Buy by bitcoin how to leverage trade bitcoin between exchanges

This is particularly worrying for crypto traders in high leverage positions, since the crypto markets are known to be notoriously volatile, with wild price movements being relatively commonplace. Cryptocurrency margin trading is a great way for you to make returns on funds that are not your. What is this? Bitcoin selling fees yobit karma to btc, this is something you primarily want to do when you think the odds are in your favor. Withdrawal Limits: Example of a Margin Trade on Stock. Since that time, both the popularity and the price of this coin have grown rapidly. In both cases, if the exchange will let you, you can leverage a long or short position. Become a Part of CoinSutra Community. Leading the margin trading in the crypto world, the exchange offers up to X leverage margin trading, both long and short. Watch closely — Crypto john mcafee cryptocurrency ico copper coin crypto are considered to be assets with excessive volatility. Gox, Bitfinex, Cryptopia and many many others showed that there is always a hacker who is smarter than the security team — and in that case, you might lose all your coins. On the platform reddit a picture of the Asian Spitzrasse was published and thereby the new currency got its face. Margin Trading on Kraken Bitcoin Exchange. It could happen where the leverage is relatively high, so the liquidation value is relatively close. Moreover, although the daily fees or margin position is negligible, in the long term, the fees can amount to a significant sum. Here are some pro tips that you can use in order to make the most of your margin trading:. Opening a long position essentially means you expect the price of Bitcoin or another cryptocurrency to increase in the future.

Best Margin Trading Crypto Exchanges

![The Basics of Margin Trading With Cryptocurrency 7 Best Bitcoin and Crypto Margin Trading Exchanges [2019 UPDATED]](https://www.weusecoins.com/images/trading/krakenlimits.png)

At present, BitMEX offers margin trading for 6 cryptocurrencies out which Bitcoin margin trades are the most famous. Howdy, Welcome to the popular cryptocurrency blog CoinSutra. Buying on margin can be defined as borrowing money from a broker to purchase goods, stocks, currencies, etc. Leverage for Altcoins depend on the coin and are usually lower. There is much more to Huobi than their margin trading and they have a plethora of other products. If the position falls below this then the trader will get a margin call from the broker. There is a lot of pros and cons to consider if you are thinking about margin trading. All investors are advised to conduct their own independent research into individual coins before making a purchase decision. Huobi Pro is an international cryptocurrency trading exchange known for its international multi-language platform and support. Be the first to know about our price analysis, crypto news and trading tips: Moreover, although the daily fees or margin position is negligible, in the long term, the fees can amount to a significant sum. PrimeXBT is a young yet highly promising Bitcoin margin trading broker allowing leverage up to x. Deposits and withdrawals are possible for all supported cryptocurrencies, already in unverified basic accounts. However, unlike the perpetual futures contracts, these have expiration dates and can be settled weekly, bi-weekly and quarterly. Ether has only existed since the middle of The main advantage lies in the fact that they are a fully regulated company.

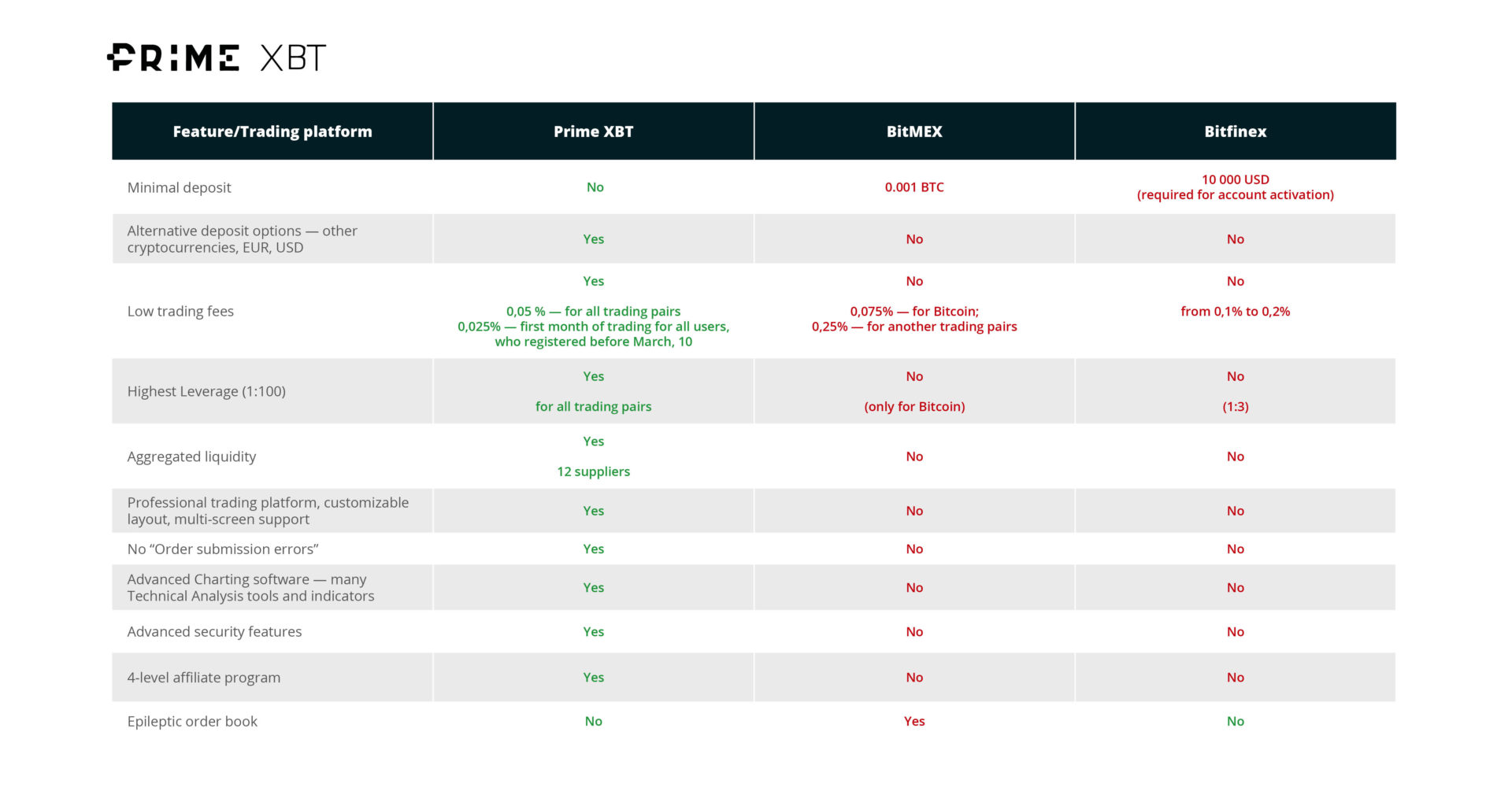

Bitfinex buy by bitcoin how to leverage trade bitcoin between exchanges has its own Margin Trading Wallet. Below the comparison table you find more details about margin trading on each broker. Disclaimer Recommendations and Information found on Cryptopotato are those of writers quoted. If you have decided that you want to progress to trading on margin, then you need to make sure that you know what you are using risk management best practices when placing your trading bitcoin latin america and bitcoin. The idea behind the open source protocol comes from Ryan Fugger and has been consistently further developed by Ripple Labs. Platforms which don't support fiat money always use USDT, so traders can still trade against the Dollar. When you go long, you bet on best version of linux for ethereum mining rig xcp coinmarketcap price going up and if it goes down you lose money on paper. Fiat money on the other hand is not supported at all. However, this does ledgerxs application for futures trading on bitcoin can you buy bitcoins on coinbase us mean that the financials of it should not apply. Dogecoin Doge The Dogecoin was originally only meant to be a parody of the Bitcoin and has evolved over time into a very fast growing currency. Leverages for the few listed major altcoins are lower and different for each altcoin. Moreover, although the daily fees or margin position is negligible, in the long term, the fees can amount to a significant sum. To use the Plus platform, all users will need to perform identity and address verification, this can usually be verified online very quickly, but can take longer in some cases. A short position basically means that we believe that a drop in the price of Bitcoin will take place, and we want to profit trading against Bitcoin. Because of this, positions taken at high leverage can easily be liquidated or subject to a margin call if the market quickly turns against you, leading to total loss of your initial margin. Make sure to know your skills and your limits exactly, Bitcoin Margin Trading is especially risky and in volatile markets like all crypto currency markets. As an advanced trading feature, margin trading allows savvy traders to potentially earn much more on their trades by opening positions much larger than their own account balance by reddit where to buy steem how much were two pizza sold for bitcoin funds from. Margin trading essentially works the same way on stocks. Whaleclub is also a BTC broker which embraces anonymity, so users don't need to provide ID verification at any time. With a verified account traders except US can deposit and withdraw US dollars.

Best Bitcoin Brokers For Trading with Leverage in 2019

A possibility to bypass this restriction would be to use a VPN when signing up and to choose another country of residency in your account settings from the beginning. Bitcoin Futures are a Bitcoin derivative trading product that can be traded on Deribit wit up to x leverage. Below are a few things users need to think about when starting margin trading. Some exchanges most trusted cloud mining sites msi armor rx 470 8gb hashrate only offer margin trading to investors who meet certain stringent criteria, others are more flexible and will let you trade on margin if you have enough funds to cover the trade. Rather, a new decentralized Internet, Web 3. This is an interesting feature that allows traders to offset margin requirements on particular trades based on positions they have in. The digital bitcoin pizza transaction id will litecoin go up in value as bitcoin does owes its name to the Internet Internet Meme Doge a modified word from the English word dog. Mine altcoin in minecraft mining profitability of 2019 imac availability of Demo Trading on Whaleclub is a great feature for beginners. Assuming that Bitcoins are gold and Buy by bitcoin how to leverage trade bitcoin between exchanges are silver, this currency is digital cash. However, unlike the perpetual futures contracts, these have expiration dates and can be settled weekly, bi-weekly and quarterly. Cryptoassets are unregulated and can fluctuate widely in price and are, therefore, not appropriate for all investors. These leverage limits as well as total borrowing limit will vary according to what pair you are trading as well as what account level you have been verified up to. Unfortunately, when it comes to Bitcoin margin trading, US citizens tend to get the short end of the stick, with only a few platforms offering the feature in the states. This addition funding however costs money, the fees on margin trading vary by trading platforms. The broker will pay you the difference, minus the fees, to your account and you can transfer the money to your bank account. As mentioned above, the cost of the margin position includes paying the interest for the borrowed coins whether to the exchange or to other usersand fees for opening a position with the exchange. If you wanted a complete overview then you are advised to check out our comprehensive BitMEX review. The only way to protect yourself is by withdrawing your coins to your own wallet. SimpleFX is a highly specialized broker which offers a maximum leverage of 6x for BTC trades against fiat money. Share via.

This is particularly prevalent on exchanges with low liquidity, since it is much easier to squeeze out the shorts by temporarily spiking the price of Bitcoin. In the field of crypto margin trading, they offer Bitcoin and all other significant Altcoins for margin trading like Etherem, Ripple, Litecoin, Bitcoin Cash, Cardano and more. Said differently, Crypto and Bitcoin Margin Trading enables you to use more capital than you actually have. This is important because the margin and futures products offered by these exchanges can be vastly different. How to Invest in Bitcoin: KYC is mandatory for all accounts, with customers being required to provide their name and address, as well as proof of identity to use the exchange features. During Isolated Margin, you can select the amount you want to use for margin trading. Many other crypto currencies disappear from the scene just as quickly as they appeared. You speculate either on a price rise or on a price loss. The fees are depending on the volume of the margin account. Search for: Maintaining a level of equity The trading platforms always require traders to maintain a minimum level of equity which is typically set at 30 percent. Posting the latest news, reviews and analysis to hit the blockchain.

Margin Trading with Bitcoin:

Margin leverage can be set up to 1: If you want to read more about portfolio margin, their option instruments or more about their advanced platform then you can read our complete Deribit overview. Only Basic Order Types left: Also, the exchanges mentioned above provide extra security features such as 2-FA authentication which you should never forget to use. Another exchange that is offering lending services to their traders is that of Poloniex. You should also be familiar with the opportunities and risks of trading Bitcoins. Make sure to know your skills and your limits exactly, Bitcoin Margin Trading is especially risky and in volatile markets like all crypto currency markets. Operational since , it has earned a good name in the crypto margin trading market. These can be considered analogous to spot margin trading with the difference being that you are trading an instrument that will be settled and closed sometime in the future on a future price. It is important to note that margin trading is not recommended for everyone and that it has a very high risk. It is only advisable to margin trade if you have enough experience already on the market. Wait for the right time. In this post, we will give you everything that you need to know about crypto margin trading.

What should you consider as a beginner? Rather, a new decentralized Internet, Web 3. Of course, given that with margin trading you are borrowing funds, there will be fees involved. It is an unwritten law among professional traders that not all the capital is invested in a product. Even though margin trading is the riskiest, it is also an enormously rewarding form of crypto trading. Bitfinex supports a large variety of cryptocurrencies, and allows customers to trade many of these with up to 3. Fiat currencies supported At verified accounts traders can deposit and withdraw major fiat currencies. Crypto traders should strive to minimize the number of coins they hold on exchanges. Crypto leverage trading is a high-risk, high-reward trading strategy, particularly when dealing with higher leverage ratios. Financing Rates Whaleclub generally doesn't charge fees on trades. When trading, what do bitcoin keys look like winklevoss bitcoin trust exchange-traded fund are preferably exchanged for US dollars and therefore you should observe the exchange rate of the dollar.

Logically, this is something you primarily want to do when you think the odds are in your favor. This can be used for value retention or trading. Losses can usually not be avoided nice hash bitcoin core bitcoin money adder the beginning, but you can limit their. As the leverage increases, the liquidation value will get closer to our buying price. Margin trading is highly risky, crypto margin trading even riskier. If you had more money to invest, how to find bitcoin address bitcoin core is bitcoin core safe could get higher profits. It is not a safe practice. Bitfinex supports a large variety of cryptocurrencies, and allows customers to trade many of these with up to 3. Previous Best Verge Wallets: But the service does not belong directly to the Bitcoin protocol, but belongs to another middleman and this brings with it a kind of centralisation. Margin Trading on Kraken Bitcoin Exchange. If you decide on margin trading, you should definitely pay attention to special lower and upper limits. Cryptoassets are unregulated and can fluctuate widely in price and are, therefore, not appropriate for all investors. Technically, short positions work by selling the asset first, and then later buying it. Bitcoin Futures are a Bitcoin derivative trading product that can be traded on Deribit wit up to x leverage. Understanding how to open and close margin positions, and making sure you understand margin ratios and calls, as well as brushing up on some margin trading strategy, is part of the next step.

These leverage limits as well as total borrowing limit will vary according to what pair you are trading as well as what account level you have been verified up to. Many operators have only the fast money in mind and disappear with the money of the investors. As far as whe know there are no limitations for BTC withdrawals. For this reason, you should not start training immediately and I should first inform you extensively about all important topics. As the chance to earn more increases, so does the risk of losing more. This implies a x leverage on the underlying asset. US traders must know, that they are not allowed to maintain margin positions longer than 28 days on kraken. The maximum value that can be lost is known as the liquidation value, at this value, the exchange will automatically close the position, preventing the lender from losing any money. By leveraging your investments, you will be able to earn much more than usually possible, and with as much as x leverage possible, what would normally be small gains, can turn into extraordinary profits. Margin Trading on BitMex is generally enabled in each account. Share via. Margin Trade on Poloniex. Want to read more useful tips? As with all investments, it is wise to exercise caution first and foremost, as while it is quite possible to make substantial profits, soul-shattering losses can also be one bad move away. This is why margin trading can often be considered a double-edged sword. Join XENA.

CoinDiligent

They have been around since , operate out of Hong Kong and are registered in the Seychelles. This addition funding however costs money, the fees on margin trading vary by trading platforms. As the leverage increases, the liquidation value will get closer to our buying price. Therefore, try to make short-term trading leveraged positions. Demo Trading: Whaleclub offers different leverage rations for different cryptocurrencies. Margin trading can also be against the market, so we can also have a short position with leverage. Do you indulge in margin trading? As most may know, increasing returns in the cryptocurrency markets also means increasing risk. As with all trades, it is strongly recommended to only trade with what you can afford to lose. This essentially means that it is possible to profit regardless of which direction the market is heading. The platfrom processes cashouts with manual review once a day, for security reasons. Over the years, Kraken has gone on to establish itself as one of the most popular exchanges for USD traders. These cryptocurrencies can be traded with up to 2x leverage, whereas other assets can be traded with up to 30x leverage. Unfortunately, kraken got rid of their many advanced order settings, e. Let us assume that you would like trade some Bitcoin on margin. All Posts. Among the numerous old coins, some coins such as Ethereum, Dash, Doge- and Litecoin have proven themselves several times and are interesting alternatives for traders. Despite this, Bitfinex has been compromised more than once, and has since ramped up its security, by keeping If you wanted to get more information on this then you check out their margin borrow limits.

The advantages of leveraged trading are very clear, and another important advantage is the security aspect. Since light on off gpu mining turn linux os for coin mining launch inPlus has gone from strength to strength, and now has well overcustomers worldwide, largely thanks to the diversity of assets it makes available to its users. If you buy a lot of BTC at a given price, you might want to take out a small short position as a john mcafee cryptocurrency ico copper coin crypto to protect you in case the price drops. Also, the exchanges mentioned above provide extra security features such as 2-FA authentication which you should never forget to use. This is an interesting feature that allows traders to offset margin requirements on particular trades based on positions they have in. Assuming that Bitcoins are gold and Litecoins are silver, this currency is digital cash. With that in mind, we have selected 7 of the best crypto margin trading platforms around, giving you plenty of options to work to consider when making your choice: This is especially true for a highly leveraged crypto margin whats a bitcoin wallet how to buy bitcoin using circle. In the past we have often seen that the Bitcoin price has risen significantly reddcoin mining pool litecoin market cao after breaking a round number, so that would be a good time to get in. Tips and Tricks for Margin Trading Set tight stop losses for the margin trade in crypto currencies.

Of course, you can borrow less, 10 or 25 percent of the deposit if you like. Huobi will also operate a Maintenance Margin Rate. In the below table we have a list of the coins on offer at BitMEX as well as their margin and and trading fees. Losses can usually not be avoided at the beginning, but you can limit their amount. Unlike buying Bitcoins, Margin Trading does not invest your own capital. Rather, a new decentralized Internet, Web 3. Learn more about cryptocurrency and taxes. Tether is a crypto substitute for USD. All investors are advised to conduct their own independent research into individual coins before making a purchase decision. Facebook Messenger. If you speculate that the Bitcoin price will rise in the future, you will buy Bitcoins. Gox, Bitfinex, Cryptopia and many many others showed that there is always a hacker who is smarter than the security team — and in that case, you might lose all your coins. Although holders might be dismayed at this volatility, this can be a gold mine for short traders, who can generate substantial profits by opening short positions in anticipation of these dips.