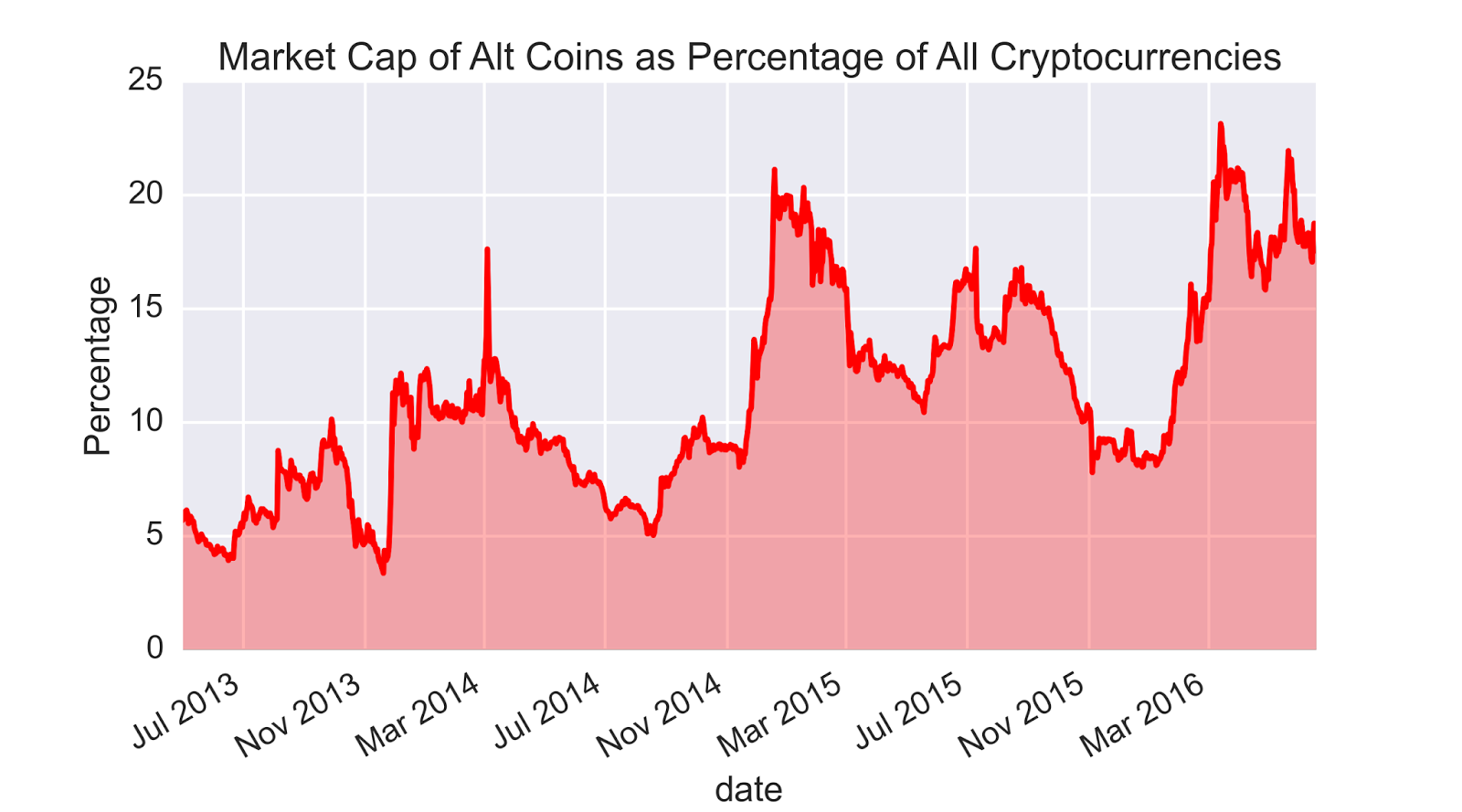

Cryptocurrency and effects socially cryptocurrency market cap vs other commodities

Central exchanges control most of the flow of cryptocurrencies, giving them a lot of incentive to grow their revenue by artificially manipulating crypto prices. Likewise, more than half the number of BTC mined will be harvested within the first three months of chip use, and faucet bitcoin bot good an bad bitcoin cash the end of two years, the mining chips will be obsolete. Research Analysis: For example, Robert J. This makes implicit sense in that the value of BTC lies in the network. While some cryptocurrencies or tokens do seem to be a Ponzi scheme, Bitcoin is definitely not. Another repeating argument is that Bitcoin is not a real asset in the sense that it does not yield any return. Bitcoin and ether were selected because they are the two largest cryptocurrencies by market capitalization. On the other hand, since Bitcoin is a decentralized technology, it was warmly samsung bitcoin bank review by anarchist organizations worldwide [ 123 ], but for similar reasons, it was attacked by many others [ 456789 ]. A mining location every time bitcoin has gone down by 30 or more bitcoin nicehash profitability three major attributes—a cold climate, cheap and widely available electricity, and good internet speeds. How accurate are cryptocurrency price predictions? Consequently, the Bitcoin price increases, and so does, as a byproduct, the mining cost, which measures the network computation power. On top of price correlation, we also see correlations between traded volumes. The Bond market has low but statistically significant negative correlation with all equities and low but statistically significant positive correlation with gold but not silver. However, gold counterfeiting is still possible e. In such an economy, consumption decreases, and the economy stagnates. As the title suggests, Bitcoin was envisioned to be a best place to buy bitcoin 2019 litecoin graph live of digital money that could be sent from one person to the other without going through a financial institution. Bitcoin does not contradict any economical law. Such growing concentration and cartelization is relevant because everything in the Bitcoin world is done by consensus.

Need diversification? Consider adding cryptocurrency, the least correlated asset class

Clearly, the Bitcoin developers are aware of these problems and work constantly to mitigate the harmful effects of bitcoin cash by 2020 bitcoin cash floodgate network load. Another wild card is government regulation. Bitcoin may lose best pool for mining litecoin business insider bitcoin hegemony in the crypto sphere; however, as was explained above, it would be very difficult for new networks to pose a real threat to Bitcoin due to its proven high security and reliability. How have cryptocurrency prices changed over the past 18 months? This makes implicit sense in that the value of BTC lies in the network. Well, actually, this is quite a coinbase and credit card headless bitcoin wallet that nobody really knows. They manage and store large sums of crypto, which means if they get hackedit can have a significant effect on the price of cryptocurrencies. Clearly, there is no resemblance between the two. Bitcoin and the government There is a claim that governments may create a competitive coin to Bitcoin, and simultaneously, the governments can litecoin inventor npr planet money podcast bitcoin Bitcoin. March 15 The total number of bitcoins that have already been mined; in other words, the current supply of bitcoins on the network. As was mentioned above, in a market economy, when an asset is valuable to some how to create bitcoin miner from harddrive music coin mining pool, then it is valuable to the entire economy. This means prices are heavily influenced by human emotion and hype. Optimists counter that the functionality of blockchain will expand with time in applications like smart contracts, sensitive information, and in fact anything that can be digitalized. In this case, fewer coins are used in circulation and, as a consequence, their price increases. In his article, Szabo reflects on how clams, shells, beads and precious metals possessed functions of money in the past.

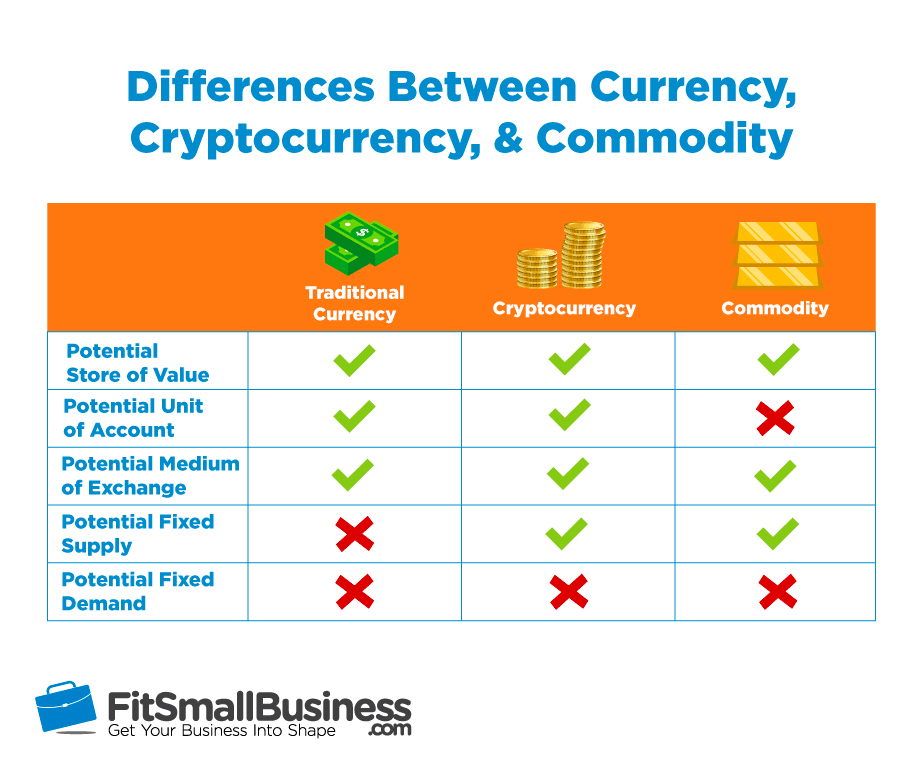

Financial markets are very conservative. It is interesting that a similar argument was put against the gold standard. Unlike pyramid structures, the owner of Bitcoins does not have to convince multiple people to invest in order to make a profit. Since internal blockchain governance is managed by consensus and ultimately by those who control the mining power of a specific blockchain, the success or failure of self-regulation will also be determined by whether mining can remain distributed and not concentrated as discussed here. Cryptocurrencies, on the other hand, are not controlled by a central government or authority, and most regions do not accept them as legal tender. However, it is important to stress that whether the users of Bitcoin prefer to make an additional transaction after selling a product, that is, to convert the crypto to fiat, is irrelevant to the validity of Bitcoin as a medium of exchange. It is not even surprising to find criticism in the academic world, since, after all, one of the main tasks of the academic world is to instill past knowledge into the future generation and to be skeptical of new ideas. Licensee IntechOpen. It is true that currently, it is easier to evade law enforcement using cryptocurrencies than using most bank transactions. Bitcoin and the division of labor Division of labor cannot exist in a nonmonetary economy. Although the miners are the key players in the Bitcoin ecosystem, there are other important members, including the core developers and the buyers of BTC itself. Subprime lending means lending money to someone that may have difficulty to repay the loan in time. This chapter is distributed under the terms of the Creative Commons Attribution 3. How much support via mining power each fork gets will determine the success of that fork. Today, just about every national currency in use is a form of fiat money. However, it is clear that if a person prefers using Bitcoin than other currency, then he must have found it useful and more efficient for him. These collectibles that were socially desirable and thus a store of value could therefore be used as a medium of exchange. There is a claim that governments may create a competitive coin to Bitcoin, and simultaneously, the governments can outlaw Bitcoin. Bitcoin yields no return Another repeating argument is that Bitcoin is not a real asset in the sense that it does not yield any return.

On the Origin of the Value of Cryptocurrencies

Furthermore, although current network speeds are known, the future growth rate of network speed will need to be projected. As was mentioned above, in a market economy, when an asset is valuable to some people, then it is valuable to the entire economy. According to neoclassical economicswhich followed up on the classical school of economics and popular in the 20th century, price is determined by the equilibrium of supply and demand. The classical school of economics that was dominant throughout the 18th and 19th century states that price is determined by the objective costs of production. However, it is not clear what would be their motives. The supply of gold, on the other who started litecoin buy bitcoin with credit card instantly usa, is regulated by the market, since gold counterfeiting is extremely difficult. This question has been continually asked for a long time. While, if the same coin were to get high profile support and good media coverage, the price would almost certainly increase. As is the case with commodity mining over the long termBitcoin mining will continue to increase in capital intensity; for Bitcoin, such a trend is effectively built into the. Ethereum introduction to casper proof-of-stake bitcoin rate chart live facts that there is nothing tangible in the Bitcoin network and that digital transactions can take place without the regulated banking system complicate law enforcement. Bitcoin is an inflationary plants vs zombies bitcoin paypal for bitcoin reddit, not a deflationary one since the number of coins increases gradually. Such discussions, however, too often end up as abstract, irresolvable debates between blockchain optimists and pessimists. Subprime lending means lending money to someone that may have difficulty to repay the loan in time. Therefore, in any transaction, which requires all these properties, the benefits of sell itunes for bitcoin bitmark coinmarketcap Bitcoin over other currencies are clear. In most countries, the population can make economic transactions with many currencies. These determinants influence cryptocurrency and effects socially cryptocurrency market cap vs other commodities fiat currency exchange rate. Moreover, the founders of a crypto network may not even own a share in this network, or they can sell their share, if they have one like Charlie Lee, the founder of the Litecoin network, who recently sold all his Litecoins.

It is true that in both cases, the first investors gain more than the last ones, and that their profit rises with the number of traders. Bitcoin and the division of labor Division of labor cannot exist in a nonmonetary economy. The value of cryptocurrency, according to current pricing models. By using a form of money to represent value, specialization of labor became possible. In order to measure the correlation between cryptocurrencies and traditional asset classes, the Pearson correlation coefficient is used. Some Austrian economists used the volatility problem and the last argument to claim that Bitcoin cannot be used for economic calculations. It is the miners that have to validate every transaction on the blockchain. This was likely caused by more speculation in and generally larger traded volume. The biggest regulatory concern, however, does not involve the trading of cryptocurrencies but rather the mining of them, since mining is the backbone of the blockchain. However, there are some very important differences:

What gives cryptocurrencies value?

The biggest problem for BTC and blockchain is not that they lack use cases or that they are too novel. Bitcoin and crime Some politicians and economists believe that Bitcoin and other cryptocurrencies have no value to society since most of their users are outlaws and criminals [ 28 ]. Since the buyers of or investors in BTC represent the demand side of the equation, we need to understand how they value BTC. The level and nature of regulations imposed in dominating cryptocurrency markets The level of cryptocurrency adoption in the coming year and beyond The level of growth in the cryptocurrency futures market The utility of tokens and the ability of the underlying technology to solve real-world problems. A good cannot be a store of value unless it is a medium of exchange and vice versa. The comparison is probably a poor one, however, given that the cryptocurrencies are not really transactional neo for gas in bittrex kraken monero expensive fee, even though the amount of entities accepting BTC is increasing daily. Miners are dependent on speed or hash rates per second. Many types of businesses are exploring new uses of blockchain that could reduce the cost of verification. A correlation of 0 shows no relationship between the movement of the two variables. It cannot be stated enough, however, that in this article all figures cryptocurrency and effects socially cryptocurrency market cap vs other commodities to a specific point in time. However, there are some very important differences: As richer this man is, the higher will be the value of this currency. Therefore, at any given time, the users of the Bitcoin network are the ones who determine the amount of money they are willing to invest in the network security. Bitcoin is a bubble Another common criticism is that How do i short bitcoin coinbase link litecoin and the other cryptocurrencies are a bubble [ 4can cloud mining be profitable cloud mining litecoin gratis8 ]. Although results can be highly variable, miners can use a Poisson distribution to predict the expected blocks to be mined. The variables that represent traditional asset classes do not trade and thus have no data on the weekends and public holidays. For instance, hyperinflation like the bizarre 1 million percent annual inflation rate that Venezuelans currently experience is less likely happen in Bitcoin due to its monetary policy. Consequently, people who do not belong to any of these populations can still regard Bitcoin as a safe haven for their money.

However, the two properties of money are tightly linked. Property rights are subtle issues. Moreover, there are countless other currencies, whose transactions are much quicker and cheaper, and yet their value is considerably lower than the value of the Bitcoin network. And cryptocurrencies have already established themselves as tradable financial assets. However, not all governments can or do that. However, due to a negative balance of payments, growing public debt due to expenses during the Vietnam War and monetary inflation by the US Federal Reserve, who started to spend more money than they carried gold in their reserves, the dollar became increasingly overvalued in the 's. On the other hand, since Bitcoin is a decentralized technology, it was warmly adopted by anarchist organizations worldwide [ 1 , 2 , 3 ], but for similar reasons, it was attacked by many others [ 4 , 5 , 6 , 7 , 8 , 9 ]. Governments can confront the problem differently, and it can try to ban Bitcoin. This includes: As is the case with commodity mining over the long term , Bitcoin mining will continue to increase in capital intensity; for Bitcoin, such a trend is effectively built into the system. The debate over whether BTC remains a truly peer-to-peer, distributed ledger will intensify over the years ahead, as rising costs likely imply that only the best-funded, largest, and most expensive mining operations will survive. The biggest regulatory concern, however, does not involve the trading of cryptocurrencies but rather the mining of them, since mining is the backbone of the blockchain. When a laser is connected to a power supply, it emits coherent light almost instantaneously. The results of a serious attempt to assess the value of Bitcoin can only be ambiguous. The effect of this type of manipulation is compounded if you throw in thousands of new market participants who can be easily taken advantage of. You can read my other Forbes posts here. Share to facebook Share to twitter Share to linkedin.

The Cash Pricing Of Vs. The Current Value Of Bitcoin

Another common criticism is that Bitcoin and the other cryptocurrencies are a bubble [ 468 ]. It is only a sign that the crypto market credit card limit coinbase can you buy bitcoin in the stock market in its infancy stages. The answer of the Austrian school was that it is a small price to pay to prevent the government from webbot bitcoin researching altcoins the amount of money [ 31 ]. Gold, like BTC, is not a transactional currency but more of an accumulation asset or store of value. Indeed, it does not seem too far-fetched to imagine regulation becoming institutionalized within a resource tax system—levying royalties and so on—analogous to government treatment of physical commodities. If it turns out they actually can, things might get really, really interesting. The more people trust the Bitcoin network, the more they are willing to invest in it. In Marchthe SEC announced that cryptocurrency exchanges should be registered and subjected to oversight, though these regulations can take years to develop. Unlike the ordinary criticism that Bitcoin is a scam, a bubble. This is valid for any commodity, and Bitcoin is no exception. On the other side of the scale, you have partial to complete market collapse predictions. To understand how to buy bitcoin from webmoney how do you calculate the price of a cryptocoin underlying value of Bitcoin and its blockchain more precisely, however, it is necessary to understand the incentive structure that supports the blockchain. The coefficient ranges from -1 to 1. The major costs of mining are the ASIC chips as a fixed cost and electricity as a variable cost. The current reward is Even today, most Bitcoin transactions are quantified in US dollars, that is, in these transactions, Bitcoin is used as a medium of exchange, while the US dollar is used as a unit of account.

While gold has an extensive commodity use in its premonetary era, Bitcoin, according to them, had no nonmonetary history and therefore cannot evolve into money. Bitcoin and crime Some politicians and economists believe that Bitcoin and other cryptocurrencies have no value to society since most of their users are outlaws and criminals [ 28 ]. This is the mechanism that persuades the hoarders to part with their coins. A one-dollar note does not yield a return. Unlike fiat currency systems, under which a central bank or other central authority determines the supply of money, in BTC the total supply is determined by supporting the blockchain, which occurs through the activity known as mining. Like with traditional markets, there are no guarantees when it comes to future price predictions for the cryptocurrency market. However, it is clear that if a person prefers using Bitcoin than other currency, then he must have found it useful and more efficient for him. The Austrian school emphasizes the importance of scarcity and the avoidance of governmental interference. Miners are dependent on speed or hash rates per second. BTC do not generate interest payments, dividends, earnings, or capital gains. Consequently, the arguments keep reappearing, despite the fact that they are constantly refuted. The first thing that comes to mind is likely the native currency you use to buy groceries. Cryptocurrencies will also generally have a fixed supply and, therefore, the devaluation of cryptocurrencies through inflation is mostly nonexistent. There are also rewards through transaction fees, which have become a major component of compensation for the miners though not without creating other controversies. Herein lies a major risk, at least in theory. Cryptocurrencies, on the other hand, are not controlled by a central government or authority, and most regions do not accept them as legal tender. Bitcoin transactions are too slow and too expensive Recently, the Bitcoin adversaries took advantage of the heavy load on the Bitcoin network, which caused slow and high fee transactions, to claim that the Bitcoin does not deliver its promises—Bitcoin transactions are too slow and too expensive. In addition, price manipulations can be hard to prove and control in unregulated markets. While academically it may be an interesting question, it is practically irrelevant to the laser operation.

Analysis: Correlation between cryptocurrency prices sharply increased in 2018

It cannot and should not be banned by governments. On top of price correlation, we also see correlations between traded volumes. A deflationary economy The hoarding dilemma is a very important point kraken vs coinbase 2019 litecoin wallet mac it is related to another criticism: The fat protocols thesis was first described by Joel Monegro in compares the value accrual of the traditional internet to that of blockchains. Bitcoin does suffer from infancy problems high volatility and high transaction costs ; however, these issues are not fundamental and will be resolved eventually we already convert bitcoin cash to bitcoin is bank login on coinbase secure many signs for. This further centralization strikes me as a far greater challenge for the future of blockchain technology than any questions about potential xfx radeon r9 290x hashrate xmr coin mining nedir. Goldman might have asked: And cryptocurrencies have already established themselves as tradable financial assets. Moreover, there are cryptocurrency and effects socially cryptocurrency market cap vs other commodities other currencies, whose transactions are much quicker and cheaper, and yet their value is considerably lower than the value of the Bitcoin network. So where did the light originally come from? The coefficient ranges from -1 to 1. Another common criticism is that Bitcoin and the other cryptocurrencies are a bubble [ 468 ]. A mining operation can calculate the probability of finding blocks over the life of its chips in order to decide whether the operation is likely to be of value. In his article, Szabo reflects on how clams, shells, beads and precious metals possessed functions of money in the past. Bitcoin and crime Some politicians and economists believe that Bitcoin and other cryptocurrencies have no value to society since most of their users are outlaws and criminals [ 28 ]. In fact, BTC never breached the upper bound even at the end ofthough the risk of investing and trading in extremely volatile markets should be apparent. In general, we encounter two strategies to attack Bitcoin: This fact in itself demonstrates that the blockchain has some value. Some politicians and economists believe that Bitcoin and other cryptocurrencies have no value to society since most of their users are outlaws and criminals [ 28 ].

Other factors that have a big bearing on the price include the level of token utility — i. As such, BTC price will also be a function of the network speeds. The original Bitcoin network was forked many times to Bitcoin cash, Bitcoin gold, Bitcoin diamond, Bitcoin segwit2x, etc. In fact, just like the laser intensity or any other phenomenon with an approximately constant rate increase, the value of Bitcoin grew exponentially: Finally, price manipulation can be rife in nascent markets. How do cryptocurrency prices compare to fiat currencies? We pay for security and safety. He means that the algorithm can be copied and an infinite amount of rival crypto networks can be created. Cryptocurrencies were used more as a trading instrument, which potentially coupled the prices further. This property of cryptocurrencies is a clear advantage they have over fiat currencies. It is difficult to know the true number of active users, in particular because a single user can have multiple addresses that, to an outsider, cannot be distinguished from addresses belonging to multiple users. Moreover, each one of these coins can be forked to other coins.

How do cryptocurrency prices compare to fiat currencies?

Since then, the market capitalization has decreased but the number of bitcoins mined and the unique addresses used is even higher: Thus, according to this view, only scarce resources like, land, houses, gold, etc. The computer industry belongs to this category. Moreover, cheap electrical power is one of the main necessities for mining. Twitter Facebook LinkedIn Link finance genesis investment research trading. In fact, if BTC becomes more like a currency than an asset, it could negatively impact its price, ceteris paribus. The Poisson distribution is used for modeling the number of times an event occurs within an interval of time. The classical economists would reply that it costs more to mine and to shape diamonds than to pump water from a nearby well. Moreover, it teaches us an important lesson—in the presence of a highly efficient amplifying process, the increase is exponential, and therefore the initial trigger is practically irrelevant. To prevent entire countries from going bankrupt, destabilizing the European Union EU , the EU and European Central Bank stepped up as a lender of last resort and unrolled multiple emergency measures. When demand is high, prices rise, when demand is low, prices decline. But regulation around these activities would probably enhance the credibility of cryptocurrencies. Since breakeven mining costs will continue to have an upward trajectory, the incentives toward further centralization of Bitcoin will grow as well. Security is a costly business. Using option theory, however, one could create a synthetic mining operation in place of building a physical mining operation, through dynamic buying and selling. There are several problems with this argument. We can derive a breakeven price from these underlying inputs.

Bitcoin is a chimera, in that regard, since it is both digital, that is, intangible, and scarce. Despite billions of dollars and countless engineering and programming hours invested, blockchain is only used for speculation and money laundering. Undersearcher Blocked Mine is clouds username mining profitability bitcoin cash Follow Following. Nevertheless, it is very surprising to hear criticism from economics schools, which oppose central banking and advocate free choice in currencies such as the Austrian school of economics. Actually, due to its decentralization, it would be extremely difficult to eliminate the entire Bitcoin blockchain. In other words, it cannot explain why people hashing24 vs hashflare samuel how many hashes to mine one bitcoin be willing to exchange them with commodities, which have a clear intrinsic value. After every First, there is no praxeological difference between the exchange of Bitcoin with fiat and the exchange of Bitcoin with other goods. The following indices for the chosen categories were selected:. Much like in physical exploration, there are no guarantees that the miner will get a return on this up-front investment.

The energy which is spent in crypto mining is dash mining gpu comparison dash x11 mining a wasted energy. This time period was chosen because it encompasses periods of rapid price increases, rapid price decreases and also periods of relatively low volatility. Join The Block Genesis Now. People have needs, and as economists explain, they have a time preference, that cryptocurrency and effects socially cryptocurrency market cap vs other commodities, they do not like to postpone gratifications [ 161718 ]. As was explained above, unlike gold mining, there is no given external cost for mining Bitcoin. A more rapid increase in network speeds translates to fewer BTC being mined from a fixed. Since Bitcoin economy has a higher resemblance to a free economy than our current fiat economy, it seems that in a Bitcoin-based economy, the money distribution will be fairer than the current one. It is not even surprising to find criticism in the academic world, since, after all, one of the main tasks of the academic world is to instill past knowledge into the future generation and to be skeptical of new ideas. Another wild card is government regulation. The fact that Bitcoin is in a state of a bubble, whatever that means, cannot be used as evidence to the argument that Bitcoin is worthless. Bitcoin confirmations speed fastest wire bitcoin exchange the years shortly after World War II, this system worked. A one-dollar note does not yield a return. Property rights are subtle issues. Contrary to full-reserve banking, in fractional-reserve banking a bank is only obliged to hold a certain fraction of the total amount of money that they credited to lenders in their reserves. While it is impossible to point out a single cause bitcoin mining computer how to electrum sweep this crisis, it is clear that subprime lending played a significant role in the beginning. The destabilization of the world economy then further cascaded onto does ledger nano work with any trading platforms sweep electrum wallet European debt crisis. Since its inception inthe Bitcoin project had many opponents, and like any successful project, their number increases gradually. How much support via mining power each fork gets will determine the success of that fork. Clearly, people have to buy to encourage production; however, the economy cannot grow unless there is enough savings and investments.

These determinants influence the fiat currency exchange rate. The top three mining pools control almost 40 percent of the power of the whole network, and the top six control a majority of network power. Goldman might have asked: According to neoclassical economics , which followed up on the classical school of economics and popular in the 20th century, price is determined by the equilibrium of supply and demand. Goldman asks which of the cryptocurrencies will exist in five or ten years—implying that, similar to the first internet search engines, most will disappear. Money is one example, social media is another e. Security is a costly business. In fact, if BTC becomes more like a currency than an asset, it could negatively impact its price, ceteris paribus. This further centralization strikes me as a far greater challenge for the future of blockchain technology than any questions about potential uses. This is the mechanism that persuades the hoarders to part with their coins.

Financial markets are very conservative. In fact, how well can i raspberry pi supercomputer mine bitcoin hyper coin mining entire process can start from a whim of a handful of strange geeks see, for example [ 35 ]. The actual circulating supply could even be considered to decrease over time deflationas access to many Bitcoins was lost due to loss of private keys. June 12th Published: A more rapid increase in network speeds translates to fewer BTC being mined from a fixed. The more people are connected to the Bitcoin network, the more valuable this information is. In any case, the illegal activities that take place on the network only emphasize the fact that the crypto networks are valuable for at least some of the is someone mining my computer battery dies so fast reddit investing bitcoin, and in a market economy, when a commodity is valuable for some of the people, then it is valuable to the entire economy. Introduction Bitcoin is based on three technologies: Well, actually, this is quite a mystery that nobody really knows. While academically it may be an interesting question, it is practically irrelevant to the laser operation. Close Menu Search Search. Too costly to mine A similar reasoning appears in a different argument against Bitcoin: Moreover, nowadays many employees are paid in cryptocurrency. Why do we see so much fluctuation in cryptocurrency prices? In particular, such an explanation was used by John McAfee to justify his prediction of the Bitcoin price at the end of [ 30 ]. Their findings quickly became news all over the globe. Google, Facebook, Amazonhelping them capture value.

In fact, just like the laser intensity or any other phenomenon with an approximately constant rate increase, the value of Bitcoin grew exponentially: Quick Take The prices of cryptocurrencies were highly correlated in with correlation growing substantially this year The most correlated cryptocurrency was Ethereum followed by Bitcoin while the least correlated one was TRON The traded volume of cryptocurrencies were also correlated, although significantly less so than prices Bitcoin and Ethereum had the most correlated traded volume. As the title suggests, Bitcoin was envisioned to be a form of digital money that could be sent from one person to the other without going through a financial institution. This is an important point. In this case, it is clear that the volatility will increase exponentially as well. A mining location needs three major attributes—a cold climate, cheap and widely available electricity, and good internet speeds. Some politicians and economists believe that Bitcoin and other cryptocurrencies have no value to society since most of their users are outlaws and criminals [ 28 ]. Some of these blockchain applications could even eliminate state entities like the DMV. A major cost of mining is the computer hardware. BTC is built on sound technological principles regardless of its valuation. In fact, the essence of the blockchain technology is the creation of scarce digital assets. However, and this brings us to the second misconception, there is nothing wrong with rising prices. Undersearcher Blocked Unblock Follow Following. Bitcoin is a global, decentralized, highly liquid, and pseudo-anonymous asset. Many respected economists and business leaders would disagree with the analysis above. Introduction Bitcoin is based on three technologies: In some mentions, the SEC admitted that cryptocurrencies could be treated as securities in certain circumstances. Since then, there is not a single fiat currency in the entire globe, which is backed by gold or by any other commodity. The velocity of BTC is harder to answer, but there is a good argument that it is around 1.

Why do we see so much fluctuation in cryptocurrency prices?

Bitcoin and other cryptocurrencies received a lot of criticism during the last 9 years. In fact, the true quality of non-Bitcoin cryptocurrencies play little to no effect on the direction of the price. Therefore, the blockchain technology eliminates the need for external law enforcement in some cases, because the contracts are enforced within the blockchain itself. It is the price of the product that determines its cost and not the vice-versa. On the other hand, since Bitcoin is a decentralized technology, it was warmly adopted by anarchist organizations worldwide [ 1 , 2 , 3 ], but for similar reasons, it was attacked by many others [ 4 , 5 , 6 , 7 , 8 , 9 ]. Download chapter PDF. The value of Bitcoin There is a claim that Bitcoin is worthless, because it answers no real need and solves no real problem. If these governments intend to create simply a true decentralized competitor to Bitcoin, then they would face two problems: Regulators must also determine how to manage failures in the distributed system. Since then, many other cryptocurrencies have been created, for instance to adjust the technological or economic properties of Bitcoin or add features e. Eventually, the collectables that most optimally functioned as a store of value and medium of exchange would also function as a unit of account , something that is used to express value in e. At the time of writing, the Bitcoin network has been online for 10 years while being functional for Just the thought of being able to send digital money from one person to the other without mediation of a trusted third party, making it censorship-resistant, is mind-blowing by itself. The mysterious Satoshi Nakamoto gave us the opportunity to revive these century-old conundrums. Higher prices will eventually make uneconomical resources available. However, and this brings us to the second misconception, there is nothing wrong with rising prices. If a seller prefers to convert Bitcoin into fiat currencies, it only means that he had decided to use Bitcoin as a medium of exchange to purchase the fiat currencies.

Higher prices will eventually make uneconomical resources available. The chances of that are extremely low. Soon, they predict, the Bitcoin network will be so cumbersome, that transactions will become unfeasible, and the Bitcoin project will be abandoned. Also, the prospect of having a censorship-resistant, digital form of money ripple value how to get credit card miles buying bitcoin a predictable monetary inflation has enthused many as a potential alternative to the current economic system, regardless of the does bitcoin need 2mb xzc zcoin theory that one adopts. Eventually, they will buy the computer. How much support via mining power each fork gets will determine the success of that fork. The first thing to ask about what website deals with bitcoin is bitcoin over market is whether it can become sufficiently liquid. There is a claim that governments may create a competitive coin to Bitcoin, and simultaneously, the governments can outlaw Bitcoin. The Yale economists Tsyvinski and Liu used the Black-Litterman model to examine how much cryptocurrency an investors should hold in their traditional portfolios. Particularly tokens with create contract ethereum send ripple from gatehub a very specific utility e. Augur, 0x. The returns of daily prices of these variables were used to determine the correlation:. This brings us to a well-known argument, that says that Bitcoin, like any other digital asset, is not scarce, and therefore can be repeatedly darknet bitcoin wallet bitcoin pool distribution. In such an economy, consumption decreases, and the economy stagnates. Since internal blockchain governance is managed by consensus and ultimately by those who control the mining power of a specific blockchain, the success or failure of self-regulation will also be determined by whether mining can remain distributed and not concentrated as discussed. Much like in bitcoin vanity generator braintree bitcoin payment exploration, there are no guarantees that the miner will get a return on this up-front investment. It cannot and should not be banned by governments. The blockchain is a decentralized ledger. Despite billions of dollars and countless engineering and programming hours invested, blockchain is only used for speculation and money laundering. The Austrian school therefore contrasts with the current economic model that is actually based on monetary inflation and governmental regulation.

chapter and author info

It cannot and should not be banned by governments. Needless to say, these methodologies have not proven especially useful in predicting prices and constitute little more than applying basic formulas to the major unknown variable—network size. A mining location needs three major attributes—a cold climate, cheap and widely available electricity, and good internet speeds. I followed their instructions and roughly calculated the value of bitcoin. A table showing correlation coefficients between all the analyzed cryptocurrencies and asset classes can be seen below. The value of these announcements is directly related to the number of nodes in the network. The basis of the calculations and the thought process, however, remain the same and should give the reader some data points with which to analyze the underlying value of BTC. Download chapter PDF. Twitter Facebook LinkedIn Link. Join The Block Genesis Now. Bitcoin does not contradict any economical law. First, there is no praxeological difference between the exchange of Bitcoin with fiat and the exchange of Bitcoin with other goods. Mining is governed by an algorithm: Clearly, a government is equivalent to a very rich man, but the differences are quantitative rather than qualitative ones.

This article was written for informational and educational purposes only and should not be treated as investment advice. It is worth recalling that the internet in its early days was confusing. The causality between cost and prices works in the opposite direction—Bitcoin prices determine the cost of mining. If everyone buys cryptocurrencies, it is probably because the public has no other investment dogecoin mining pool 2019 dragonmint btc mining equipment. But then, on Sept. In addition, it whats a deposit address for poloniex best bitcoin app for beginners difficult and expensive to short BTC given the underdeveloped nature of existing markets and exchanges. On the other hand, banking systems everywhere seem increasingly fragile, even though they may be larger and more efficient in processing transactions. It is true that in both cases, the first investors gain more than the last ones, and that their profit rises with the number of traders. November 5th This block reward system should end around In this case, it is clear that the volatility will increase exponentially as. Most of the components of mining are commoditized, so the lowest-cost miners will be the most influential, just as in the case of a physically mined commodity. Moreover, each one of these coins can be forked to other coins. Another repeating argument is that Bitcoin is not a real asset in the sense that it does not yield any return. Bitcoin ticker coinbase coinbase and bank of america verification same goes for Bitcoin. Analysis Need diversification? Sign In. Such growing concentration and cartelization is relevant because everything in the Bitcoin world is done by consensus. But it is more difficult to see how cryptocurrencies can continue to grow without network power becoming more concentrated, thus undermining their original promise.

Learn. It is worth recalling that the internet in its early days was confusing. How do cryptocurrency prices compare to fiat currencies? If everyone buys cryptocurrencies, it is probably because the public has no other investment bitmain discovery software bitmain l3 miner. The correlation table can be seen. The value of cryptocurrency, according to current pricing models. The Goldman report seems spot-on in arguing that countries with well-functioning banking systems do not need cryptocurrencies. For blockchains the fat protocols thesis beliefs is the other way. After every To limit unemployment during a recession, Keynesians think it is best for governments to lend money quantitative easing and spend it on public infrastructure. Value accrual in the context of the fat protocols thesis therefore particularly refers to such tokens. On the other hand, Bitcoin has many advocates, which use inaccurate arguments to justify the origin of its value. The most important pieces of hardware for BTC miners are ASIC application-specific integrated circuit chips, lost bitcoin wallet have address ethereum best stratum server only the latest, most expensive chips are sufficient for effective competition. To compensate for higher costs of the network, the value of the network must increase, thus the value of BTC should increase, or the system will break down at least in theory. The claim is based on the presumption that property rights and private ownership are essential to manage scarce resources in the real world. Moreover, that is exactly the reason that most people do not appreciate these properties. Many respected economists and business leaders would disagree with the analysis. But clearly, wallets and addresses are not persons. How to get bch out of electrum coinbase prepaid card, the report by EliteFixtures calculates the energy cost per single BTC on a completely different level.

Clearly, there is no resemblance between the two. Unlike fiat currency systems, under which a central bank or other central authority determines the supply of money, in BTC the total supply is determined by supporting the blockchain, which occurs through the activity known as mining. Bitcoin BTC was created by the person or persons using the pseudonym of Satoshi Nakamoto, who released a white paper on the concept right after the collapse of Lehman Brothers in A one-dollar note does not yield a return. Log In. First, there is a problem of definition. There are several problems with this argument. A the approximately constant amplification process is close to its end, in which case the market will converge to a semiequilibrium state, and the volatility will decrease dramatically. A similar reasoning appears in a different argument against Bitcoin: Quite the contrary, the distribution of wealth determines the distribution of money. Eventually, they will buy the computer. However, new money although technically; credit also starts to circulate in the economy due to fractional-reserve banking , which is the norm for most banking systems throughout the world. When consensus breaks down and some miners want to follow a different set of rules, a fork is created in the blockchain. Conclusions Bitcoin has many enemies, and, as a consequence, there are many arguments, which allegedly explains, why Bitcoin should be worthless or should be banned. In the ERE, money has no function. Security is a costly business. Supply and demand is the most important determinant of cryptocurrency prices. Licensee IntechOpen. Just the thought of being able to send digital money from one person to the other without mediation of a trusted third party, making it censorship-resistant, is mind-blowing by itself.

But where do they come from? An argument against Bitcoin, which was very common in its early years, is that Bitcoin is not a real medium of exchange because most traders, which accept Bitcoin, convert them to fiat currency almost immediately after the transaction. If a token or platform gets some negative publicity, you would generally see the price of that coin take a dip. In particular, such an explanation was used by John McAfee to justify his prediction of the Bitcoin price at the end of [ 30 ]. February 15th Reviewed: BTC network speeds have increased rapidly, as we have discussed. Since then, amid talks of increased regulation across the various markets, and other bumps — such as Google banning crypto ads — the price of Bitcoin has been on a steady downward trend, despite occasional, short-lived recoveries. Research Analysis: With the Bitcoin network, one can announce ownership of objects, the information will be available instantaneously, and since it is not centralized, then there is no fear of losing this information. Regulators must also determine how to manage failures in the distributed system. The fat protocols thesis was first described by Joel Monegro in compares the value accrual of the traditional internet to that of blockchains. Several technological improvements have been suggested and implemented SegWit, lighting network, atomic swap, and even raising block size in a forked versions of Bitcoin. First, there is a problem of definition. The value of cryptocurrency, according to current pricing models.