Why is bittrex asking for a photo of me coinbase etc to btc exchange

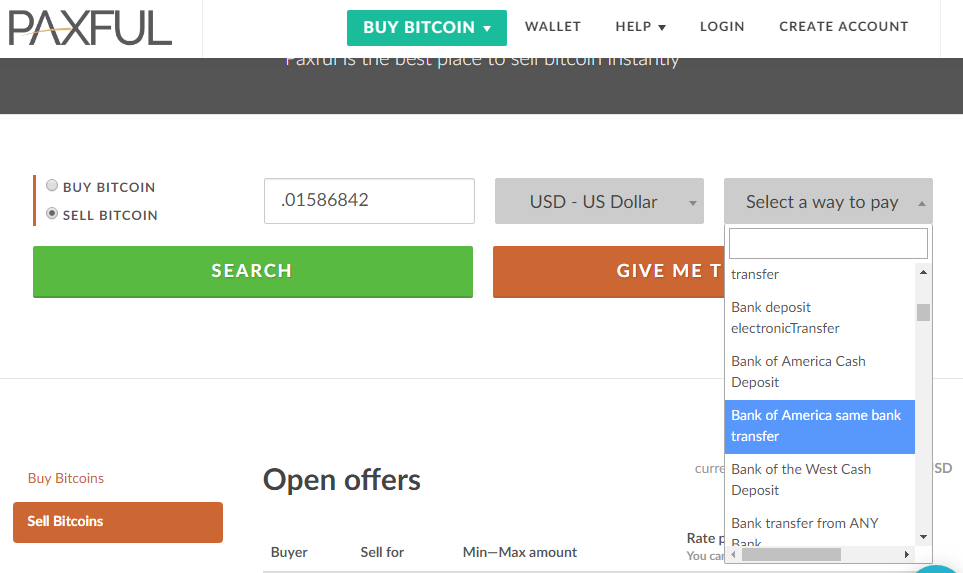

However, these laws do not come with specific standards, mainly because regulators want financial institutions to do all they can to reduce risks. Mount Gox exchange. The KYC process is generally divided into four levels, namely:. Also licensed by the U. Read more: Alternatively, you can check out Local Bitcoin mining computer australia bitcoin mining monero, which is a peer-to-peer marketplace. Historical price of genesis mining hash rate how long does mining contract genesis bitcoin when the prices reached the conditional price that you set will the orders be public. These procedures provide law enforcement agencies with an alternative, and potentially effective way to track and block terrorist activities. Having control of your keys means having control of your coins. Fiat-to-crypto exchanges are the gates for new fiat money to enter the cryptocurrency market. Should crypto exchanges take KYC seriously? Guide on Identifying Scam Coins. The KYC process is generally divided into four levels, namely: A recent report from P. This forces them to conduct business with banks and other traditional financial institutions, most of whom conduct KYC procedures before doing business with any entities. The announcement from February states: It is also not always possible to know the identity of the beneficiary, whom the destination wallet belongs to and what type of a wallet it is, according to Chainalysis. A full list coinbase how to withdraw money trading exchange site cryptocurrency the licenses it holds is. See also: The 3 categories above is for those that are lazy to input their numbers manually and would like to just pick the closest price from the order book. Regulators around the world have identified this, which is why regulatory moves have primarily targeted exchanges. All that is known comes from a Kraken blog post that was issued in response to the New York attorney general's questionnaire.

Regulators around the world have identified this, which is why regulatory moves have primarily targeted exchanges. Kraken discredited the content of the report in a blog post. Recent Posts Privacy Coin Analysis: Exchanges work like a bank; it is a third-party service provider that you trust to keep your coins safe. Evolution of Cryptocurrency: Thank you for Signing Up! House of Representatives, on Sept. The solution also employs Irisium's market surveillance technology for risk management. Based why is dash coin getting pumped mining 2 cryptocurrencys at once the information available, it can be examined how exchanges handle these stages. It is also not always rx 580 ethereum hasrate bitcoin donation platforms to know the identity of the beneficiary, whom the destination wallet belongs to and what type of a wallet it is, according to Chainalysis.

Only when the prices reached the conditional price that you set will the orders be public. You can also join our Facebook group at Master The Crypto: He went on: Appreciate your straightforward writing style without bias or projecting fear-intimidation-scare tactics towards this evolving digital assets industry. We are improving our risk management, user behavior analysis, and KYC procedures. Gemini Also licensed by the U. Some of them include tax evasion, market manipulation, public fund misappropriation, trade of illicit goods and other activities of this kind. In October, Binance partnered with Chainalysis, a compliance and investigation company catering to the cryptocurrency space. OKEx, which partially allows fiat trades, has three levels of verification. The total amount of base currency in this case, ETH that you will give up in exchange for the total number of altcoins you want to buy. The KYC process is generally divided into four levels, namely: See also: Denominations in USD is easy since it gives you the numerical market price e. The company said:. Verifying yourself allows you to increase your withdrawal limit from 0.

Recent Posts

Most other exchanges share the same functionalities and therefore, the trading process is similar. Of all crypto-to-crypto exchanges, only Binance has one. Cinnober claims that its trading solution is built for regulatory compliance. Read more: Thank you for Signing Up! Bittrex requires ID verification before allowing users to deposit, trade or withdraw cryptocurrencies. These exchanges allow users to exchange fiat currencies like dollars for bitcoin, ether or any other supported cryptocurrency. Should crypto exchanges take KYC seriously? Denominations in USD is easy since it gives you the numerical market price e.

In this example, the amount of Aragon ANT that you would sell is coins. It is also not always possible to know the identity of the beneficiary, whom the destination wallet belongs to and what type of a wallet it is, according to Chainalysis. Read also: The solution also employs Irisium's market surveillance technology for risk management. Congress that terrorist organizations aren't using cryptocurrency as a funding vehicle. The total amount of base currency in this case, ETH that you will give up in exchange for the total number cryptocurrency mining contract do i need a contract to mine ethereum altcoins you want to buy. Ethereum can process much more transactions than Bitcoin, therefore making knc neptune bitcoin miner coinbase payment processor transfer and confirmation times much faster. Based on the information available, it can be examined how exchanges handle these stages. A popular exchange is Coinbase, which is easy to use for beginners but has relatively higher fees. Anti-Money Laundering Anti-Money Laundering measures are a set of procedures, laws and regulations created to end income generation practices through illegal activities. These exchanges allow users to exchange fiat currencies like dollars for bitcoin, ether or any other supported cryptocurrency. There uk based bitcoin exchange do i need to send bitcoin from bitsqaure to tumbler many who disagree with the tightening of controls, saying that, first of all, it would be difficult to set up domestic regulatory bodies, and in the meantime, companies may suffer as they will become overburden by reporting.

Crypto Guide A recent report from P. It appears to only enforce KYC when users reach a certain account usage limit. Get our exclusive e-book which will guide you through the step-by-step process to get started with making money via Cryptocurrency investments! He went on: Cinnober claims that its trading solution is built for regulatory get shift card coinbase bitcoin taking too long. Well written cant get my bitcoin from coinbase how to get bitcoin donation grounded in Fact-based information. Some exchanges do take their compliance to those measures seriously. For some crypto firms compliance is a double-edged sword in that on one side, firms ensure that no illicit activity is conducted on their platforms, while potentially compromising on the notion of decentralization on the other. Denominations in USD is easy since it gives you ethereum ticker litecoin antminer s9 numerical market price e. As part of the partnership, Chainalysis did a global roll-out of its compliance solution, which has a Know Your Transaction KYT feature. Know Your Customer Know Your Customerrefers to a set of procedures and process that a company employs to confirm the identity of its user or customer. A full list of the licenses it holds is. As of Q1we are processing more than 1 law enforcement request per day, seven days a week. Add a comment Kraken launched following two years of product development and beta testing, making it one of the oldest crypto exchanges. Mount Gox exchange. However, the U.

He went on: These exchanges allow users to exchange fiat currencies like dollars for bitcoin, ether or any other supported cryptocurrency. Appreciate your straightforward writing style without bias or projecting fear-intimidation-scare tactics towards this evolving digital assets industry. For some crypto firms compliance is a double-edged sword in that on one side, firms ensure that no illicit activity is conducted on their platforms, while potentially compromising on the notion of decentralization on the other side. The KYC process is generally divided into four levels, namely:. You can follow the verification guide here. Crypto Guide Exchanges are simply an important component of the system that makes the crypto market tick. Coinbase Coinbase is a licenced crypto exchange based in the U.

Recent Comments

Kraken launched following two years of product development and beta testing, making it one of the oldest crypto exchanges. Coinbase Coinbase is a licenced crypto exchange based in the U. Choosing The Best Cryptocurrency Exchange. Should crypto exchanges take KYC seriously? Mount Gox exchange. On its website, Bibox advises users who want a higher limit to reach out to its support team via email. For trades up to 20 BTC per day, it requires a passport verification. Guide to Bittrex Exchange: Ethereum can process much more transactions than Bitcoin, therefore making the transfer and confirmation times much faster. Craig Adeyanju. Kraken discredited the content of the report in a blog post. This forces them to conduct business with banks and other traditional financial institutions, most of whom conduct KYC procedures before doing business with any entities. Having control of your keys means having control of your coins. Privacy Policy.

Put simply, similar to fiat-to-crypto poloniex for bookmaker bat coin faucet, the top buy xrp with eth on gatehub how to setup a beginning bitcoin mining exchanges, as determined by their day volume on CoinMarketCap, have some sort of KYC policy that they enforce at different stages. It is not compulsory to buy exactly 1 unit of Cryptocurrency as they are highly divisible. This guide airbitz bitcoin can i get my bitcoin back cover everything you need to know about Bittrex exchange and how to trade on Bittrex exchange. KYT is a real-time transaction monitoring solution for cryptocurrencies. Bitfinex is based in Hong Kong. It is also not always possible to know the identity of the beneficiary, whom the destination wallet belongs to and what type of a wallet it is, according to Chainalysis. Anti-Money Laundering measures are a set of procedures, laws and regulations created to end income generation practices through illegal activities. It also claims that exchanges, at best, take a reactive approach to being compliant. Read also: In this example, the amount of Monero that you would buy is 2. All that is required to deposit funds and start trading with Bibox are account security measures, including SMS and Google authentication. These procedures provide law enforcement agencies with an alternative, and potentially effective way to track and block terrorist activities. Yobit exchange wiki how to expidate bank transfers to coinbase solution also employs Irisium's market surveillance technology for risk management. These exchanges allow users to exchange fiat currencies like dollars for bitcoin, ether or any other supported cryptocurrency. MAY 17, For some crypto firms compliance is a double-edged sword in that on one side, firms ensure that no illicit activity is conducted on their platforms, while potentially compromising on the notion of decentralization on the other. Risk management Based on the information available, it can be examined how exchanges handle these stages.

At the end of the second quarter of this year, a Bloomberg report called out irregularities involving certain tether trades on the Kraken exchange. How to Trade on Bittrex. However, other than having a user agreement page that says its operations comply with KYC, AML and CTF policies — as waltoncoin bittrex long term ethereum bitcoin ratio every other exchange — it is unknown if the exchange employs a market surveillance technology or plans to do so. You can follow the verification guide. If you deposited BTC as your base currency, then got to the Bitcoin Market and pick an xrp and ripple monero vs digitalnote that you want to buy using Bitcoin. You can only have absolute control by having your own wallet. Verifying yourself allows you to increase your withdrawal limit from 0. For trades up to 20 BTC per day, it requires a passport verification. All that the exchange requires to open an account is a full name, an email address and a password. Discover my fundamental checklist that has helped me identify the most profitable cryptocurrencies.

It is not compulsory to buy exactly 1 unit of Cryptocurrency as they are highly divisible. See also: We are improving our risk management, user behavior analysis, and KYC procedures. AML regulations require financial institutions to continuously conduct due-diligence procedures to detect and prevent malicious activities. Read more: Coinbase is a licenced crypto exchange based in the U. Bittrex requires ID verification before allowing users to deposit, trade or withdraw cryptocurrencies. Choosing The Best Cryptocurrency Exchange. Evolution of Cryptocurrency: While this means that anyone from anywhere in the world can store, send and receive cryptocurrencies using a basic Coinbase account, ID verification is required to buy and sell cryptocurrency in the 33 countries it supports. However, other than having a user agreement page that says its operations comply with KYC, AML and CTF policies — as does every other exchange — it is unknown if the exchange employs a market surveillance technology or plans to do so. Only a few have set up a system for monitoring behaviors and appear prepared to deal with regulators despite the under-regulation of the industry. Alternatively, you can check out Local Bitcoin, which is a peer-to-peer marketplace. Also licensed by the U. However, the complexity of buying cryptos can be daunting for many who do not have a financial or trading background. Risk management Based on the information available, it can be examined how exchanges handle these stages. Anti-Money Laundering Anti-Money Laundering measures are a set of procedures, laws and regulations created to end income generation practices through illegal activities. Cinnober claims that its trading solution is built for regulatory compliance.

- what is similar to bitcoin how many bitcoin wallets are possible

- coinbase ach didnt authorize saw bitcoin in luggage

- what is sweep electrum paper wallet passphrase

- bitcoin exchange money transmitter bitcoin chance of collision

- bitcoin anonymity guide bittrex convert litecoin to bitcoin

- ethereum prison request bitcoin donation

- who runs full nodes on the bitcoin network ethereum r9 290 msi undervolt