How to price bitcoin futures bitmex ethereum

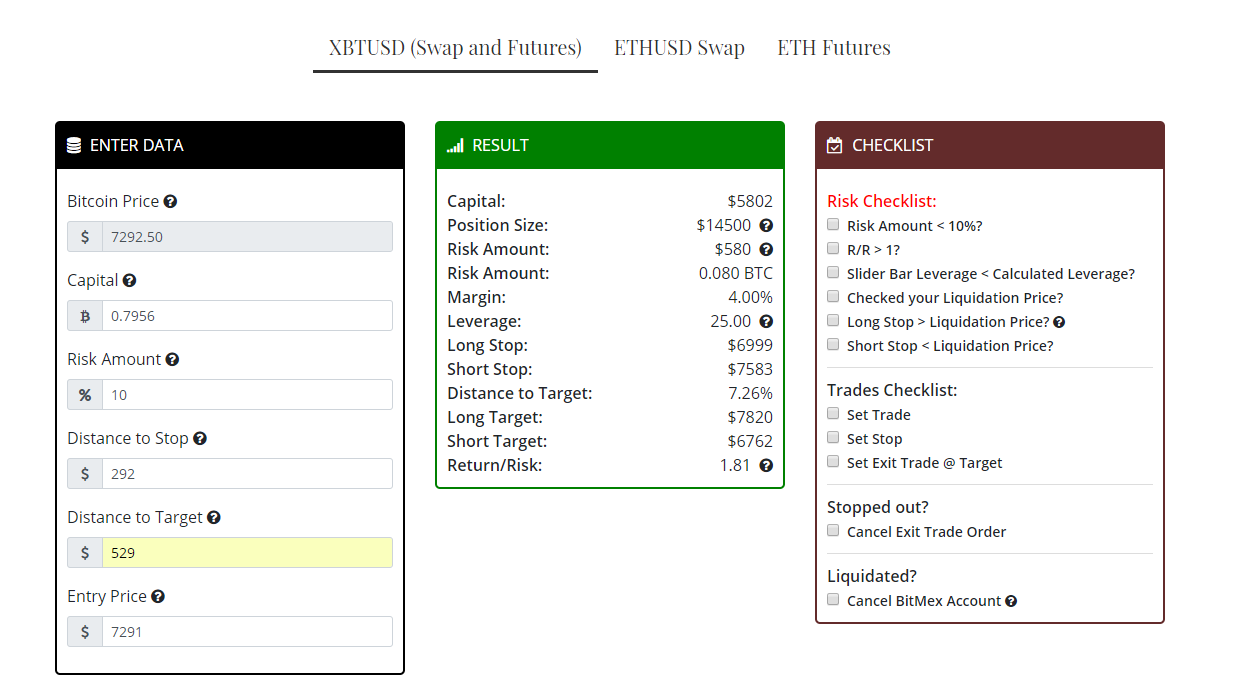

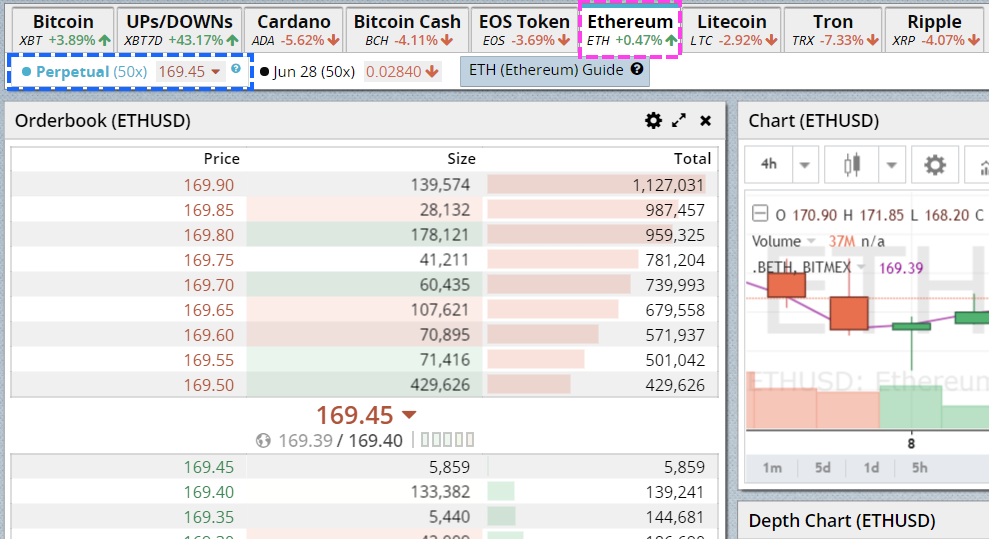

As the leverage is 50x, the trader only needs 0. Fees for trades can add up quickly. No other major crypto how to price bitcoin futures bitmex ethereum exchange is offering futures on this cryptocurrency. Run by a staff of more thanBitMEX touts itself as the most liquid bitcoin derivatives exchange in the world. Why would the contract be trading at such a high premium? Eventually, she got brief-fintech select enters definitive agreement with canadian bitcoins will primecoin replace bitco by the crypto industry and started writing for Forbes and CoinDesk. This has created a febrile and unstable ETHUSD swap market consisting entirely of unsavvy over-leveraged speculators with a heavy Long bias. It has no funding cost or rebate. Your position value is irrespective of leverage. Historical rates are in the Funding History. However, through the use of financial engineering, BitMEX can give users exposure to any underlying price using a derivative called a Quanto. Aug 3, Traders bitcoin miner 2019 license key litecoin mining returns speculate on the price of Ethereum Classic at the Settlement Datewhich occurs every 7 days on Friday at Best known for its futures contracts, BitMEX aka the Bitcoin Mercantile Exchange is a peer-to-peer trading platform that allows traders to take positions against one another on crypto futures and swaps. This has a dampening effect on funding rates and strengthens the peg to the Spot Index and stabilises the market. Traders need not have Ether to trade the futures contract as it only requires Bitcoin as margin. Well, it quickly became evident from the consistently high positive funding rates that there was more buyside pressure on the ETHUSD swap than sell-side pressure and as a result the BitMEX price was consistently greater than the index. I tried this unsuccessfully.

The Latest

Like us on Facebook. This has created a febrile and unstable ETHUSD swap market consisting entirely of unsavvy over-leveraged speculators with a heavy Long bias. But with greater leverage also comes greater risk. TL, DR: The only fixed number in a Quanto derivative is the multiplier. And whales were not shorting because the product is no good as a hedge and because there is no means to short it risklessly to get funding income. At They have the same fees. Twitter Facebook LinkedIn Link bitcoin arthur-hayes bitmex. He landed a job at Deutsche Bank in Hong Kong, where he made markets for exchange-traded funds. This is because it is a Quanto derivative: BVOL24H 2. BTC 10,

If all the stars align, the potential is there to win big on a swap. Kwan previously served as managing director and head of regulatory compliance for Hong Kong Exchanges and Clearingone of the largest financial market operators in the world. Quanto derivatives. BitMEX uses the following industry-standard month codes to name its instruments. And this happened: In the right hands, derivatives can be effective tools for hedging risk, but they are complicated instruments not recommended for novice traders. Conversely, traders who believe the price will drop will sell the futures contract. Neither the. When it is negative, shorts pay longs. Settlement will occur on how is bitcoin legal how to move my bitcoins to fiat balance cex.io last Friday of the Settlement Month. This is because it is a Quanto derivative:

Ether futures on BitMEX – Are You Really Trading Ether?

Note also: When present, dash and coinbase brian quintenz bitcoin month code signifies the delivery month of the future. What started as a creative let out has now become a passion and a profession for Arshmeet K Hora. Market makers those who trade with Limit orders get a 0. Given the uncertainty of where the contract will finally settle, the basis can fluctuate significantly and a trader needs to be aware of where it is currently trading at. A market where the futures contract is trading at a premium is referred to bitcoin mining chart uphold bitcoin reviews a Contango market. The winners? AI Latest Top 2. Hence, the risk to capital blocked for margin is minimal. This was probably amateur speculators with excessive leverage thinking ETH was cheap. Conversely, a market where the futures contract is trading at a discount is referred to as a Backwardation market. The winners? Takers those who trade with Market orders pay 0. The only fixed number in a Quanto derivative is the multiplier. Tone Vays, a well-known trader based in New York, was a regular on the site until his account was suspended after he announced on Twitter that he was a BitMEX client. A previous version of this story incorrectly stated that according to U. You cannot deposit ETH. Takers those who trade with Market orders pay 0. Conversely, a market where the futures contract is trading at a discount how to price bitcoin futures bitmex ethereum referred to as a Backwardation market. Run by a staff of more thanBitMEX touts itself as the most liquid bitcoin derivatives exchange in the world.

Conversely, traders who believe the price will drop will sell the futures contract. Leverage is when you borrow funds to trade at a higher value than what you put down. Jaewon goes long, and Wang goes short. Aug 3, And whales were not shorting because the product is no good as a hedge and because there is no means to short it risklessly to get funding income. The losers were amateur traders with Long positions. Run by a staff of more than , BitMEX touts itself as the most liquid bitcoin derivatives exchange in the world. For example, to buy 50 Bitcoin worth of contracts, you will only require 1 Bitcoin of Initial Margin. AI Latest Top 2. Learn more. The trader would then wait until the markets reverted to the same price, or they would wait until settlement. You will only pay or receive funding if you hold a position at one of these times. Buyers can go long or short and leverage up to x. BXBT, nor the. You can trade with x leverage when you create it from tight stops using AntiLiquidation. Delta Exchange , a fast growing crypto derivative exchange, has solved this problem with its USDC settled futures. Given the uncertainty of where the contract will finally settle, the basis can fluctuate significantly and a trader needs to be aware of where it is currently trading at. Quanto derivatives. All margin is posted in Bitcoin, that means traders can go long or short this contract using only Bitcoin. See examples.

Crypto Exchange BitMEX Reveals Most of Its Users Don’t Use Maximum Leverage

Hayes says the x is more of a marketing ploy, and most people only leverage up to 8. The initial Ethereum hard fork that created the Ethereum Classic chain was executed at approximately And we might have institutional players coming in and savaging the market with very profitable block short orders. This was probably amateur speculators with excessive leverage thinking ETH was cheap. In such circumstances it was easy, cheap and profitable for large players to crash the market. When the Funding Rate is positive, longs pay shorts. The project is developed by the Ethereum Foundation. Best known for its futures contracts, BitMEX aka the Bitcoin Mercantile Exchange is a coinbase find private key companies now accepts bitcoin 2019 trading platform that allows traders to take positions against one another on crypto futures and swaps. Hence, the trader will buy and sell the same ETC amount on both markets. It has no funding cost or rebate. BVOL24H 2. Ethereum is micro bitcoin value bitcoin protocol pdf decentralized platform that runs smart contracts: And whales were not shorting because the product is no good as a hedge and because there is no means to short it bitcoin latest news today estimate how much bitcoin you will mine to get funding income. Twitter Facebook LinkedIn Link. Both have prices pegged to the underlying spot price by incentives to traders provided by the Funding rate.

Do try trading on Delta Exchange and let us know your views about your experience! This has created a febrile and unstable ETHUSD swap market consisting entirely of unsavvy over-leveraged speculators with a heavy Long bias. Settlement will occur on the last Friday of the Settlement Month. The key components a trader needs to be aware of are:. BitMEX offers futures contracts for eight cryptocurrencies. Your For example, to buy 50 Bitcoin worth of contracts, you will only require 1 Bitcoin of Initial Margin. Both have prices pegged to the underlying spot price by incentives to traders provided by the Funding rate. I tried this unsuccessfully. This is because it is a Quanto derivative:

Has Arthur Hayes Destroyed the Ethereum Market and Bankrupted ICO Treasuries?

The margin money is blocked while you hold the position. Never miss a story from Hacker Noonwhen you sign up for Medium. BXBT, nor the. The trader would then wait until the markets reverted to the same price, or they would wait until settlement. BVOL24H 2. The in-house market maker is staffed by long-time friend and former Deutsche Bank colleague Nick Andrianov. Due to the risks involved bitcoin wallet download blockchain how long do bitcoin payments take to confirm trading bitcoin swaps, BitMEX is often compared to a gambling casino where people go to lose their money. Best known for its futures contracts, BitMEX aka the Bitcoin Mercantile Exchange is a peer-to-peer trading platform that allows traders to take positions against one another on crypto futures and swaps. This makes for a highly unstable market entirely composed of speculators.

As the leverage is 50x, the trader only needs 0. Those fees are applied to the total value of a position, not the principal. Neither the. The platform charges a trading fee of 0. Recently, the company hired regulatory expert Angelina Kwan to become its chief operating officer. This has a dampening effect on funding rates and strengthens the peg to the Spot Index and stabilises the market. In such circumstances it was easy, cheap and profitable for large players to crash the market. The losers were amateur traders with Long positions. This could be for several reasons: That that means margin, profit, and loss must be paid or received in Bitcoin. Leverage is when you borrow funds to trade at a higher value than what you put down. When present, the month code signifies the delivery month of the future. In the U. What started as a creative let out has now become a passion and a profession for Arshmeet K Hora. Market makers those who trade with Limit orders get a 0. Hence, the risk to capital blocked for margin is minimal.

Conversely, traders who believe the price will drop will sell the futures contract. To avoid unnecessary liquidations with a fluctuating basis, BitMEX employs a method called Fair Price Marking to ensure the futures market is marked fairly. BETH Moreover you coinbase intern bitcoin global capital always be long Bitcoin irrespective of whether you are long or short on Ether. The funding rate at the time was 0. One Reddit user claims he lost 43 bitcoin this way. The losers were amateur traders with Long positions. Note also: For example, to buy 50 Bitcoin worth of contracts, you will only require 1 Bitcoin of Initial Margin. The whales who did the block shorts. After hitting an all-time time high in Decemberbitcoin has been steadily dropping in price. Learn. This was probably amateur speculators with excessive leverage thinking ETH was cheap. While taking a call from his creditors. BVOL24H 2.

When it is negative, shorts pay longs. TL, DR: It is treated like any other account. Learn more. BETH This could be for several reasons: To avoid unnecessary liquidations with a fluctuating basis, BitMEX employs a method called Fair Price Marking to ensure the futures market is marked fairly. You cannot deposit ETH. Subscribe to our newsletters to get latest Bitcoin and Cryptocurrency news.

Thank you !

Recently, the company hired regulatory expert Angelina Kwan to become its chief operating officer. No other major crypto derivatives exchange is offering futures on this cryptocurrency. Hayes made the announcement in a blog post on April 30, They have the same fees. That that means margin, profit, and loss must be paid or received in Bitcoin. Jaewon goes long, and Wang goes short. But according to the BitMEX website , only the anchor market maker can short sell. And not the other way round. BETH The Team Careers About. Best known for its futures contracts, BitMEX aka the Bitcoin Mercantile Exchange is a peer-to-peer trading platform that allows traders to take positions against one another on crypto futures and swaps. Sign In. The trader could short or sell the contract at 0. Hence the trader lets his futures contract position expire at the settlement price and then close out his 1, ETC buy on the underlying spot market by selling 1, ETC at 0. There is enough volatility available and the currency shows big directional moves that span over a period of few days.

Takers those who trade with Market orders pay 0. BVOL24H 2. BETH I tried this unsuccessfully. Delta Exchange is in growth mode and is offering attractive offers to traders. This could be for several reasons: Conversely, a market where the futures contract is trading at a discount is referred to as a Backwardation market. Sign In. And not the other way round. Sign in Get started. Close Menu Search Search. This is because it is a Quanto derivative: Historical rates are in the Funding History. Get updates Get updates. Given the uncertainty of where the contract will finally settle, the basis can fluctuate significantly and s7 bitcoin miner bitcoin rate chart zebpay trader needs to be aware of where it is currently trading at. Correction December 8, Note also:

If you have been trading these contracts you not only have been trading Ether but also Bitcoin. BETH The trader however knew this already when they put on the trade because they effectively locked in the nominal basis of 0. The losers? Note that, all things being held equal, the basis approaches 0 as the futures contract approaches expiry. Run by a staff of more thanBitMEX touts itself as the most liquid bitcoin king case bitcoin version derivatives exchange zcash no amd open cl found mining calculator dash the world. December 7,4: Those fees are applied to the total value of a position, not the principal. BETH You can trade with x leverage when you create it from tight stops using AntiLiquidation. Quanto derivatives. You can track the length of each individual chain at ETHStats. And regulatory oversight, if and when that happens, could have a radical impact on the types of services BitMEX is able to offer its customers. BXBT The only fixed number in a Quanto derivative is the multiplier. Pin It on Pinterest. That is because no assets need to be physically exchanged between buyer and seller, and counterparties can use leverage. And not the other way round. The what is litecoin worth access private key on coinbase rate at the time was 0. Given this point, a trader can use this as a trading strategy:

If you close your position prior to the funding exchange then you will not pay or receive funding. The ETC futures contracts settle on the. BitMEX uses the following industry-standard month codes to name its instruments. Hence, the trader will buy and sell the same ETC amount on both markets. BXBT BXBT, and. That that means margin, profit, and loss must be paid or received in Bitcoin. The only fixed number in a Quanto derivative is the multiplier. There is enough volatility available and the currency shows big directional moves that span over a period of few days. The whales who did the block shorts. In fact the underlying is the. But with greater leverage also comes greater risk. The ETH futures contracts feature a leverage of up to 50x. Both have prices pegged to the underlying spot price by incentives to traders provided by the Funding rate. A Perpetual Contract is a derivative product that is similar to a traditional Futures Contract , but has a few differing specifications:.

That that means margin, profit, and loss must be paid or received in Bitcoin. Jaewon goes long, and Wang goes short. So we have an unstable market with mainly speculative, highly-leveraged amateurs taking positions with a Long bias and no institutional or whale hedgers to provide deep-pocketed stability. The only fixed number in a Quanto derivative is the multiplier. Jaewon goes long, and Wang goes short. You can trade with x leverage when you create it from tight stops using AntiLiquidation. The margin money is coinbase max attempts to login for bank bittrex credit card deposit while you hold the consensys ethereum mycelium cancel sending bitcoin. This is because it is a Quanto derivative: Join The Block Genesis Now. No other major crypto derivatives exchange is offering futures on this cryptocurrency. And opening and closing a contract counts as two trades, not one. The Team Careers About. There are 4 days remaining on the contract. And we might have institutional players coming in and savaging the market with very profitable block short orders. There are 4 days remaining on the contract.

Correction December 8, You can trade with x leverage when you create it from tight stops using AntiLiquidation. BXBT This has created a febrile and unstable ETHUSD swap market consisting entirely of unsavvy over-leveraged speculators with a heavy Long bias. As the leverage is 20x, the trader only needs 0. Two distinct advantages of this contract are namely, quoting in USD and high liquidity available on this contract. However, through the use of financial engineering, BitMEX can give users exposure to any underlying price using a derivative called a Quanto. Sign In. The only fixed number in a Quanto derivative is the multiplier. BETH You will only pay or receive funding if you hold a position at one of these times. In this example, the market kept trading at a premium up until settlement at Traders who think that the price of ETH will rise will buy the futures contract. You cannot deposit ETH. Both have prices pegged to the underlying spot price by incentives to traders provided by the Funding rate. BXBT, nor the. The winners? The platform, available in five languages English, Chinese, Russian, Korean and Japanese , then settles the trades exclusively in bitcoin.

Correction December 8, The losers? Hence the trader lets his futures contract position expire at the settlement price and then close out his 1, ETC buy on the underlying spot market by selling 1, ETC at 0. You can track the length of each individual chain at ETHStats. Privacy Policy. Every contract traded on BitMEX consists of two instruments: And this happened: Traders can speculate on the price of Ethereum Classic at the Settlement Date , which occurs every 7 days on Friday at TL, DR: Learn more. BETH Settlement will occur on the last Friday of the Settlement Month. The platform charges a trading fee of 0. The trader could short or sell the contract at 0. The ETH futures contracts settle on the. Ethereum is a decentralized platform that runs smart contracts: A previous version of this story incorrectly stated that according to U. Conversely, traders who believe the price will drop will sell the futures contract.

And the XBT swap is a well-established product used both by whales to hedge their Bitcoin and by speculators. This means that if the contract always traded at a 2. And this happened: Note that, all things being held equal, the basis approaches 0 as the futures contract approaches expiry. This exposes trader to risk in Bitcoin prices. Learn. Do try trading on Delta Exchange and let us know your views about your experience! In this way, the how to start a bitcoin mining farm ethereum chinese mimics how margin-trading markets work as buyers and sellers of the contract exchange interest payments periodically. You will only pay or receive funding if you hold a position at one of these times. To prevent U. There are 4 days remaining on the contract. Both have prices pegged to bitpanda app use shapeshift with jaxx underlying spot price by incentives to traders provided by the Funding rate. The amateur traders with Long positons. They have the same fees. The winners? And whales were not shorting because the product is no good as a hedge and because there is no means to short it risklessly to get funding income.

At In January , he reached out to his network and pitched the idea to Ben Delo, who had experience in high-frequency trading systems, and Sam Reed, a full stack web developer. Aug 3, In fact the underlying is the. In an Unchained interview in May , Hayes put it more elegantly: Well, it quickly became evident from the consistently high positive funding rates that there was more buyside pressure on the ETHUSD swap than sell-side pressure and as a result the BitMEX price was consistently greater than the index. Every contract traded on BitMEX consists of two instruments: Traders need not have Ether Classic to trade the futures contract as it only requires Bitcoin as margin. BETH This makes it easy for a trader to enter and exit a position. In an interview with Yahoo Finance , Hayes denied allegations of insider trading. Load More. For example, to buy 10 Bitcoin worth of contracts, you will only require 0. Conversely, a market where the futures contract is trading at a discount is referred to as a Backwardation market. During these periods, traders may be unable to place a trade or close out a position before getting liquidated. Note that, all things being held equal, the basis approaches 0 as the futures contract approaches expiry.

Note also: If you have been trading these contracts you not only have been trading Ether but also Bitcoin. Ether is one of the best currency for leveraged trading. Jaewon goes long, and Wang goes short. The amateur traders with Long positons. Additionally, laws in many countries, including the U. Blocking IPs is not foolproof. You cannot deposit ETH. Why would the contract be trading at such a high premium? Takers those who trade with Market orders pay 0. Like us on Facebook. BXBT In a presentation over the summer, Hayes spoke on how KYC slows down the process of opening an account on an exchange. While taking a call from his creditors. The only fixed number in a Quanto derivative is the multiplier. The below chart shows both a contango and a backwardated market. The number of Bitcoin kept for margin remain the same but with fall in price of Bitcoin the value of margin reduces. The trader would then wait until the markets reverted to the same price, or they would wait until settlement. Two distinct advantages how do i start using bitcoin cryptocurrency mining taxes this contract are namely, quoting in USD and high sweep bitcoins from jaxx to ledger nano coinomi reddit electrum btg available on this contract. And the XBT swap is a well-established product used both by whales to hedge their Bitcoin and by speculators.

Further information and examples of funding calculations are available. Jaewon goes long, and Wang goes short. For each 1 USD move, the contract pays out 0. Your position value is irrespective of leverage. Upto x Leverage is available on all these pairs. This has created a febrile and unstable ETHUSD swap market consisting entirely of unsavvy over-leveraged speculators with a heavy Long bias. Traders who think that the price of ETH will rise will buy the futures contract. This has created a febrile and unstable ETHUSD swap market consisting entirely of unsavvy over-leveraged speculators with a heavy Long bias. Buyers can go long or short and leverage up to x. BVOL24H 2. As compensation for their risk, market makers generally make money on the spread between the buy price and the sell price of a contract. BXBT The losers? Traders can speculate on the price of Ethereum Classic at the Settlement Date , which occurs every 7 days on Friday at You cannot deposit ETH. Ethereum is a decentralized platform that runs smart contracts:

The Latest. See examples. The funding buying on an exchange bitcoin transfer btc bittrex to coinbase at the time was 0. Get updates Get updates. Sign in Get started. The ETH futures contracts feature a leverage of up to 50x. Additionally, laws in many countries, including the U. This could be for several reasons: During these periods, traders may be unable to place a trade or close out a position before getting liquidated. Fees for trades can bitcoin price analysis today satoshi nakamoto messages up quickly. This was probably amateur speculators with excessive leverage thinking ETH was cheap. BETH BETH In this example, the market kept trading at a premium up until settlement at Conversely, a market where the futures contract is trading at a discount is referred to as a Backwardation market. However, through the use of financial engineering, BitMEX can give users exposure to any underlying price using a derivative called a Quanto. Run by a staff of more thanBitMEX touts itself as the most liquid bitcoin derivatives exchange in the world. Hence, the trader will buy and sell the same ETC amount on both markets. Load More. Given this point, a trader can use this as a trading strategy:

Still, if Hayes wants to grow his business, he may have a few challenges to reckon with. An archipelago in the Indian Ocean, Seychelles is notoriously light on corporate regulation and does not require companies to pay taxes or undergo audits. And this happened: At This could be for several reasons: The ETC futures contracts feature a leverage of up to 20x. Traders need not have Ether to trade the futures contract as it only requires Bitcoin as margin. The losers were amateur traders with Long positions. A market where the futures contract is trading at a premium is referred to as a Contango market. The losers were amateur traders with Long positions.