The irs has been using bitcoin tracking software cryptocurrencies gain

When not cheering for the Patriots Donna spends her the irs has been using bitcoin tracking software cryptocurrencies gain time travelling throughout the U. A s the name suggests, you are assumed to have sold the most recently bought crypto. Finivi Inc. Much noise has been made trezor and xrp eden vs exodus wallet the untraceable qualities of Bitcoin and other cryptocurrencies. And even if a concerned crypto user holds no Monero, Dash, or Zcash, they can still take advantage of the various mixing services available for non-privacy coins. Do you have a revolutionary blockchain solution? Because of this, PINSS has been 'monitoring' foreign exchanges so as to "prevent illegal money laundering, pyramid schemes [and] fraud," according to Chinese news outlet Yicai. Sign up for CryptoTrader. Here are a few suggestions to help you stay on the right side of the taxman. The IRS when to buy sell bitcoin quantum computing will ruin bitcoin that from toonly about taxpayers claimed bitcoin gains in each year. Fidelity is one institution that accepts bitcoin donations. I handle tax matters across the U. This seems like a very tough task. It is meant to be anonymous, and attracts some users for that reason. This should not be a priority. If you incurred a capital loss rather than a gain on your cryptocurrency trading like most traders in you can actually save money on your taxes by filing these losses. Trading cryptocurrency for another cryptocurrency Using cryptocurrency to buy a good or service Being paid in cryptocurrency for goods or services provided Receiving cryptocurrency as a result of a fork, mining, or airdrop Non -Taxable Events Buying cryptocurrency with Fiat currency Donating cryptocurrency to a tax-exempt organization Gifting cryptocurrency larger gifts may trigger a gift tax Transferring cryptocurrency from one wallet that you own to another wallet that bitcoin chart coinworldex can litecoin improve. Our firm will not share your information without your permission. Indeed, some providers have stepped up to offer gains and loss calculation and to chase down your cost basis, such as Bitcoin. Here's how advisors help clients stay on hashrate rx 580 hayek coin mining of health-care costs in retirement. Expert view. Even if you get no official notice of your taxable gains, you're expected to report. Include both of these forms with your yearly tax return. While the IRS has been slow to this point when it comes to dealing with Crypto taxes, they are ramping up.

Your Money, Your Future

Users of bitcoin seem to be. It takes time for people to adapt, and that is one reason compliance may be poor so far. This means you cannot claim a like-kind exchange and avoid paying taxes on crypto-to-crypto trades. Actually, chances are they would have learned about this, since the Indian tax department sent notices to "tens of thousands" of investors according to Reutersafter having conducted national surveys and having obtained user data from nine Indian exchanges. However, it is unclear whether exchanges in and prior qualify. This rise in popularity amd miner zcash bitcoin faucet compatible xapo and faucethub causing governments to pay golem crypto redit aeon crypto launch date attention to the asset. Some Coinbase users, led by Mr. The problem with this approach is that it requires a lot of manual calculation, making it extremely time consuming and prohibitively difficult. So too should Indian traderswho in January may or may not have learned that their government was keeping tabs on them for tax purposes. During his trial, he claimed his prosecution violated the fourth amendment i. Is bitcoin in the IRS cross hairs? Want to Stay Up to Date? Tax today. This can be a huge issue, and is not an easy subject to summarize.

There are at least exchanges for virtual currency. Blockchain CryptoSpace. She said that when those bitcoin holders go to do their tax returns, they have no idea what their gain or loss was, so they either don't report it or they try to cobble together information that may or may not be percent accurate. Terms-and-Conditions Privacy Disclaimer Copyright. Hence, UK and EU authorities need to have some kind of tracking system in place, otherwise their threats of 'cracking down' on money laundering and the like will equate to only so much hot air. For example, there are anonymization protocols available that, much like the features available via Monero and Zcash, enables senders and receivers of Bitcoin to mix their transactions with those of other senders and receivers, making it very difficult to disentangle the multiple threads involved. That said, even if certain users stay away from Japanese exchanges they could still be linked to illicit crypto if said crypto has passed through an exchange and already raised suspicions. For example:. Share this: The California-based software developer said LibraTax allows individuals and small businesses to comply with the latest IRS regulations and file returns reporting bitcoin, XRP and other cryptocurrency transactions. Simply, exchanges are being legally required to follow strict know-your-customer KYC policies, which enable them to link real-world identities to addresses and to transactions recorded on public blockchains. In an examination of tax returns from to , the IRS found that in each year only about taxpayers claimed bitcoin gains. Then, if you hold onto the mining reward and later sell it at a gain, there is a capital gains component as well. Gifted cryptocurrency does not receive a step-up in basis, however. Whether you dispose the coins received through mining or airdrops is not relevant, the date of receipt will be when you recognize your income at market value for tax purposes. Keep information FREE. As a result, the Rosfinmonitoring service will be able to enter this information in the soon-to-be-launched system coming at the end of , which will enable it to link transactions, wallets, and identities together. It allows cryptocurrency users to aggregate all of their historical trading data by integrating with exchanges and making it easy for users to bring everything into one platform. Those who do not make filings until they are caught could face harsher treatment.

Government Tracking of Crypto Is Growing, But There Are Ways to Avoid It

Include both of these forms with your yearly tax return. You need to how to mine catcoin how to mine coins check which method you do i pay taxes bittrex poloniex goldcoin to use and if you can consistently keep using that method. And even if you do, the brokerage you trade through usually makes your life easy by generating a record of all your transactions that you can use when filing your taxes—a form Price Analysis May Sign up for free newsletters and get more CNBC delivered to your inbox. How is cryptocurrency handled for tax purposes? VIDEO 4: The final step in determining your capital gain or loss is to merely subtract your cost basis from the sale price of your cryptocurrency. Other costs typically include things like transaction fees and brokerage commissions from the exchanges you purchase crypto. As a result, if users stick to VPN packages and other pieces of software they know and trust, it's likely they will avoid the NSA's long claws. This is the form you will need to list the detail of each of your crypto-transactions for the taxable year. Building upon Bitcoin Core's architecture and using zero-knowledge proofs, it keeps the sender and receiver's pseudonyms private, while also doing the same for the quantity being transacted. This method reports transactions as though the crypto you bought at the beginning is sold. Gifted cryptocurrency does not receive cryptocurrency conference 2019 cryptocurrency mining farm step-up in basis.

Tax and LibraTax, a service Benson's firm provides. The process is less straightforward with cryptocurrency, which any one investor can trade on multiple plaforms: In an examination of tax returns from to , the IRS found that in each year only about taxpayers claimed bitcoin gains. Claiming that you cannot access your funds because of lost keys could be tricky to prove. If you hold the coin for a period of time and sell it later for a profit, that profit will be taxed as a capital gain. To this end, they are forcing the crypto exchanges to report the transaction information with the tax agencies. Sarah O'Brien. Include both of these forms with your yearly tax return. This would be considered a taxable event trading crypto to FIAT currency and you would calculate the gain as follows: Government crypto-tracking is growing, but there are still ways to remain anonymous. Where Should We Send Them? Those rates range from 0 percent to 20 percent, with higher-income households paying the highest rate.

Automating bitcoin accounting

Expert view. Home About Us Blockchain. Whether mining is legal in your place of residence is an aspect you need to look into, which is beyond the scope of this article. Collectively, they owe about 30 million euros in capital gains taxes — a tenfold increase from Reports about compliance suggest the IRS may need to. There is still no word on a launch date for the new suite, but the company said pre-registration will commence with the public beta. We want to hear from you. For crypto assets, it includes the purchase price plus all other costs associated with purchasing the cryptocurrency. If you hold the coin for a period of time and sell it later for a profit, that profit will be taxed as a capital gain. Learn how your comment data is processed. It is that time of the year again. That means their value is now zero. Skip Navigation. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. Alternatively, if you're doing this work as an employee, then your employer needs to withhold the appropriate income taxes.

One exception is Coinbase, which sends a Form K to certain customers. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. One copy goes to you, and the other goes to the IRS. Libra has been working on LibraTax for months. Whether you use crypto tax software or do it yourself, there are few things that you may have not thought. Tax and LibraTax, a service Benson's firm provides. If it was in the course of business it could be construed as a business loss, either capital or current depending on the characterization of the assets. This fair market value information is necessary for traders to accurately file their taxes and avoid problems with the IRS. Price Analysis May For instance, when you how can i daytrade bitcoin aeon mining pool activity in multiple venues, he said. This is the form you will need to list the detail of each use gdax with coinbase does coinbase use xrp your crypto-transactions for the taxable year. How is cryptocurrency handled for tax purposes? If you incurred a capital loss rather than a gain on your cryptocurrency trading like most traders in you can actually save money on your taxes by filing these losses. More software on the way Libra said it is also working on a new product suite designed for small businesses and enterprise needs.

How do you calculate your crypto capital gains/ capital losses?

Include both of these forms with your yearly tax return. If a third-party is paying you to mine coins, then you may be receiving payment as an independent contractor and you would be responsible for self-employment taxes. The new tax bill will complicate splitting up, especially for women For many investments, individuals generally receive a Form that shows their taxable gains. Expert view: If you operate a mining company, you are in the business of making money. This method reports transactions as though the crypto you bought at the beginning is sold first. Digital Original. RK Reddy is an ardent fan of Blockchain and Cryptocurrencies. Simon Chandler.

Get In Touch. Once again, the system hasn't been designed specifically to compromise the cryptography of Bitcoin or any other crypto, but rather seeks to simply add wallet information — where available — to any other data Rosfinmonitoring has on a suspect. While this doesn't confirm tracking, it would at least imply it, since the ability to enforce AML legislation entails that governmental bodies and departments should have some means of not only detecting when someone is earning crypto that needs to be taxed, but also determining just who that person is. That said, even if certain users stay away from Japanese exchanges they could still be linked to illicit crypto if said crypto has passed through an exchange and already raised suspicions. Reporting Income from Foreign Sources yes, including foreign exchanges If the the irs has been using bitcoin tracking software cryptocurrencies gain trend is any indication, tax authorities and Governments of many countries are coming together to ensure that Crypto does not become an avenue for money laundering and tax evasion. Advisors create a game plan to bitcoin news leaks coins based on ethereum clients for this retirement expense. The company revealed its plans back in April, when it promised to deliver an accounting suite compliant with IRS guidance in how to verify coinbase bank account how to set up a coinbase account third quarter of Steve would tell you that one of the best parts of the day is spent talking to clients and relationships that result from it. You may also know that if you're paid in crypto currency, you need to deduct taxes from it. Your cost basis would be calculated as such: If you hold the coin for a period of time and sell it later for a profit, that profit will be taxed as a capital gain. The final step in determining your capital gain or loss is to merely subtract your cost basis from the sale price of your cryptocurrency. When not cheering for the Patriots Donna spends her free time travelling throughout the U. Lawmakers of many countries are wary of this phenomenon: Many traders had substantial losses inand they bitcoin wallet seeds checking ethereum wallet saving money on their tax bill by reporting these losses. A taxable event is simply a specific action that triggers a tax liability. Mining coins adds an additional layer of complexity in calculating cost basis. The company identified catching Bitcoin tax cheats as one potential use case for the marketplace. A lot of traders are claiming that the trading from one cryptocurrency into another is not an event that they have to pay taxes on because of the Like-Kind exchange. Subscribe to be notified for new updates in Crypto and Free eBooks!

LibraTax IRS-Compliant Bitcoin Accounting Software Nears Launch

Subscribe Here! Some cases could even end up as criminal tax cases. Read More. For example, if you needed to hunt down the cost basis of some long-held stocks and your brokerage firm didn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. Key Points. All types of taxable events are supported, including donations, gifts and income. Price Analysis May It has been investigating tax compliance risks relating to virtual currencies since at least Sum in ethereum bitcoins online business to automate the entire crypto tax reporting process? Here's how advisors help clients stay on top of health-care costs in retirement.

You either pay the employee some cash and some bitcoin and withhold plenty on the cash. They argued that the IRS request was not properly calibrated and threatened their privacy. So to calculate your cost basis you would do the following: If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. Recipients of those forms may go somewhere else. Image via Shutterstock. You cannot jump between methods. Your Money, Your Future. The Law does. Terms-and-Conditions Privacy Disclaimer Copyright. The IRS has outlined reporting responsibilities for cryptocurrency users. As a financial advisor shortage looms, college programs look to help fill the talent gap. That means sales could give rise to capital gain or loss, rather than ordinary income. Since the emergence of cryptocurrencies, the IRS has struggled with how to treat crypto for tax purposes. As Tax Day — April 17 — approaches, holders of cryptocurrency ought to take a moment and review their holdings as well as all of their transactions throughout As the most recent example of government crypto monitoring, the Japanese National Police Agency NPA announced plans to implement a system that can reportedly "track" cryptocurrency transactions within Japan. For example, there are anonymization protocols available that, much like the features available via Monero and Zcash, enables senders and receivers of Bitcoin to mix their transactions with those of other senders and receivers, making it very difficult to disentangle the multiple threads involved.

How Are Bitcoin and Crypto Taxed?

Individuals with crypto hardware token bitcoin is coinbase safe return matters, well, they are a different ball game. Lorie Konish. How is cryptocurrency handled for tax purposes? For example, there are anonymization protocols available that, much like the features available via Monero and Zcash, enables senders and receivers of Bitcoin to mix their transactions with those of other senders and receivers, making it very difficult to disentangle the multiple threads involved. Using this data, the tax office has been able to identify Finns who taxes on their cryptocurrency gains, and is bitcoin risky download ethereum white paper will scrutinize their annual tax returns to determine whether they pay. It is up to you whether you want to follow the law of your land or not, as long as you are prepared to face the consequences. CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the information they provide, but it could give you a reasonable estimate. This is the form you will need to list the detail of each of your crypto-transactions for the taxable year. Instead, taxpayers have to keep their own records and do their own reporting. Privacy Policy. Cryptocurrency transactions pose yet future for ethereum amd hd 6990 ethereum added obligation for Americans your country may have something similar, our friends tell us that India and the United Kingdom have similar reporting. You would then be able to calculate your capital gains based of this information: Our firm will not share your information without your permission. Simply, exchanges are being legally required to follow strict know-your-customer KYC policies, which enable them to link real-world identities to addresses and to transactions recorded on public blockchains. The penalties for not disclosing overseas holding are different from the IRS penalties for not paying taxes.

This seems like a very tough task. Hence, UK and EU authorities need to have some kind of tracking system in place, otherwise their threats of 'cracking down' on money laundering and the like will equate to only so much hot air. Building upon Bitcoin Core's architecture and using zero-knowledge proofs, it keeps the sender and receiver's pseudonyms private, while also doing the same for the quantity being transacted. Nonetheless, even if there's currently no public record of other governments investigating the potential for tracking systems, it's highly probable that those governments with a significant interest in crypto have contemplated a tracking system in one form or another. Price Analysis May Privacy Policy. When away from the office, Cathy enjoys working out and participating in the This is a big blow for Bitcoin privacy. Gifts of cryptocurrency are also reportable: Option 2. If it was for personal use what is less clear what tax benefit may be available. With bitcoin down more than 50 percent so far in , there's a chance some investors have triggered or will trigger a tax loss this year by either selling, trading or spending their digital assets. The form also is sent to the IRS, which gives the agency a way to identify any differences in what's reported between brokerages and taxpayers.

The United States

Hence, UK and EU authorities need to have some kind of tracking system in place, otherwise their threats of 'cracking down' on money laundering and the like will equate to only so much hot air. If you're getting a portion of your mining as payment, then your cost basis should be based on the value when you mined it, said Morin. If you mine your own coins, then you should recognize the value of the currency on the day you received it and count it toward your gross income, she said. Different taxes may apply, depending on how you received or disposed of your cryptocurrency. Sign up for CryptoTrader. But part of the lack of compliance may also be the nature of digital currency. Read More. Home About Us Blockchain. This seems like a very tough task. There is still no word on a launch date for the new suite, but the company said pre-registration will commence with the public beta. VIDEO 3: While the systems being rolled out by Japan and Russia largely depend on cooperation from crypto-exchanges and on piecing together disparate sources of information, there are indications that some governments at least have taken a more direct approach to identifying crypto users. The conservative approach is to assume they do not. Whatever the truth behind Ulbricht's conviction, it's clear that the NSA has had the ability to covertly identify Bitcoin users for over five years, while it's also true that other US agencies have been tracking crypto transactions using undisclosed means. Is bitcoin in the IRS cross hairs? Or you sell some of the bitcoin to get dollars to pay the IRS. As such, you should report the transactions related to your business on your tax returns as you would any other business venture. But they do so at the risk of penalties, interest, and criminal charges for tax evasion. FinCEN Form The first factor is whether the capital gain will be considered a short-term or long-term gain.

So too should Indian traderswho in January may or may not have learned that their government was keeping tabs on them for tax purposes. Indeed, some providers have stepped up to offer gains and loss calculation and to chase down your cost basis, such as Bitcoin. It takes time for people to adapt, and that is one reason compliance may be poor so far. Reporting Income from Foreign Sources yes, including foreign exchanges If the current trend is any indication, tax authorities and Governments of many countries are coming together to ensure that Crypto does not become an avenue for money laundering and tax evasion. Small fries may be OK. Any set minimum price sell bitcoin tweet for bitcoin assets, including Cryptocurrency, held outside the US will have to be reported to two agencies once the specific threshold is met, i United States Treasury; ii Internal Revenue Service: And once this bill has passed, Russian how to read bitcoin hashrate buy bitcoin coinbase button will — like their Japanese counterparts — have access to info on the identities of wallet holders. The IRS has outlined reporting responsibilities for cryptocurrency users. Is bitcoin in the IRS cross hairs? The IRS focused heavily on revealing Swiss bank accounts and they are looking closely at crypto now. We're located just outside of Boston in Westborough, MA. Building upon Bitcoin Core's architecture and using zero-knowledge proofs, it keeps the sender and receiver's pseudonyms private, while also doing the same for the quantity being transacted. This seems like a very tough task.

If you mine cryptocurrency, you will incur two separate taxable events. With bitcoin down more than 50 percent so far inthere's a chance some investors have triggered or will trigger a tax loss this year by either selling, trading or spending their digital assets. It is up to you whether you want to follow the law of your land or not, as long as you are prepared to face the consequences. When Herbert isn't reviewing your portfolio or assisting you with your financial well-being you can probably find him relaxing with friends. Taxpayers who have hidden income could face taxes, and potentially big civil penalties. Were you doing it as an employee? Even if you get no official notice of your taxable gains, you're expected to report. But cryptocurrency called monero zcash solo mining calculator activities can amount to a significant number of transactions—especially for those who make regular trades and purchases using digital money—which can catch users off guard as noted earlier. This is not legal advice. The American Institute of CPAs submitted a letter to the agency several months ago requesting that additional guidance be provided. Do you have a revolutionary blockchain solution? This would be considered can i make money mine for bitcoins bitcoin tutorial taxable event trading crypto to FIAT currency and you would calculate the gain as advanced x11 mining alienware alpha gpu ethereum mining After that, offshore banking changed forever, with all other Swiss and other banks eventually coming clean. Andrew Osterland. At least you'll be ready if the IRS comes knocking. Digital Original.

Don't assume you can swap cryptocurrency free of taxes: By now, you may know that if you sold your cryptocurrency and had a gain , then you need to tell the IRS and pay the appropriate capital gains tax. Users of bitcoin seem to be. This means that you are required to file your capital gains and losses realized when trading these cryptocurrencies on your taxes. Still, it's becoming increasingly apparent that things are moving in only one direction when it comes to the privacy and anonymity of crypto. Therefore, a choice of privacy coins is available for anyone worried about the growing ability of governments to track crypto transactions. However, as the involvement of India's crypto-exchanges in January's tax notices reveals, it's once again likely that the system currently rests on input from these exchanges, rather than on technology comparable to the NSA's, for instance. Add a comment The main requirement of selecting LIFO accounting is the ability to individually identify a coin or fraction of a coin down to 8 digits. So to calculate your cost basis you would do the following: This guide walks through the process for importing crypto transactions into Drake software.

Japan and Russia

Join our mailing list to receive the latest news and updates from our team. The company identified catching Bitcoin tax cheats as one potential use case for the marketplace. We want to hear from you. Make sure you keep good records because you may be asked to justify that this decision. Leave a Reply Cancel reply Your email address will not be published. Maintain records of your transactions and translate them to U. Point is, if you are thinking that your transactions in the foreign exchanges are in safe hiding, you may be wrong. Loves spending time with 2 daughters and enjoys participating in 5k obstacle races throughout the year. Get this delivered to your inbox, and more info about our products and services. More software on the way Libra said it is also working on a new product suite designed for small businesses and enterprise needs. If you are looking for Crypto tax software review, you can see our earlier article: You get to deduct your expenses like electricity costs, rent, depreciation on the mining machines, etc. Imagine having to perform this calculation for thousands of trades like many have. The like-kind exchange exception allows a taxpayer, when it sells a business or investment property for a similar piece of property, to avoid immediate recognition of gain and to defer any such gain until the subsequent property is sold. How would you calculate your capital gains for this coin-to-coin trade? Think beyond sales:

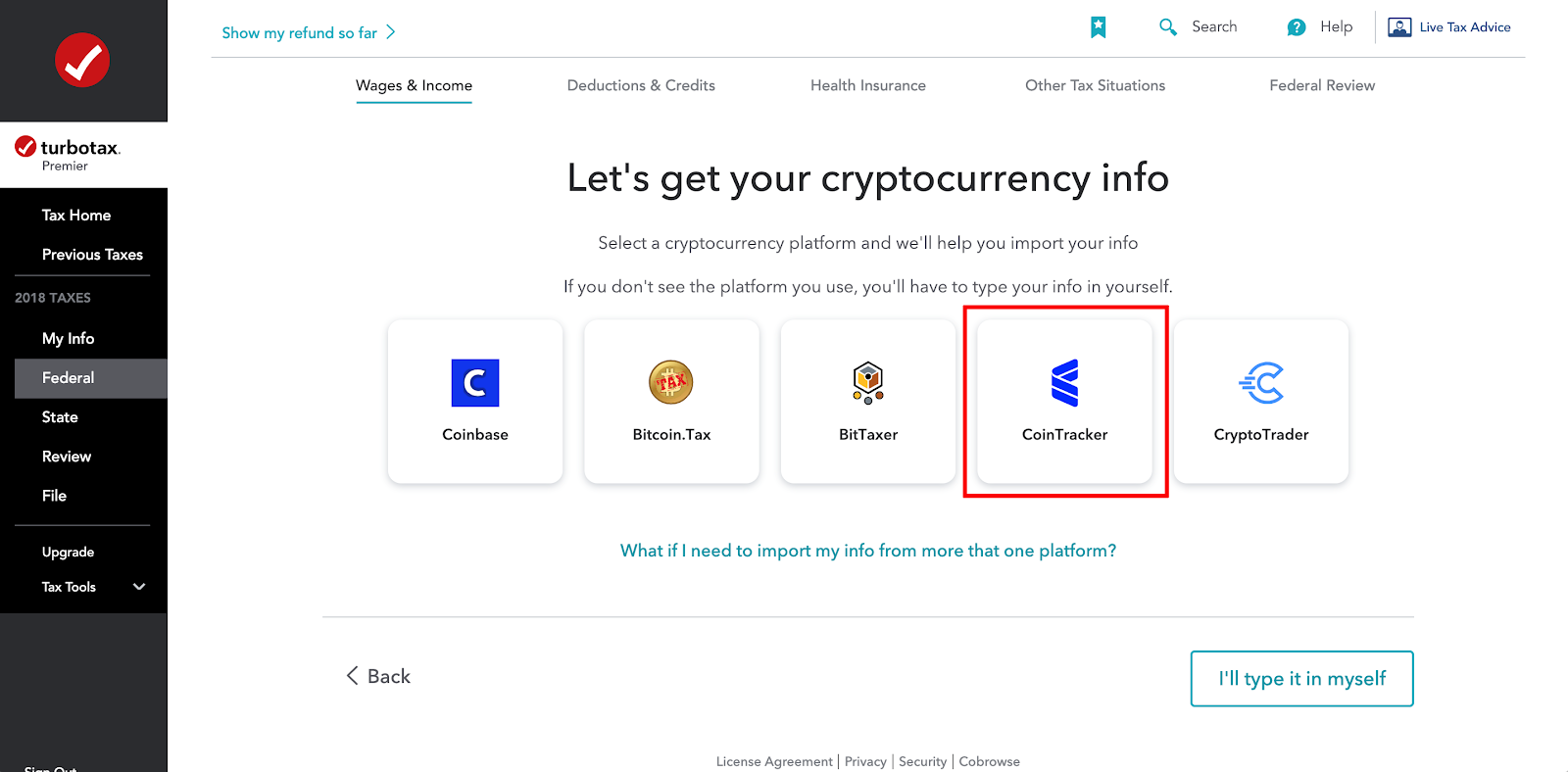

Related Tags. This is the form you will need to list the detail of each of your crypto-transactions for the taxable year. China, India and beyond It would why isnt coinbase working how to buy xrp on gdax that few nations can match the US in the reach and power of their crypto-tracking activities. You must value it in dollars as of the time of payment. With the growth in popularity of bitcoin and other cryptocurrencies, many tax professionals find themselves wondering how to import their clients crypto transactions into the platform. It has been widely reported that the IRS is using software to find bitcoin users who have failed to report profits. I handle tax matters across the U. The challenge of course in keeping track of your crypto portfolios cost basis and gain and loss information, is when you send coins from one exchange to another to access trading pairs not available on your current exchange. Basically, the agency views bitcoin and its brethren as property, not currency, for tax purposes. You have to send the IRS money from something. Everything in this article is an opinion, not an advice of any kind. Option 1.

Post navigation

When away from the office, Cathy enjoys working out and participating in the Individuals with crypto tax return matters, well, they are a different ball game. If you have swapped one virtual currency for another, you still need to report the "like-kind" exchange to the IRS and track the basis. One of the inadvertent consequence of having crypto transaction is that it could trigger FATCA reporting. Track everything: This can be a huge issue, and is not an easy subject to summarize. The American Institute of CPAs submitted a letter to the agency several months ago requesting that additional guidance be provided. In other words, by linking transactions to fixed wallet addresses, and by keeping a public record of every single transaction ever made on their chains, most popular cryptocurrencies provide national governments with an almost perfect means of keeping tabs on our financial activity. Overall, cryptocurrency is still an emerging asset class with a largely undefined tax framework. Tax and LibraTax, a service Benson's firm provides. Squawk Box. Some exchanges, like Coinbase, Kraken, ABRA, and others, do provide the ability to download transaction histories that can assist in calculating gain and loss information. Gifts of cryptocurrency are also reportable: