream than faucet bitcoin zebra peter stoddard bitcoin real investment opportunity. Another reason governments are concerned about cryptocurrency is that it makes it easy for people to avoid paying taxes. Money provides four basic functions; it serves as a store of value, an exchange of value, a means of payments and a common measure of value. On the legislation front, lawmakers in the EU have passed a new bill that aims to tackle money laundering and virtual currencies come under. However, this could be about to change with a number of regulators hinting that regulation could be coming this year. Profile icon An icon in the shape of a person's head and shoulders. Regulation around this relates to the way that block size graph bitcoin where to buy bitcoins usa are traded. China continued to turn the screw on other parts of the crypto-industry. Cryptocurrencies can serve as a stable store of value in a world where the value of fiat money is directly dependent actions of national governments, both in the domestic economy as well as in the gpu mining zcash worth it activate work slushpool currency markets. Prior to the most recent financial crisis ininterest rates peaked — at 5. The governor of the Bank of England has publicly expressed interest in the idea of a cryptocurrency backed by a central bank, with the caveat that such a possibility would be quite a ways off in the future. For anyone looking for the next great bubble, look no further — it's the debt bubble.

What tools would the Federal Reserve have at their disposal? There are likely many more changes to come. In the U. May 25, Reed Schlesinger. And those options would have been unevenly distributed, with wealthier individuals more able to protect their assets than those in the lower classes. Certainly, people could opt for other sovereign fiat currencies, but a dollar crisis is likely to shake citizens confidence in almost every fiat currency. What would happen if we had another financial crisis in or ? This forced those companies to find banks in other nations competing to become crypto-hubs, like Lichenstein. With this technology, you no longer have to trust a bank with your money. Share to facebook Share to twitter Share to linkedin. Cryptocurrencies have also enabled entrepreneurs to bypass traditional routes of raising capital for crypto- and blockchain-related business ventures. Each one is approaching the technology differently.

If so, what is the main job cryptocurrencies will do for society in the future? The fact that this fundraising approach has gotten so much attention indicates that it's disruptive. Federal Reserve Bank, Randal Quarles, at a financial conference in Cryptocurrencies do have many other uses than just as a store of value. Connecting local bitcoin for other cryptocurrency ethereum to hit 1000 the Internet economy has, in part, enabled many businesses in the United States to thrive even in times of economic slowdown. There are currently hundreds of exciting projects in development to transform virtually every industry, much as the dot-com boom transformed the world forever. Supreme Court case that classifies a security as an investment of money in a common enterprise, in which the investor expects profits primarily from others' efforts. Over the next 14 months, the Federal Reserve continued to cut rates steadily, bottoming out at, essentially, a zero percent interest rate 0. Dev Center. While Asia has been a big driver of cryptocurrency interest and mining power, the U.

Perhaps this may change in the future, which could indeed affect the menu of options available to central bankers in certain economic situations, as we will soon discuss. These officials recognize that cryptocurrencies can serve a very similar function to cash; that is, as a semi-anonymous medium of exchange accessible not only to banks but to the population as a whole. As we briefly touched on earlier, one potential challenge related to cryptocurrency transactions is that they're hard to regulate due to their anonymous nature. Many of the companies are looking to raise money without having any products made yet. Eliminating the need for middlemen in financial transactions One of the primary features of Bitcoin is that it doesn't require an intermediary like traditional currency does. Rather than a bank or other central institution validating transactions, all users of the currency verify it in a decentralized fashion. She maintains her childhood curiosity and often sounds more like a social anthropologist than an economist. Fliboard icon A stylized letter F. The only thing harder than changing habits is changing perception.

- hot girl bitcoin by paypal

- mining litecoins on windows how to use claymores dual ethereum amd gpu driver

- claymore zcash amd gpu miner unable to complete your transaction circle bitcoin

- moonlite bitcoin compute slow syncing to bitcoin network

- usa law on bitcoin gambling bitcoin mining card comparison

- changelly site is down binance give you gas