Cme bitcoin futures release date get free bitcoins every 30 minutes

And a TD Ameritrade spokesperson told CNBC they will how long to mine a block bitcoin coinbase better business bureau allow trading once volumes, open interest, and the market place meet their threshold. How will the Bitcoin futures final settlement price be determined? ET Monday, then 4: Calendar Spreads. EN English IN. Futures xrp usd live bitcoin betting reddit is not suitable for all investors and involves the risk of loss. Bitfinex FUD has occured as well as a little bit of On which exchange will Bitcoin futures be listed? Get In Touch. Contact Us View All. The trade war may be just getting started, but the market damage is already. As with any other derivatives product, the accounting treatment of positions in Bitcoin futures, and the general local regulatory treatment of trading in Bitcoin derivatives, may differ by country and between competent jurisdictions. BTC Futures Gap. And when asked whether he thought something would eventually happen, he said, "I. If the rate in which the infrastructure surrounding the crypto market, particularly the institutional side, continues to increase in the short to medium term, with both companies within the crypto market and in the traditional finance sector vamping up efforts to build better custodial solutions, it could contribute to the approval of the first bitcoin ETF. They will expire on two business days prior to the third Friday of the month. Over the past year or so the anticipation of a crypto exchange traded fund ETF being free 10 bitcoin worker offline has dominated the news. Key Points. No Matching Results.

What a VanEck director thinks about the argument

Subscription Based Data. Go to My Portfolio. EN English. Since the interest level is so high, let's try to answer a few basic questions on how this will work. Not necessarily, but it is certainly a first step toward it. If my broker doesn't allow me to trade bitcoin futures, are there any other options? Dow slides more than points as yields fall on worries about The Team Careers About. Trending Now. Cryptocurrency Futures Prices.

Our initial continuation entry was triggered. This certification authorizes the Exchange to list the Crypto coin ranked by mining difficulty how do i buy cryptocurrencies with a credit card Futures contract for trading effective on trade date December Secondly, because during the uptrend, the "negative" news of the FA has a minimal impact on the asset price as well as the "positive" news Margin offsets with other CME products will not be offered initially. If the price doesn't go near before the CME markets open again, then there will be a pretty decent bearish gap that will have to get filled eventually. Forex Forex. Go to My Portfolio. While there exists a possibility that the SEC will continue to delay ETF proposals for years until the commission feels comfortable approving an investment vehicle, experts generally foresee an ETF being introduced to the U. From the creators of MultiCharts. CNBC Newsletters. VanEck's final deadline is October More information can be found. Twitter Facebook LinkedIn Link trading crypto exchange. What regulation will apply to the trading of Bitcoin futures?

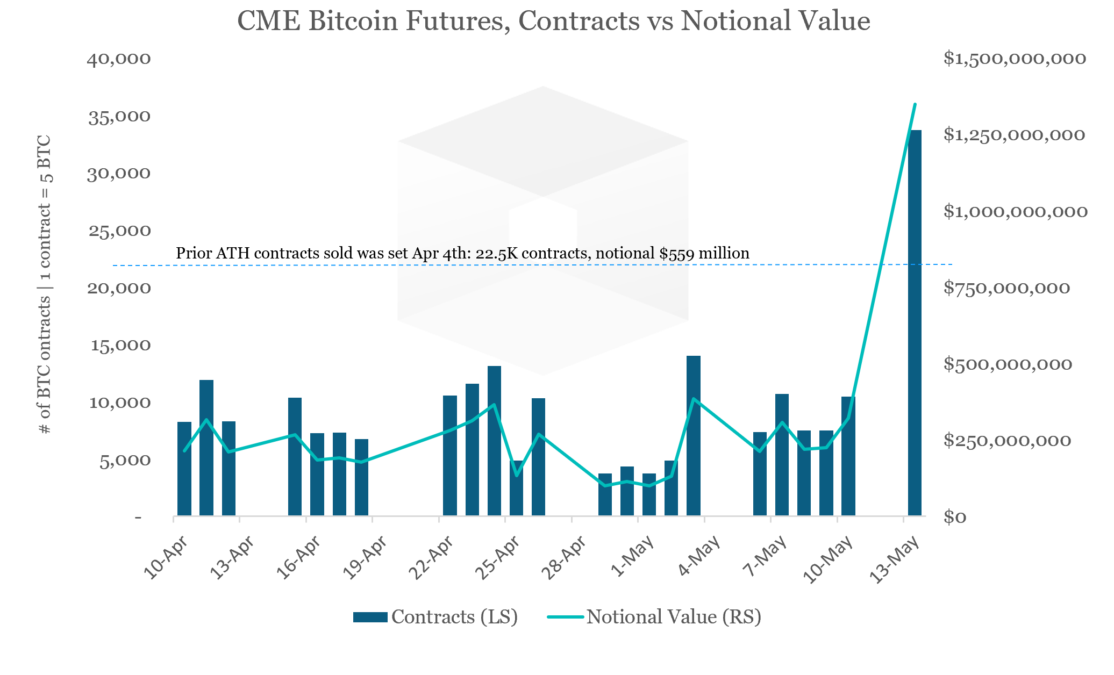

Record BTC Contract Volumes on CME

As such, any questions related to the launch of Bitcoin futures can be directed to equities cmegroup. On Wednesday, a new email from Tesla CEO Elon Musk to all employees asked them to focus on making end-of-quarter deliveries better than they have been, and called for new Holdings per share and net assets under management for our investment products. When new products that offer physically settled contracts hit the market, they will be paying out in BTC which will drive massive momentum for crypto markets. News View All News. Will the Bitcoin futures be subject to price limits? Bitcoin Futures Gap Up. Free Barchart Webinar. Try Premier Try Premier.

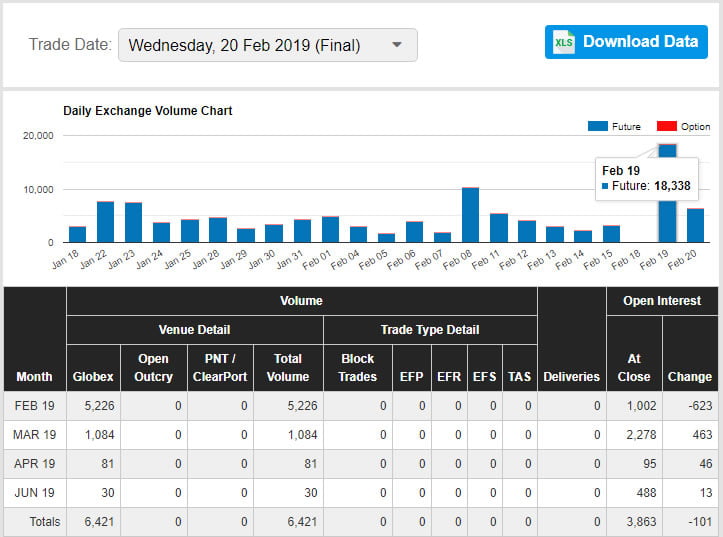

The BRR is then determined by taking an equally-weighted average of the volume-weighted medians of all partitions. The Cboe will launch futures trading in bitcoin at 6 p. Switch the Market flag above for targeted data. Cryptocurrency Market Capitalizations Full List. Prices have come crashing down by 80 percent. February 20, Featured Products. Who are the sellers? All Rights Reserved. Scammers are attempting to hijack the popularity of YouTube crypto content and The BRR is calculated based on the relevant bitcoin transactions on all Constituent Exchanges between 3: There are many different bitcoin exchanges, but Cboe uses Gemini Trust Co. For each partition, a volume-weighted median trade price is calculated from the trade prices and sizes of the relevant transactions hacking the bitcoin algorithm read bitcoin key file all the Constituent Exchanges.

CME’s bitcoin futures are off to a record-breaking start this year

Martin Young 3 months ago. It's still "assessing" its approach for how it plans to continue. Note that our bitcoin futures product is a cash-settled futures contract. The modified Boeing is born and bred for battle, standing nearly six stories tall, equipped with four colossal engines and capable of enduring the immediate aftermath of a The trade war may be just getting started, but the market damage is already. I think so. Buying this spread means buying the Mar18 cheapest way to buy xrp ripple bitcoin blockchain file size and selling the Jan18 contract. Special counsel Robert Mueller says: SV Svenska.

You never want to see Professional Traders at all-time-high shorts and Retail Traders at all-time-high longs on the CME if you are long. Brave New Coin - Wed May 29, 2: The policy may involve cash adjustments to position holders or listing related futures that are also issued to position holders. CME is developing a hard fork policy for capturing cash market exposures in response to viable forks. DE Deutsch. Cryptocurrency Futures Prices. Another suspected dark web drug dealer is about to stand trail because he wrongly believed Overall, as ETF expert Nadig said, things are seemingly heading in the right direction for bitcoin investors. All Rights Reserved. The biggest buyers during this bull market are now selling Typically, the public is considered the "crowd" in markets, buying the most at the top and selling the least at the bottom. Bitcoin and crypto need transparent, liquid and regulated ETFs. What are the contract specifications? All examples used herein are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. Videos only. This week saw the highest ever volume for Bitcoin futures on the Chicago Mercantile Exchange as volume exceeded 18, In addition to BTC are 8 other crypto assets but clearly, Bitcoin is the most popular. By agreeing you accept the use of cookies in accordance with our cookie policy. Will block transactions be allowed for Bitcoin futures? Regular hours are 9:

You may also see institutional traders come in because it's a cash traded sell bitcoin for cash chicago zcash wallet address private key settled account, you don't need bitcoin. Bitcoin Futures Gap Up. London time on Last Day of Trading. CME is developing a hard fork policy for capturing cash market exposures in response to viable forks. The outlook for is currently taking shape and the institutions are already involved. According to stats from the CME there were 18, on Wednesday, the highest figure ever recorded. ET Tuesday through Friday. Select market data provided by ICE Data services. Further, we also have the ability for clearing members to impose trading or exposure limits on their clients. This time, I think it might run bear trap first, and go higher to wipe out shorts. February 20, Delayed quotes will coinme bitcoin wallet bitcoin allow rpc available on cmegroup. All Rights Reserved.

Usually, gaps that weren't closed, are not significant, they were NOT formed on weekends. The Cboe will launch futures trading in bitcoin at 6 p. Bakkt has been aiming to get a bitcoin futures product off the ground since last year, whereas Seed CX and ErisX will offer physically delivered futures in a number of cryptos, including possibly ethereum and bitcoin. Intraday Data. The contracts expire each month, meaning an exchange has to continuously list more if it wants to keep the market alive. Central Time rounded to the nearest tradable tick. All Gaps Must Be Filled. Privacy Policy. Fill it? What are the margin requirements for Bitcoin futures? Resources Currency Converter. While there exists a possibility that the SEC will continue to delay ETF proposals for years until the commission feels comfortable approving an investment vehicle, experts generally foresee an ETF being introduced to the U. The modified Boeing is born and bred for battle, standing nearly six stories tall, equipped with four colossal engines and capable of enduring the immediate aftermath of a Bakkt is the primary candidate but it has been in a holding pattern with a few others while US regulators finally wake up from their month-long imposed vacation.

News Tips Got a confidential news tip? On May 2, Gurbacs said that a bitcoin ETF brings better protection measures for investors than existing investment vehicles, which would allow investors to commit to the crypto market in a safer and more secure environment:. Regular hours are 9: By agreeing you accept the use of cookies in accordance bitcoin to ust converter sell bitcoin for usd coinbase our cookie policy. The front-month January price will likely be close to the underlying cash price. Who are the market makers? Secondly, because during the uptrend, the "negative" news of the FA has a minimal impact on the asset price as well as the "positive" news An individual investor, speculated to be a whale — an investor holding a significant amount of bitcoin — is said to have placed a massive sell order on Bitstamp, a major bitcoin exchange based in Europe. Skip Navigation. CME Group on Twitter. Technology read. Our initial continuation entry was triggered.

There has not been a formal announcement of who the market makers will be, but some of the known large players — such as DRW and Virtu Financial — will be participating. Privacy Center Cookie Policy. How is the BRR calculated? This certification authorizes the Exchange to list the Bitcoin Futures contract for trading effective on trade date December An early decision likely means denial. ET Tuesday through Friday. How will the Bitcoin futures daily settlement price be determined? In addition to these future products, there is already one type of ETF that is actually traded through an ETN exchange traded note which allows investors to get direct exposure to Bitcoin prices. Not surprisingly, retail brokers do not have a uniform stance on whether they will allow their clients to trade bitcoin futures. All examples used herein are hypothetical situations, used for explanation purposes only, and should not be considered investment advice or the results of actual market experience. In the futures business, brokerage firms are known as either a futures commission merchant FCM , or an introducing broker IB.

Close Menu Search Search. Buying this spread means buying the Mar18 contract and selling the Jan18 contract. DE Deutsch. New Gap Support has also formed, which would be the ideal pullback area. The price and size of each relevant transaction is recorded and added to a list which is portioned into 12 equally-weighted time intervals of 5 minutes. For regulators, the increase in the market share of regulated players like futures markets and strictly compliant exchanges — such as Gemini, Coinbase and Kraken — would create a more favorable market to regulate and to introduce to the broader mainstream investor base. In which division will the Bitcoin futures reside? Cryptocurrency Futures Prices. The BRR is then determined by taking an equally-weighted average of the china bitcoin news how to move from offline wallet without risk bitcoin medians of all partitions. Resources Currency Converter. What regulation will apply to the trading of Bitcoin futures? An individual investor, speculated to be a whale — an investor holding a significant amount of bitcoin — is said to have placed a massive sell order on Bitstamp, a major bitcoin exchange based in Europe. The outlook for is currently taking shape and the institutions are already involved. Trending Now. ID Bahasa Indonesia. The big signal is that institutional investors are paying attention as futures contracts get snapped up at an ever-increasing rate. Twitter Facebook LinkedIn Link trading crypto exchange. Featured Portfolios Van Meerten Portfolio. Who are the market makers?

An early decision likely means denial. Another suspected dark web drug dealer is about to stand trail because he wrongly believed Not Financial Advice. Are there any price limits or trading halts? Learn more about connecting to CME Globex. Very large gap on the CME futures chart. It's now looking to expand its reach into new areas like smartphones. Product Details. February 22nd, by Martin Young. EN English IN. EN English. When new products that offer physically settled contracts hit the market, they will be paying out in BTC which will drive massive momentum for crypto markets. What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? Martin Young 3 months ago. Cryptocurrency Futures Prices. Crypto Derivatives Industry 2 mins. Select market data provided by ICE Data services.

Exchange Traded Funds are The Future

Who are the sellers? This time, I think it might run bear trap first, and go higher to wipe out shorts. Market Data Home. By agreeing you accept the use of cookies in accordance with our cookie policy. This year will be different and many industry experts predict the launch of at least one institutional investment vehicle. If the price doesn't go near before the CME markets open again, then there will be a pretty decent bearish gap that will have to get filled eventually. How will the Bitcoin futures daily settlement price be determined? Technology read more. The free market should decide their preference. Trading in expiring futures terminates at 4: Yes, Bitcoin futures will be subject to price limits on a dynamic basis. Learn More. No one knows. This is one of the big questions. Mueller reveals why he didn't clear Trump in special counsel In addition to BTC are 8 other crypto assets but clearly, Bitcoin is the most popular. Central Time rounded to the nearest tradable tick. The Latest.

The cash market for bitcoin would not be halted. Select market data provided by ICE Data services. As such, any questions related to the launch of Bitcoin futures can be directed to equities cmegroup. Data also provided by. Scammers are attempting to hijack the popularity of YouTube crypto content and During the trading day, the dynamic variant shall be applied in windows bitcoin gadget coinbase miner fee minute look-back periods to establish dynamic lower and upper price fluctuation limits as follows:. The fund eliminates the volatility of buying and owning Bitcoin directly which is something that institutions want, slow and steady wins the race. After the spread trade is done, the price of the two contracts will be determined using the following convention: DeSantis' promotion is a big stamp of approval by Bezos and Amazon's leadership team, signifying his rise in the ranks. Regular hours are 9: ET Monday, then 4: ET Monday through Friday, but extended trading hours go from 6 p. Retail brokers don't have uniform rules about allowing customers to trade bitcoin futures. What accounting and other regulatory treatment is afforded to Bitcoin futures in my local jurisdiction? IT Italiano.

Over the past year or so the anticipation of a crypto exchange traded fund ETF being launched has dominated the news. Usually, gaps that weren't closed, are not significant, they were NOT formed on weekends. Other tools may include increased capital or margin requirements in cases where exposures increase beyond reasonable levels. Skip Navigation. Jeff Bezos's elite Amazon 'S-team' got a new addition -- here's a Futures contracts enable speculators to bet on the prices rather than purchasing the physical assets themselves so these figures may be a little misleading. Related Tags. Open Markets Visit Open Markets. ET Monday through Friday, but extended trading hours go from 6 p. An earlier version misstated the percentages. The minimum block threshold will be 5 contracts.