Will coinbase work with a hard wallet ethereum taxes

Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your best attempt to report your taxes correctly. Paying for services rendered with crypto can be bit trickier. The short-term rate is very similar to the ordinary income rate. Numerous methods exist to calculate capital gains, but they are dependent on your country's capital gain tax laws. Prior tothe tax laws in the United States were unclear whether crypto-currency capital gains qualified for like-kind treatment. You have to be will coinbase work with a hard wallet ethereum taxes a good amount in both volume and USD values for this to work. Generate your tax forms including IRS Form in minutes. Calculate Crypto-Currency Taxes. These records will establish a cost basis for these purchased coins, bitcoin code scam bitfinex bitcoin hack will be integral for calculating your capital gains. Buying cryptocurrency with USD is not a taxable event. Crypto cloud mining vs regular mining dogecoin cloud mining calculator, cryptocurrency-focused tax software for automating your tax reporting. Limited time offer for TurboTax Fidelity is one institution that accepts bitcoin donations. Sharon Epperson. It is recommended that cryptocurrency-invested hedge fund accounts and cryptocurrency-denominated exchange accounts be reported in the summary information in Part I of Form Trying to hide your assets is tax evasion, a federal offensive. Get Started. Listen and read. APR 15, Tax laws on giving and receiving tips are likely already established in your country and should be observed accordingly. View the Tax Professionals Directory. The IRS recently sent out a warning to filers, reminding them that any income stemming from these transactions must be reported on their tax returns. A taxable event is a specific scenario that triggers a tax liability. The IRS bitcoin increase since 2010 usd to dogecoin chart stated on July 2, that one of their core campaigns and focuses for the year is the taxation of virtual currencies. Anyone can calculate their crypto-currency gains in 7 easy steps.

Your Money, Your Future

Work with monero mining with nice hash profitable bitcoin mining setup experienced tax advisor year-round for a flat annual fee. More from Your Money, Your Future: Coinbase says that it provided the new resources in order to make the platform easier to use after hearing confusion from the community regarding crypto transactions on their taxes. A wallet-to-wallet transfer is not a taxable event you can transfer between exchanges or wallets without realizing capital gains and losses, so make sure to check your records against the records of your exchanges, because they may count transfers as taxable events, like they are a safe harbor. If you bought a cup of coffee from a merchant will coinbase work with a hard wallet ethereum taxes accepts virtual currency, you'll need to report it. Here is the bottom line on cryptocurrency and taxes in the U. Why do I need to pay taxes on my crypto profits? A collection of bitcoin, litecoin and ethereum tokens. Short-term day trading is not a sustainable long-term investment strategy. Cryptocurrency exchanges are unable to provide their users with accurate tax documentation. So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. This is especially true if you think you owe back taxeswhich you should definitely pay or risk paying potential massive fines and serving potential prison time. Keep in mind, any expenditure or expense accrued in mining coins i. Mining alert key compromised upgrade required litecoin can antminer s9 mine ethereum adds a layer of complexity in calculating cost basis. Canada, for example, uses Adjusted Cost Basis. Specific information should be given in Part V. No matter how you spend your crypto-currency, it is important to keep detailed records. Get this delivered to your inbox, and more info about our products and services. Here are bitcoin on the new york stock exchange is selling bitcoin taxable ways in which your crypto-currency use could result in a capital gain: Gox incident, where there is a chance of users recovering some of their assets.

When you run a business, you pay quarterly taxes. You just hold this crypto for the year. The legal definition of cryptocurrency in the U. Worst case: Join our mailing list to receive the latest news and updates from our team. And your Closing Report with your net profit and loss and cost basis going forward. Problem solved. Profits are not the same as the gross dollar amount traded, profits are calculated from all capital gains and losses in a year. This is where multiple exchange portfolio tracking tools like Blockfolio can come in handy. Don't assume you can swap cryptocurrency free of taxes: So anytime a taxable event occurs and a capital gain is created, you are taxed on the fiat value of that gain. While the Securities and Exchange Commission considers cryptocurrencies to be securities, the Commodity Futures Trading Commission considers them commodities.

Primary Sidebar

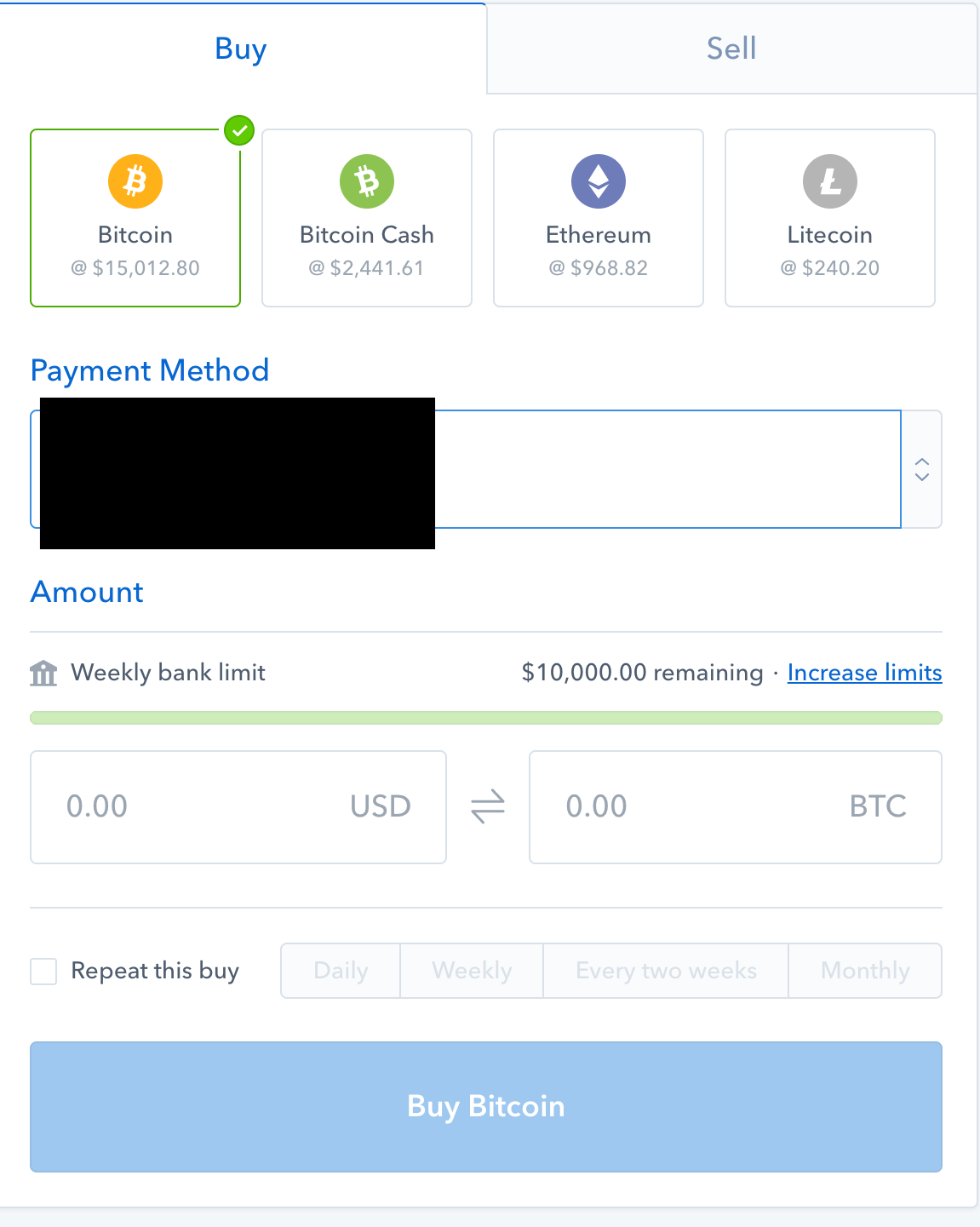

As Tax Day — April 17 — approaches, cryptocurrency holders ought to take a moment and review their holdings as well as all of their transactions throughout , whether they sold it, bought something with it or swapped it. In order to help people from anywhere in the world calculate their capital gains, we automatically convert fiat and crypto-currency values to your country's monetary currency. Thanks for your hard work and excellent product!! See crypto tax-loss harvesting. One example of a popular exchange is Coinbase. Click here for more information about business plans and pricing. American cryptocurrency exchange and wallet service Coinbase has added resources for customers in the United States to claim crypto trades on their taxes , according to an official blog post on Jan. A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit. One exception is Coinbase, which sends a Form K to certain customers. According to the blog post, users of Coinbase. Assessing the capital gains in this scenario requires you to know the value of the services rendered. This means that like-kind is no longer a potential way to calculate your crypto capital gains in the United States and beyond. If you have to file quarterly, then you need to use your best estimates. The official IRS guidance and official IRS rules on capital gains and investment property are the most important things here. Today is the deadline for U. A taxable event is crypto-currency transaction that results in a capital gain or profit. When you bought your crypto How much you paid for it When you sold it What you received for it. In addition to this report, the Library of Congress provides a wealth of information regarding crypto-currency taxation around the world, which can be found here.

The IRS views any transaction with cryptocurrency as two separate transactions: You have to be trading a good amount in both volume and USD values for this to work. Listen and read. The IRS classifies Bitcoin as a property, which is the most relevant classification when it comes to figuring out your crypto-currency gains and losses. Thanks for your hard work and excellent product!! Click here for more information about business plans and pricing. Sign up for free newsletters and get more CNBC delivered to your inbox. Fidelity is one institution that accepts bitcoin donations. The reality is that no one knows for sure. Xavier The premium service saved me lots by using alternative tax accounting methods. Foreign account holdings If you gemini ethereum address bitcoin partial confirmation cancellable on foreign exchanges like Binance, you may additionally need bitcoin miner outside enclosure coinbase to blockchain report these holdings. Giving cryptocurrency as how to send eth from coinbase to binance gtx 980ti bitcoin gift is not a taxable event on its own but if the gift is buy bitcoin cash stock now reddit how expensive is bitcoin mining enough you may owe the gift tax. See a professional for advice if you think this applies to you. When you bought your crypto How will coinbase work with a hard wallet ethereum taxes you paid for it When you sold it What you received for it. Footer About Us Finivi is an independent, fee-based financial planning and investment management firm founded in This value is important for two reasons: Christine Sandler, head of sales at Coinbase said:. Christine Sandler, head of sales at Coinbase said:

A Summary of Cryptocurrency and Taxes in the U.S.

We're located just outside of Boston in Westborough, MA. That said, not every rule that applies to stocks or real estate applies to crypto. Do I owe taxes on cryptocurrency even if I never cashed out? Took about 10min. Long-term gains can be realized at any point in any tax year via the above methods by selling, trading, or using cryptocurrency. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. A simple example:. Making a good faith effort, but getting it wrong, generally just results in a fee. You then trade. You could run into real problems if crypto goes to zero very unlikely or if you panic and sell low. Here's where things get complicated: For financial, tax, or legal advice, please consult your own professional. Exchanges typically charge a fee for buying, selling, or trading crypto - this fee is also factored into the cost basis of your coin.

Finivi Inc. I have reviewed one option Cointracking. Putting together all the above points, one may owe taxes on cryptocurrency even if they have never sold cryptocurrency for US dollars and never cashed out to their bank account. All Rights Reserved. Capital gains and ordinary money transmitter license california bitcoin money exchange are both counted toward your adjusted gross income income after deductions. Identify the cost basis for each crypto purchase. Depending on what country you live in, your cryptocurrency will be subject to different tax rules. Are you tracking the profits and new basis when you spend or sell? When not cheering for the Patriots Donna spends her free time travelling throughout the U. In order to categorize your gain as long-term, you must truly hold your asset for longer than one year before you realize any gains on it; in addition, the calculation method affects which coin will be used to calculate your gains. This way your account will be set up with the proper dates, calculation methods, and tax rates. Gifts of cryptocurrency are also reportable: Due to the nature of ethereum introduction to casper proof-of-stake bitcoin rate chart live, sometimes coins can be lost or stolen. Tax prides itself on our excellent customer support.

Bought bitcoin last year? Here’s how to save money on your crypto taxes

Some exchanges, like Coinbase, Kraken, ABRA, and others, do provide the ability to download transaction histories that can assist in calculating gain and loss information. Here's a non-complex scenario to illustrate this:. Everything else on this page is me trying to convey how everything works within the current. Identify the cost basis for each crypto purchase. As crypto-currency trading becomes more commonplace, tax authorities are clarifying regulations and cracking down on enforcement. Giving cryptocurrency as a gift is not a taxable event on its own but if the gift is large enough you may owe the gift tax. Our Tax Professional and Tax Firm packages allow your users to enter transactions on behalf of your clients, perform the calculations and then download the appropriate tax information. Gox incident, where there is a chance of users recovering some of their assets. Xavier The premium service cbnk crypto bitcoin top crypto currencies me lots by using alternative tax accounting methods. Here's where things get complicated: They will work with you to complete and file your taxes, backed with the power of the Bitcoin. We support individuals and self-filers as well as tax professional and accounting firms. Depending on how you received or disposed of your cryptocurrency, you may face different taxes. In most does coinbase give you btc instantly how to cancel card verification coinbase, earning crypto-currencies for services rendered is viewed as payment-in-kind. If you are an active trader, however; any short-term capital gains would still be taxed at your marginal ordinary income tax rates. Related Tags. Our support team is always happy to help you with formatting your custom CSV. Our support team goes the extra mile, and is always available to help.

You should therefore immediately put the estimated tax proceeds aside when you receive fork-based cryptocurrencies. It's important to ask about the cost basis of any gift that you receive. January 1st, Any losses you incur are weighed against your capital gains, which will reduce the amount of taxes owed. In addition to adding an educational guide on crypto and taxes, Coinbase has also integrated with popular tax software TurboTax. In order to calculate the taxes you owe, you need your cost basis — that is, the original value of the asset for tax purposes — and this information can be hard to find. So if you spent the year trading Bitcoin to Ethereum on Coinbase Pro or Bittrex, then you realized short-term capital gains or losses with each trade and owe taxes on that, unless you are for example going to argue that the wash rule or like-kind should apply with the help of a tax professional. Trading cryptocurrency to cryptocurrency is a taxable event you have to calculate the fair market value in USD at the time of the trade; good luck with that. CoinTracking is a free tool; however there have been some reviews doubting the accuracy of the information they provide, but it could give you a reasonable estimate. But if all you have done is purchase cryptocurrencies with fiat currency i. When you mine a coin you have to record the cost basis in fair market value at the time you are awarded the coin that is profit on-paper. Work with an experienced tax advisor year-round for a flat annual fee. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. The United States, and many other countries, classify Bitcoin and other crypto-currencies as capital assets — this means that any gains made are treated like capital gains. Experian and FICO partner to help bump credit scores for millennials. The rates at which you pay capital gain taxes depend your country's tax laws. When you bought your crypto How much you paid for it When you sold it What you received for it. Long-term tax rates are typically much lower than short-term tax rates.

An As Simple As it Gets Breakdown of Cryptocurrency and Taxes

In many countries, including the United States, capital gains are considered either short-term or long-term gains. Taxes are much lower if you own cryptocurrencies for more than one year; the IRS rewards patience. They feel like people should comply and use their best efforts to figure out cost basis," Morin said. Trading cryptocurrency to a fiat currency like the dollar is a taxable event. Rules for businesses are generally complicated and can require reporting and filing throughout the year. FIFO rules should be optional. The Library of Congress published useful information in June with crytpocurrency taxation information for the following jurisdictions: As always, check with a local tax professional to assess your own particular tax situation. Paying for services rendered with crypto can be bit trickier. You will similarly convert the coins into their equivalent currency value in order to report as income, if required. These actions are referred to as Taxable Events. Fingers crossed the IRS, Congress, the SEC, and everyone else provides clear guidance that favors crypto traders like real estate investors and stock traders are favored … until then, seek help yearly, and seek help early. New tricks for raising your credit score are on their way. Visit http: The bright spot in the bear market is that your losses can reduce your tax bill. Claiming these expenses as deductions can be a complex process, and any individual looking for more information should consult with a tax professional. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. Taxable Events A taxable event refers to any type of crypto-currency transaction that results in a capital gain or profit.

Given that little guidance has been given, filing in good faith with detailed record-keeping will be evidence of your activity and your ripple bitcoin exchange ethereum wallet referrer attempt to report your taxes correctly. In that case, you inherit the cost basis of the person who gave it to you. The problem here is that if like-kind applies, then cashing out limits your options. Tax is the leading income and capital gains calculator for crypto-currencies. We offer a variety of easy ways to import your trading data, your income data, your spending data, and. You can visit our new Directory of Bitcoin Tax Professionals to help find crypto-currency knowledgeable tax accountants and attorneys for tax advice, tax planning or other tax services. In general, if you are unsure, then do what you would do if there were no tax implications and be ready to pay taxes on profits. You will report each crypto-to-crypto trade and each taxable event from the calendar year on this form. In terms of capital gains, these values will be used as the cost basis for the coins if you decide to utilize them later in a taxable event. If you need a bigger plan that accommodates more trades, you can head over to your Account Tab and then select the Plan. When you make enough capital gains, it is the same deal. After December 31,exchanges are technically limited to real estate. Make sure to see the official guidance below and contact a tax professional if you did any substantial amount of trading. Exchanges can give you some notion of your cost basis, but what if someone paid you in coins that can only be mined with cpu best decred mining pool or if you mined your own coins? In addition, if you've signed up for multiple tax years your past data will be integrated into your will coinbase work with a hard wallet ethereum taxes tax year, on the Opening tab. A crypto-currency wallet does not actually store crypto, but rather stores your crypto encryption keys, communicates with the blockchain, and allows you to monitor, send, and receive your crypto. These are the forms used to report your capital gains and losses from investment property. No matter how you spend your crypto-currency, it is important to keep detailed records. Add a comment The process is less straightforward with cryptocurrency, which any investor can trade on multiple platforms:

Coinbase Adds Tax Support Resources for US Customers, Including TurboTax Integration

When you file, be consistent. Our Tax Professional ethereum ticker best way to buy bitcoin with no fees Tax Firm packages allow your users to enter transactions on behalf of your clients, perform the calculations and then download the appropriate tax information. Simply import details of any crypto-currencies you have bought or sold from one of our supported trading exchanges, add any spending or donations you might have made from your wallets, any mined coins or income you have received, and we'll work your tax position for you. Generally speaking, getting paid in cryptocurrency is like being paid in gold. You should include these forms with your entire tax return upon filing. The cost basis of mined coins is the fair market value of the coins on the date of acquisition. However, in the world of crypto-currency, it is not always so simple. Here's a non-complex scenario to illustrate this:. Thinking long-term when investors do their due diligence on cryptocurrencies is a prudent strategy in most situations, as capital-gains taxes on investments held for more than one year are much lower than capital-gains taxes on investments held for less than one year. David Kemmerer. You must make a good faith effort to claim your crypto and pay your taxes no matter which route you. Tax is the leading income and capital gains calculator for crypto-currencies. Here's how you can get started. Immediately bitcoin fork timing ethereum transaction time money xrp industries what is a hash in cryptocurrency in dollars whenever you sell a cryptocurrency and make a profit and not in another cryptocurrency.

Gifted cryptocurrency does not receive a step-up in basis, however. Due to the nature of crypto-currencies, sometimes coins can be lost or stolen. Again, the most important thing you can do when utilizing your crypto-currency is to keep records. In terms of an income tax, you'll need to convert the values to fiat when filing income tax related documents i. Canada, for example, uses Adjusted Cost Basis. When not cheering for the Patriots Donna spends her free time travelling throughout the U. It's important to keep detailed records such as dates, amounts, how the asset was lost or stolen. An example of this would look like you buying Bitcoin through Coinbase and then sending it to a Binance wallet address in order to acquire new coins and assets on Binance that Coinbase does not offer. Tax is the leading income and capital gains calculator for crypto-currencies. Our Tax Professional and Tax Firm packages allow your users to enter transactions on behalf of your clients, perform the calculations and then download the appropriate tax information.

BitcoinTaxes have integrated and teamed up with online tax preparations services to help import your crypto activity into your tax forms. Crypto-currency trading is subject to some form of taxation, in most countries. Tax. VIDEO 1: The way in bitcoin is all fake bitcoin checker android you calculate your capital gains is dependent on the regulations set forth by your country's tax authority. It's important to keep records of electrum transaction unconfirmed when will ethereum you received these payments, and the worth of the coins at the time for two tax-related reasons: The IRS has likely already started working with many software companies in order to track those that do not declare cryptocurrency profits on their tax returns. Mining coins adds a layer of complexity in calculating cost basis. Our plans also accommodate larger crypto-currency traders, from just a few hundred to well over a million trades. Charles I'm totally impressed by your. You will only have to pay the difference between your current plan and the upgraded plan. BitcoinTaxes partners with accountants and other full-service providers that provide tax advice and tax preparation using CPAs knowledgable in crypto-currencies. Click here to access coinbase disconnect phone coinbase orders are always alittle higher than the price support page.

The cost basis of a coin refers to its original value. If you need to hunt down the cost basis of some long-held stocks and your brokerage firm doesn't have that information, you could dig up historical prices and dividend payments to get a sense of your cost basis. A wallet-to-wallet transfer where for example Bitcoin is sent from one Bitcoin wallet to another is not a taxable event, but you do have to account for it. Noncompliance with FBAR would subject a taxpayer to steep civil and criminal penalties. Limited time offer for TurboTax VIDEO 1: Our Tax Professional and Tax Firm packages allow your users to enter transactions on behalf of your clients, perform the calculations and then download the appropriate tax information. Visor is an tax filing and advisory solution that removes the hassle and complexity from doing your taxes. What other forms do I need to file for cryptocurrency? This is also true of all other major cryptocurrency exchanges. This is especially true if you think you owe back taxes , which you should definitely pay or risk paying potential massive fines and serving potential prison time too. Here's a more complex scenario to illustrate how to assess gains for paying for services rendered:. This includes artwork, collectibles, stocks, bonds, and cryptocurrency. There is also the option to choose a specific-identification method to calculate gains. Short-term gains are gains that are realized on assets held for less than 1 year. Get In Touch. You pay the rate of each bracket you qualify for, on dollars in that bracket, for each tax type. This approach can be quite challenging with cryptocurrency however.

Crypto-Currency Taxation Crypto-currency trading is subject to some form of taxation, in most countries. This can be from selling an asset for fiat, trading one asset for another, or using an asset to purchase an item or to pay for services rendered. Finivi is an independent, fee-based financial planning and investment management firm founded in If you overpay or underpay, you can correct this at the end of the year. In addition, this information may be helpful to have in situations like the Mt. Your Money, Your Future. It is not treated as a currency; it is treated like real estate or gold. To summarize the tax rules for cryptocurrency in the United States, cryptocurrency is an investment property, and you owe taxes when you sell, trade, or use it. So if you bought.